Sentiment Nosedives, Crypto Funds See Outflows

Today in crypto, market sentiment dove on Tuesday as Bitcoin dipped, crypto exchange-traded products saw $360 million in outflows last week and DeFi protocol Balancer suffered a $116 million exploit involving staked Ether.

Crypto sentiment nosedives as Bitcoin drops under $106,000

Crypto market sentiment fell significantly on Tuesday, with the Crypto Fear & Greed Index dropping by 50% to a score of 21 out of 100 to indicate “Extreme Fear” after Bitcoin (BTC) briefly fell below $106,000 for the first time in over three weeks.

It was the lowest score for the index in nearly seven months, having dropped to 18 out of 100 on April 9 as the wider stock and crypto markets fell in reaction to US President Donald Trump’s sweeping global tariffs that took effect that day.

Bitcoin fell to a 24-hour low of $105,540 on Monday, sliding from an intraday peak of over $109,000, but had recovered above $106,500 in early trading on Tuesday. It’s the first time the cryptocurrency had dropped below $106,000 since Oct. 17.

The index has swung between “Extreme Fear” and “Neutral,” after the market crash over Oct. 9-10, when Bitcoin rapidly cooled from its Oct. 6 peak of over $126,000.

Analysts have attributed Bitcoin’s current dip to reduced institutional demand and blockchain activity, as well as concerns that the Federal Reserve won’t commit to more interest rate cuts this year.

