Is Warren Buffett preparing for an unprecedented crisis?

2025-11-05 07:20:00

Warren Buffett’s name has become as legendary in the world of investing as Bruce Lee’s in martial arts. So it’s no surprise that millions of investors closely track every move in Berkshire Hathaway’s portfolio, even if only after the fact, through documents such as Form 10-Q and Form 13F.

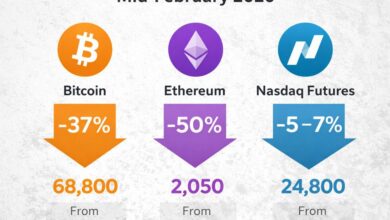

However, in recent years, Buffett’s activity has been relatively moderate, mainly limited to cutting Berkshire’s position in Apple or accumulating cash reserves. Many view this growing accumulation of cash as a classic Buffett signal: “be cautious when others are greedy,” and a possible indication of an imminent collapse in the S&P 500 or Nasdaq.

But they seem to forget that Berkshire Hathaway is not a typical investment fund. It is a conglomerate based on insurance and reinsurance businesses, which, by their nature, require a considerable amount of cash on hand in case insured risks materialize.

It is also possible that Buffett is laying the groundwork for his successor. The 95-year-old investor will step down as CEO at the end of the year, with Greg Abel set to take over.

Therefore, placing too much importance on changes in Berkshire’s portfolio, as if they were warning signs of a crisis similar to that of 2008, could be overly simplistic. There could be many other reasons for such moves, including simple portfolio optimization.

But what are the real chances of a market crash?

Beyond the Treasury’s fiscal challenges, ongoing trade tensions, and mixed signals from the Federal Reserve, the so-called “permabears” have identified another potential black swan: weakening consumer confidence.

On the macroeconomic front, The Conference Board’s consumer confidence index fell slightly in October, dropping 1.0 points to 94.6. While views on the current situation of businesses and the labor market improved modestly, short-term expectations for income, businesses, and employment fell 2.9 points to 71.5.

On the corporate side, reports like Chipotle’s start to worry. The company reported a 4% decline in same-store sales last quarter, with CEO Scott Boatwright noting a “meaningful pullback” among younger and lower-income customers.

Still, the overall earnings picture isn’t bad. According to FactSet, with 64% of S&P 500 companies having reported, 83% have posted positive EPS surprises and 79% have exceeded revenue expectations. Add to that the ongoing AI boom and the Fed’s approaching QE shift — and the market growth might still have some fuel left.

Regarding how an investor can protect their portfolio from potential market downturns, Buffett’s investment philosophy offers valuable guidance: buy businesses, not just stocks, and when evaluating companies, focus on adjusted earnings instead of short-term market noise.