At this time information

2025-01-23 12:00:00

By Omkar Godbole (All instances ET until indicated in any other case)

Bitcoin and most main cryptocurrencies are weaker after Chicago Mercantile Trade, a proxy for institutional exercise, denied reviews of itemizing futures tied to XRP and SOL. Conventional markets are additionally holding their breath for the anticipated Financial institution of Japan interest-rate improve on Friday.

Regardless of BTC’s continued vary play above $100,000, retail demand stays strong. Glassnode’s shrimp-Crab cohort, which incorporates addresses holding as much as 10 BTC, have absorbed 1.9 instances the newly mined provide final month, totaling over 25,600 BTC. In the meantime, long-term holders have slowed their spending and profit-taking actions, indicating a cautious, however agency, dedication to their investments.

Nonetheless, dropping beneath $100,000 may show pricey. In accordance with Wintermute’s OTC dealer Jake Ostrovskis, that may “body Monday’s inauguration as a sell-the-news occasion and the narrative might swap fairly rapidly.”

Experiences recommend the variety of whale wallets holding between 1 million and 10 million XRP has surged to an all-time excessive of two,083, signaling elevated accumulation and confidence in its future efficiency.

On this planet of innovation, chatter round Bitcoin Synths is gaining traction on X. These artificial belongings enable customers to learn from bitcoin’s value actions with out truly proudly owning the cryptocurrency. Bitcoin Synths will be traded or used as collateral in lending protocols, avoiding the complexities related to wrapped tokens and specialised bridges.

Ethereum layer-2 protocols are additionally making headlines with document transaction volumes, at the same time as issues about their capability nearing limits persist.

On the macroeconomic entrance, latest knowledge from the Labor Division exhibits that the “all tenant hire” index, an indicator of shelter inflation within the Client Worth Index (CPI), rose at a slower tempo final quarter. The info recommend that latest worries about inflation could also be overdone and the Fed might pivot away from its hawkish forecast, which might be a constructive signal for danger belongings. Keep alert!

What to Watch

- Crypto

- Macro

- Jan. 23, 8:30 a.m.: The U.S. Division of Labor releases the Unemployment Insurance coverage Weekly Claims Report for the week ended Jan. 18.

- Preliminary Jobless Claims Est. 215K vs. Prev. 217K.

- Jan. 23, 10:00 a.m.: The Nationwide Affiliation of Realtors releases December 2024 U.S. Current Dwelling Gross sales report.

- Current Dwelling Gross sales Est. 4.16M vs. Prev. 4.15M.

- Current Dwelling Gross sales MoM Prev. 4.8%.

- Jan. 23, 4:30 p.m.: The Fed releases the H.4.1 report, the central financial institution steadiness sheet, for the week ended Jan. 22.

- Complete Reserves Prev. $6.83T.

- Jan. 23, 6:30 p.m.: Japan’s Ministry of Inner Affairs and Communications releases December 2024’s Client Worth Index (CPI) report.

- Inflation Fee MoM Prev. 0.6%.

- Core Inflation Fee YoY Est. 3% vs. Prev. 2.7%.

- Inflation Fee YoY Prev. 2.9%.

- Jan. 23, 10:00 p.m.: The Financial institution of Japan (BoJ) releases Assertion on Financial Coverage.

- Curiosity Fee Choice Est. 0.5% vs. Prev. 0.25%.

- Jan. 23, 8:30 a.m.: The U.S. Division of Labor releases the Unemployment Insurance coverage Weekly Claims Report for the week ended Jan. 18.

Token Occasions

- Governance votes & calls

- Morpho DAO is discussing decreasing incentives by 30% throughout all networks and belongings.

- Yearn DAO is discussing funding and endorsing a subDAO known as Bearn to concentrate on constructing and launching merchandise on Berachain.

- Frax DAO is discussing a $5 million funding in World Liberty Monetary (WLFI), the crypto undertaking backed by the household of U.S. President Donald Trump.

- Jan. 23: Livepeer (LPT) is internet hosting a Core Dev name.

- Jan. 24: Arbitrum BoLD’s activation vote deadline. BoLD permits anybody to take part in validation and defend in opposition to malicious claims to an Arbitrum chain’s state.

- Jan. 24: Hedera (HBAR) is internet hosting a neighborhood name at 11 a.m.

- Unlocks

- Jan. 31: Optimism (OP) to unlock 2.32% of circulating provide price $52.9 million.

- Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating provide price $626 million.

- Token Launches

- Jan. 23: Sky (SKY) is being listed on Bitget.

- Jan. 23: Animecoin (ANIME) is launching, with claims beginning at 8 a.m. The token can be listed on a number of exchanges together with Binance, OKX and KuCoin.

Conferences:

Token Speak

By Francisco Rodrigues

- Azuki, a non-fungible token (NFT) assortment, is introducing its Animecoin (ANIME) right this moment on Ethereum and Arbitrum. The token was introduced on Jan. 13.

- An airdrop will embody Azuki NFT holders, Hyperliquid HYPE stakes, some Arbitrum ecosystem individuals and Kaito yappers.

- It’s going to additionally embrace sure anime communities and BNB token holders who, between Jan. 17 and Jan. 20, subscribed to Easy Earn with their tokens on Binance.

- The debut builds on a rising development of NFT collections launching their very own tokens, a development that began in 2021 when Bored Ape Yacht Membership (BAYC) launched ApeCoin.

