Daily Broad Market Recap – November 10, 2025

Markets opened the week with cautious optimism on Monday as hopes for an imminent end to the U.S. government shutdown lifted sentiment, though traders remained attentive to mixed economic signals from China and growing expectations for Bank of Japan policy tightening.

Gold led gains among major assets, reclaiming ground above $4,000 as investors weighed signs of U.S. economic weakness against progress toward reopening the federal government.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- China Consumer Price Index Growth Rate for October 2025: 0.2% m/m (-0.1% m/m forecast; 0.1% m/m previous); 0.2% y/y (0.0% y/y forecast; -0.3% y/y previous)

- Reserve Bank of Australia Deputy Governor Hauser indicated on Monday that monetary policy must remain restrictive to control inflation, as the economy is operating above potential output with limited spare capacity

- Australia Building Permits Final for September 2025: 12.0% m/m (12.0% m/m forecast; -6.0% m/m previous)

- Japan Prime Minister Takaichi expressed hopes for BOJ to guide monetary policy appropriately to achieve sustainable 2% inflation driven by wage growth, not just cost-push factors

- The Bank of Japan’s Summary of Opinions from the October 2025 meeting indicated a growing consensus among policymakers for a near-term interest rate hike

- On Monday, Bank of Japan board member Nakagawa emphasized that the BoJ will make appropriate policy decisions based on data, and highlighted concerns about rising inflation potentially weakening demand

- Japan Leading Economic Index Prel for September 2025: 108.0 (107.7 forecast; 107.0 previous)

- The Sentix Investor Confidence Index fell to -7.4 in November from -5.4 in October, missing market expectations of -4.0

- Bank of Canada Market Participants Survey indicated that market participants expect the main interest rate to remain at 2.25% until mid-2027, with nearly 90% anticipating inflation to stay within the 1%-3% range by the end of 2025 and 80% by the end of 2026

- On Monday, the White House expressed support for a deal to end the US shutdown; for the deal to happen, the Senate still must pass the legislation & House members must travel back to Washington to vote

- China suspended export restrictions on gallium, germanium, and antimony through November 2026, signaling easing U.S.-China trade tensions

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Monday’s trading session reflected a delicate balance between optimism over increased potential that the U.S. government will reopen soon, and lingering concerns about economic visibility, with precious metals claiming top spot among major assets.

Gold had an impressive bullish run, climbing approximately 2.77% to settle around $4,111 per ounce. The precious metal likely benefited from multiple supportive factors: expectations for a December Federal Reserve rate cut following recent signs of U.S. economic weakness, progress toward ending the government shutdown that would shift focus back to deteriorating U.S. fiscal conditions, and continued safe-haven demand. Silver tracked gold’s strength, surging over 4.50%% to trade over $50 per ounce.

The S&P 500 posted solid gains of approximately 1.44%, extending its rally as the prospect of government reopening lifted market sentiment. The index found support throughout the session, with technology shares contributing to the advance as traders positioned for restored economic data flow that could reinforce December rate cut expectations.

Bitcoin advanced roughly 1.6% to close around $105,500, after reaching session highs around $106,500 as risk appetite improved on shutdown resolution hopes. The cryptocurrency also likely continued to attract interest as an alternative asset amid questions about fiscal sustainability in traditional markets, and possible dip buying after the October to November pullback.

WTI crude oil posted modest gains of around 0.57%, settling near $60.10 per barrel. Energy prices likely found support from expectations that government reopening would boost demand in the world’s top oil consumer, though gains remained limited, possibly by ongoing concerns about excess supply and upcoming monthly reports from OPEC and the IEA.

The 10-year Treasury yield rose approximately 12 basis points to around 4.12% as improved risk sentiment reduced demand for safe-haven bonds. The yield increase reflected investors moving away from government debt as prospects for ending the shutdown lifted market confidence, though expectations for Fed easing likely continued to cap upward pressure on longer-term rates.

