Drawdown to breakeven: a critical lesson for new traders

2025-11-05 12:41:00

If you ask any professional trader what his number one priority is, the answer would be “capital preservation”.

The retail world is unfortunately 99% just marketing, so the focus is on gains as that is what sells the most.

You should be focusing first and foremost on risk.

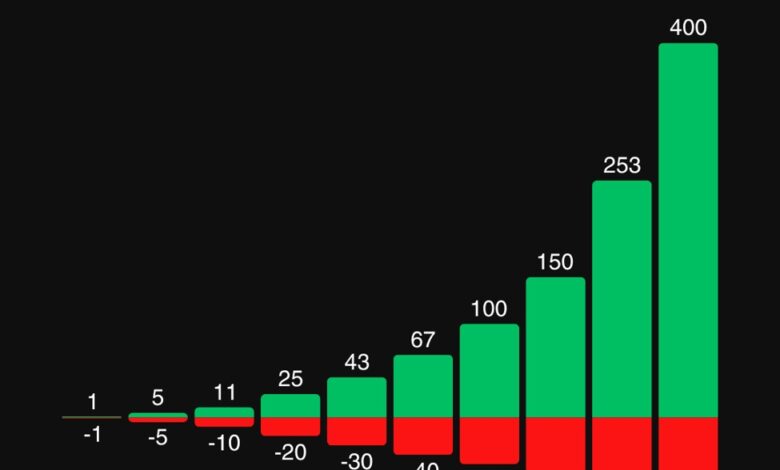

The chart above shows you how much percentage gain you need just to get back to even. If you lose 50% of your money, you need to make 100% to get it back.

As you can see, above 10% drawdown, the math starts to work against you.

Ideally, you should keep your drawdown below that mark. You can trade comfortably in the 3-5% drawdown range, but above that, you should start to retrench.

Start reducing your size or get more picky with your trades until you get back on track. Trading when your account is at ATH (all-time high) is much easier than when it’s in a meaningful drawdown. You can trade in attack when you are around the highs, but you need to play in defence when you are in drawdown.

NEVER EVER increase size just to recoup your losses. That’s what kills trading accounts.

Managing drawdowns is critical because it will also define your annual returns. For example, if you make 20% in year 1, 2 and 3, your CAGR (compunded annual growth rate) will be 20%. On the other hand, if you lose 20% in year 3, your CAGR falls to just 4.83%. You can see how easy it is to ruin a track record.

Remember that traders have winning and losing streaks. How you manage those streaks will define your long-term success.