U.S. ADP Employment Rebounded in October, But Weak Spots Remain

2025-11-06 02:41:00

The U.S. private sector added 42,000 jobs in October, according to the latest ADP National Employment Report released this week, marking a return to positive job growth after two consecutive months of losses and exceeding economists’ expectations of 37,500 new positions.

Key Takeaways

- Private sector employment increased by 42,000 jobs in October, rebounding from revised losses of 29,000 jobs in September and 3,000 in August

- Annual pay growth held steady at 4.5% for job-stayers and 6.7% for job-changers, unchanged from September

- Job gains were concentrated in three sectors: Trade, transportation, and utilities led with 47,000 new positions, followed by education and health services (26,000) and financial activities (11,000)

- Three sectors posted significant losses: Information (-17,000), professional and business services (-15,000), and other services (-13,000)

- Large establishments drove growth, adding 73,000 jobs, while small and medium-sized businesses collectively shed 31,000 positions

The concentrated nature of the job gains raises concerns about the breadth of the recovery. Three sectors—trade, transportation and utilities, education and health services, and financial activities—accounted for 84,000 new jobs, masking widespread losses elsewhere in the economy.

Professional and business services has now shed jobs for three consecutive months, while the 6,000-job decline in leisure and hospitality is particularly noteworthy given the sector’s traditional strength during the fourth-quarter holiday season.

Link to ADP Employment Change Report (October 2025)

While October’s job gains represent an improvement over the previous two months, ADP Chief Economist Dr. Nela Richardson cautioned that the recovery remains weak and narrowly focused.

“Private employers added jobs in October for the first time since July, but hiring was modest relative to what we reported earlier this year,” Richardson said in a statement. “Meanwhile, pay growth has been largely flat for more than a year, indicating that shifts in supply and demand are balanced.”

The absence of official employment data during the U.S. government shutdown leaves private company estimates to take on heightened importance for economists, investors, and policymakers attempting to gauge labor market health.

However, it’s also worth noting that ADP’s figures don’t always align with subsequent NFP results, as the company’s methodology focuses exclusively on private-sector employment, excluding government workers.

Market Reactions

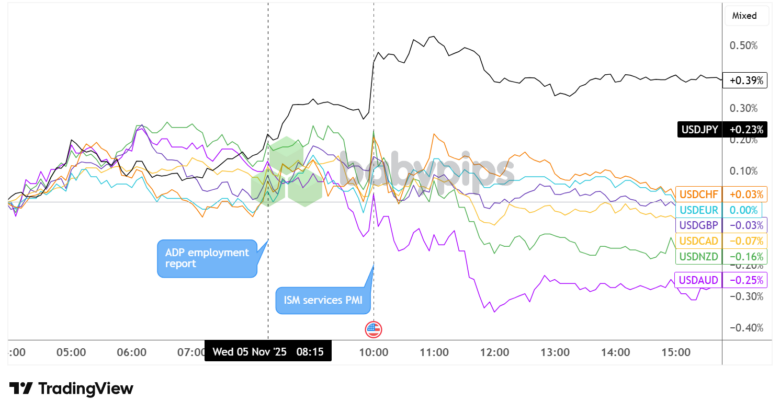

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar, which had been edging slightly lower leading up to the release, showed a generally positive reaction following the ADP report’s 8:15 AM ET release as it strengthened against most major currencies before the next major data point dropped.

The ISM Services PMI, released roughly a couple of hours afterwards, appeared to trigger more pronounced volatility across dollar pairs, overshadowing the initial ADP reaction. After all, the fifth consecutive monthly decline in the ISM employment index appeared to highlight the weak spots in underlying ADP data.

The dollar chalked up notable declines versus AUD (-0.25%) and NZD (-0.16%) while fighting to stay afloat versus EUR (0.00%) and GBP (-0.03%). USD managed to stay in positive territory versus JPY (+0.38%) and CHF (+0.03%) until the latter half of the New York session.