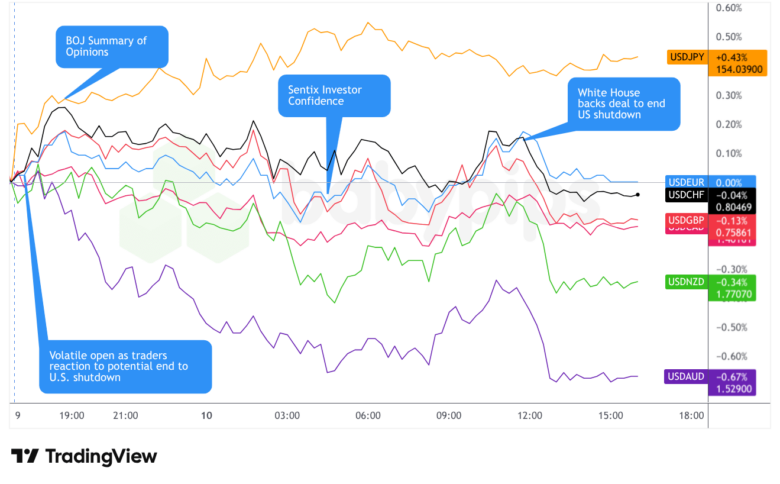

FX Market Behavior: U.S. Dollar vs. Majors:

The U.S. dollar experienced a volatile session on Monday, posting an arguably net neutral-to-bearish performance against the basket of major currencies, though significant divergence emerged across individual pairs.

The greenback opened the Asian session with modest strength, climbing against most major currencies as traders maintained cautious positioning ahead of key developments on the government shutdown. This early momentum proved short-lived, however, as the dollar topped out mid-morning Asia and began pulling back heading into European hours.

The reversal accelerated during the London morning session, where the dollar dipped against major currencies on net. The pullback appeared driven by rising broad risk-on sentiment, and arguably further profit-taking from the bullish October run as traders assessed the implications of potential government reopening and its impact on Fed policy expectations.

The U.S. trading session brought renewed dollar strength as the greenback rallied against major currencies on net, eventually finding a peak around the London close. The advance likely reflected a mix of factors including defensive positioning and technical rebounds from earlier session lows. However, the rally proved unsustainable, with the dollar surrendering most of its U.S. session gains by the close as risk-on behavior persisted.

By session end, the dollar’s performance told a nuanced story. While technically posting a marginal net under performance against the broader basket, strong gains against the Japanese yen—likely reflecting growing expectations for BOJ policy tightening creating relative pressure on the yen—and a slight advance against the euro provided enough offset to leave the greenback roughly neutral for the day. The dollar posted losses against most other major currencies, including the commodity currencies which benefited from improved risk sentiment and easing U.S.-China trade tensions.

Upcoming Potential Catalysts on the Economic Calendar

- Australia Westpac Consumer Confidence Change for November 2025 at 11:30 pm GMT

- Japan Bank Lending & Current Account for October 2025 at 11:50 pm GMT

- Japan Reuters Tankan Index for November 2025 at 12:00 am GMT

- Australia NAB Business Confidence for October 2025 at 12:30 am GMT

- New Zealand Business Inflation Expectations for December 31, 2025 at 2:00 am GMT

- Japan Eco Watchers Survey Outlook for October 2025 at 5:00 am GMT

- U.K. Employment situation update for September 2025 at 7:00 am GMT

- European Central Bank President Lagarde Speech at 8:20 am GMT

- Germany ZEW Economic Sentiment Index for November 2025 at 10:00 am GMT

- U.S. NFIB Business Optimism Index for October 2025 at 11:00 am GMT

- U.S. ADP Employment Change Weekly at 1:15 pm GMT

Tuesday’s session will be shaped by several key developments. Any fresh news on progress toward ending the U.S. government shutdown—including Senate passage of the funding bill and House scheduling—could drive volatility across markets as traders assess the timeline for data resumption and its implications for December Fed policy decisions.

The U.K. employment update will provide insight into labor market conditions that could influence Bank of England rate cut expectations for December, with particular focus on wage growth trends. Be sure to check out our Event Guide to gain more insight into event and potential scenarios that may influence the British pound.

Additionally, any further developments on the U.S.-China trade front following Monday’s suspension of export restrictions on critical minerals could impact risk sentiment.

With the Veterans Day holiday in the U.S., trading volumes may be subdued during the U.S. session, potentially amplifying moves on any surprise headlines while limiting follow-through absent significant news catalysts.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!