- Different examples embrace DeGods’ DUST and Pudgy Penguins’ PENGU tokens, which have a $1.6 billion market capitalization.

- Different indicators point out the NFT market is heating up, with Nansen lately stating {that a} Crypto Punk was offered for 170 ETH (round $540,000) whereas an Azuki was offered for 165 ETH. The Azuki NFT had been purchased a month earlier than for 105 ETH.

Derivatives Positioning

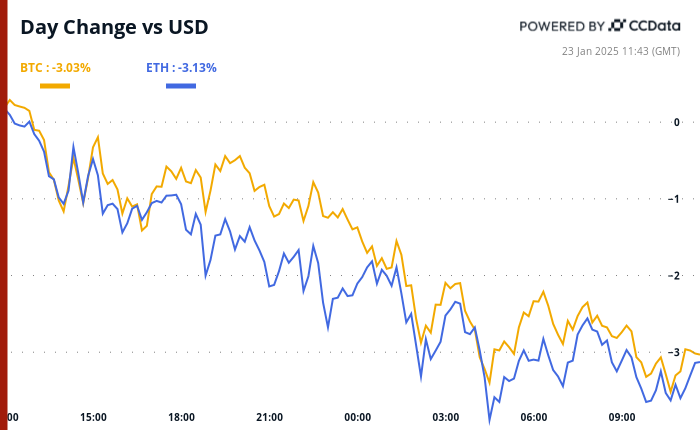

- The cumulative quantity delta indicator reveals that main cryptocurrencies, excluding TON, have skilled internet promoting strain within the perpetual futures markets over the previous 24 hours.

- Block flows on Deribit and Paradigm featured lengthy positions in short-dated BTC places at $100K, $95K and $70K. An entity purchased ETH put at $2.9K.

- Entrance-end BTC and ETH calls now traded at par with places.

Market Actions:

- BTC is down 4.1 % from 4 p.m. ET Wednesday to $102,020 (24hrs: -2.71%)

- ETH is down 3.85% at $3,206.18 (24hrs: -2.83%)

- CoinDesk 20 is down 3.61% to three,799.21 (24hrs: -3.58%)

- CESR Composite Ether Staking Fee is down 15 bps to three.15%

- BTC funding fee is at -0.0019% (-2.08% annualized) on OKX

- DXY is unchanged at 108.25

- Gold is down 0.35% at $2,761.10/oz

- Silver is down 0.73% to $30.57/oz

- Nikkei 225 closed up 0.79% at 39,958.87

- Cling Seng closed down 0.4% at 19,700.56

- FTSE is unchanged at 8,538.7

- Euro Stoxx 50 is unchangedat 5203.6

- DJIA closed +0.3% to 44,156.73

- S&P 500 closed +0.61% at 6,086.37

- Nasdaq closed +1.28% at 20,009.34

- S&P/TSX Composite Index closed +0.12% at 25,311.5

- S&P 40 Latin America closed +1.21% at 2,297.32

- U.S. 10-year Treasury is up 3 bps at 4.59%

- E-mini S&P 500 futures are down 0.19% to six,109.00

- E-mini Nasdaq-100 futures are down 0.56% to 21,876.75

- E-mini Dow Jones Industrial Common Index futures are unchaged at 44,384.00

Bitcoin Stats:

- BTC Dominance: 58.59

- Ethereum to bitcoin ratio: 0.031

- Hashrate (seven-day transferring common): 781 EH/s

- Hashprice (spot): $58.9

- Complete Charges: 8.5 BTC/ $876,410

- CME Futures Open Curiosity: 188,396 BTC

- BTC priced in gold: 37.1 oz

- BTC vs gold market cap: 10.56%

Technical Evaluation

- BTC’s retreat from Monday’s excessive is teasing a formation of a double high bearish reversal sample.

- A transfer beneath the horizontal line would verify the sample, doubtlessly bringing extra chart-led sellers to the market.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $377.31 (-3.03%), down 1.89% at $370.19 in pre-market.

- Coinbase International (COIN): closed at $295.85 (+0.56%), down 2.59% at $288.18 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$32.81 (+4.99%)

- MARA Holdings (MARA): closed at $19.69 (+0.66%), down 2.54% at $19.19 in pre-market.

- Riot Platforms (RIOT): closed at $13.14 (+3.14%), down 1.75% at $12.91 in pre-market.

- Core Scientific (CORZ): closed at $15.97 (+4.58%%), down 1.63% at $15.71 in pre-market.

- CleanSpark (CLSK): closed at $11.14 (+1.64%), down 2.51% at $10.86 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.53 (+2.24%), up 2.58% at $28.27 in pre-market.

- Semler Scientific (SMLR): closed at $62.11 (-4.36%), up 2% at $64.90 in pre-market.

- Exodus Motion (EXOD): closed at $41.00 (+2.5%), down 2.07% at $40.15 in pre-market.

ETF Flows

Spot BTC ETFs:

- Day by day internet move: $248.7 million

- Cumulative internet flows: $39.23 billion

- Complete BTC holdings ~ 1.161 million.

Spot ETH ETFs

- Day by day internet move: $70.7 million

- Cumulative internet flows: $2.81 billion

- Complete ETH holdings ~ 3.648 million.

Supply: Farside Traders

In a single day Flows

Chart of the Day

- The chart exhibits a spike within the variety of energetic addresses on Solana.

- Addresses holding USDC led the expansion as TRUMP token frenzy gripped the market over the weekend.

Whereas You Have been Sleeping

Within the Ether