The US Greenback (USD) depreciated considerably yesterday following the weaker-than-expected US inflation information. At first look, this will likely appear logical. In any case, subdued inflationary stress favours probably quicker rate of interest cuts by the Fed. Nevertheless, the response was something however trivial. One may simply as nicely argue that the dangers of stagflation have diminished, which might be optimistic for the greenback, Commerzbank’s Head of FX and Commodity Analysis Thu Lan Nguyen notes.

FX market react to the US CPI figures with USD weak point

“Nevertheless, the truth that the FX market reacted to the figures with greenback weak point is also as a result of one thing else: The US president is more likely to really feel vindicated by the end result. And this doesn’t imply the – admittedly considerably decrease – egg costs, however above all the dearth of a tariff impact within the April value information, which can have stunned some. In fact, explanations will be discovered: Adequate stock, for instance, which permit corporations to delay value will increase. Nevertheless, the actual fact is that to date there was little signal of the horrendous value will increase that have been feared. That is excellent news for these in favour of a tricky US tariff technique, because it reduces the stress on the US authorities to withdraw tariffs as rapidly as potential and current ‘offers’ with buying and selling companions.”

“However, nevertheless, the inflation figures additionally present that the impression of the tariffs may very well be tougher to evaluate than anticipated. This doesn’t make issues any simpler for the US Federal Reserve and should recommend that it’s extra more likely to maintain off on a potential rate of interest reduce. Even when the current settlement between the US and Chinese language governments on a big discount in reciprocal tariffs has lowered the value dangers, there may be more likely to be settlement {that a} tariff of 30% on imports from China nonetheless has a big inflationary impact.”

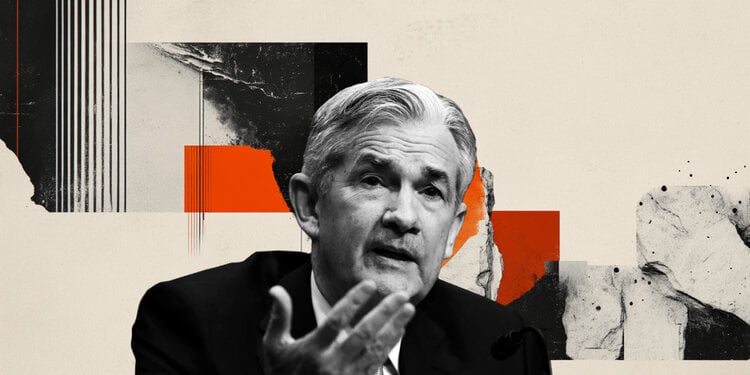

“This may very well be all of the extra the case as Fed Chairman Jay Powell is underneath fireplace from US President Trump. The latter couldn’t resist lashing out at Powell on his favorite social media channel yesterday after the inflation figures. If solely to underpin the independence of the US central financial institution, it may very well be worthwhile for the Fed to proceed to reject hopes of fast rate of interest cuts. In any case, inflation has not fallen massively in need of expectations (0.2% as a substitute of 0.3% in comparison with the earlier month in accordance with the Bloomberg survey). Maybe we should not get carried away?”