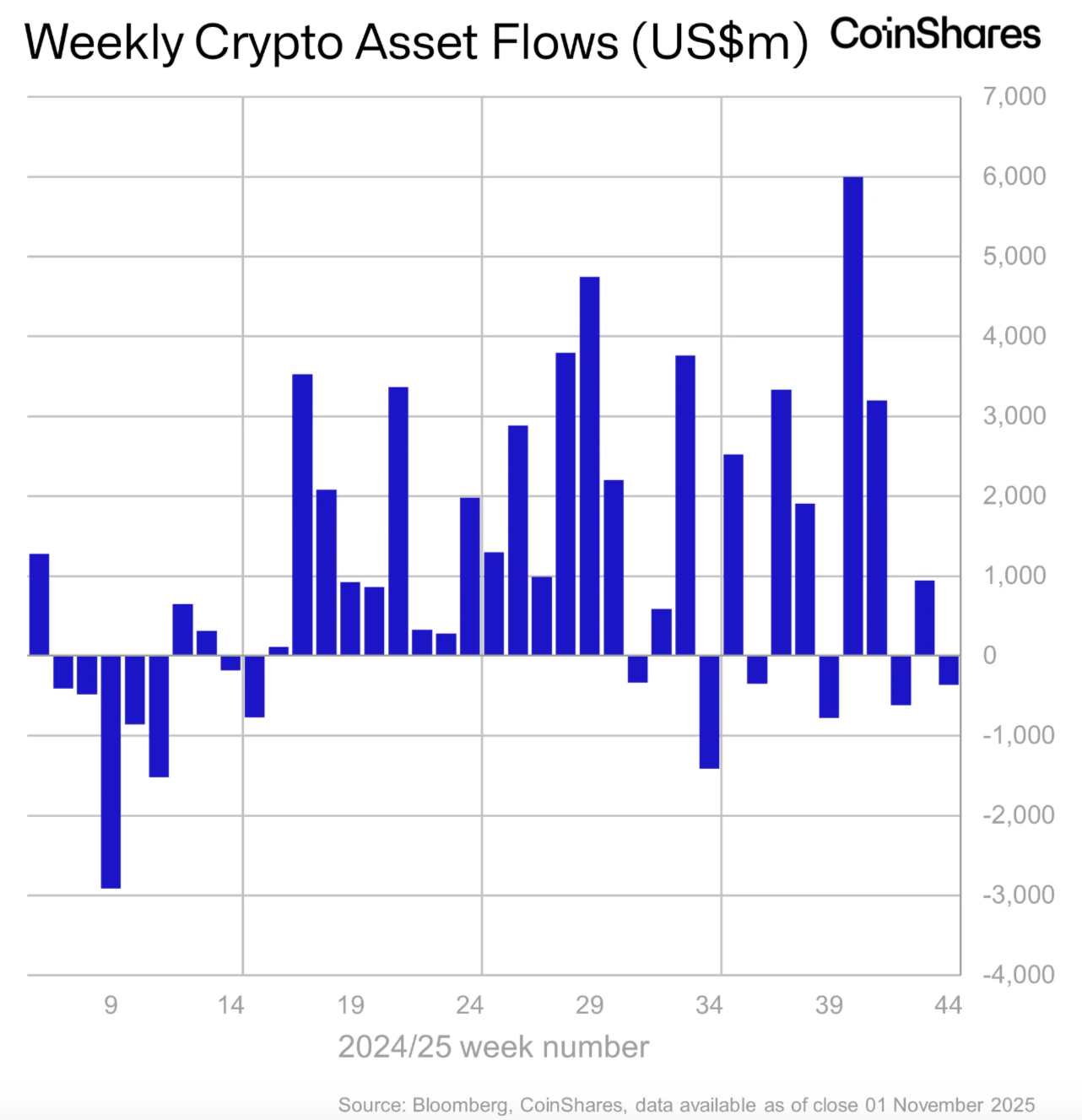

Hawkish Fed triggers $360M in crypto outflows as Solana ETFs buck trend

Cryptocurrency investment products saw $360 million in outflows last week as investors reacted to Federal Reserve Chair Jerome Powell’s cautious remarks on future rate cuts.

Despite Wednesday’s rate cut, Powell’s remark that another one in December was “not a foregone conclusion,” combined with the absence of economic data due to the ongoing government shutdown, appears to have left markets uncertain, CoinShares reported on Monday.

Most of the selling pressure came from the US markets, which saw $439 million in outflows, partly offset by modest inflows from Germany and Switzerland. Bitcoin exchange-traded funds (ETFs) led the decline, with $946 million in redemptions.

Even as Bitcoin funds bore the brunt of outflows, not all assets followed suit. Solana stood out, attracting $421 million in inflows, its second-largest on record, driven by demand for newly launched US ETFs, lifting year-to-date totals to $3.3 billion.

Ethereum also saw $57.6 million in inflows, although daily activity suggested a mixed sentiment among investors.

The outflows come after crypto products amassed $921 million in inflows the previous week, driven by lower-than-expected Consumer Price Index (CPI) data released on Oct. 24.

Balancer exploit swells to $116 million in outflows as team offers 20% bounty

The decentralized exchange (DEX) and automated market maker (AMM) Balancer has been exploited, with more than $116 million worth of digital assets transferred to a newly created wallet.

“We’re aware of a potential exploit impacting Balancer v2 pools. Our engineering and security teams are investigating with high priority,” the Balancer team said in a Monday X post, adding that it will share more updates as information becomes available.

Onchain data initially showed that the decentralized finance (DeFi) protocol was exploited for $70.9 million worth of liquid staked Ether (ETH) tokens transferred to a fresh wallet across three transactions, according to Etherscan logs.

The transfers included 6,850 StakeWise Staked ETH (OSETH), 6,590 Wrapped Ether (WETH) and 4,260 Lido wstETH (wSTETH), crypto intelligence platform Nansen said in a Monday X post.

By 8:52 am UTC on Monday, the ongoing exploit has swelled to over $116.6 million in stolen funds, according to blockchain data platform Lookonchain.

The Balancer exploit may stem from smart contract issues that had a “faulty access check allowing the attacker to send a command to withdraw funds,” Nicolai Sondergaard, research analyst at Nansen, told Cointelegraph, adding:

“From what I see, losses are now greater than $100 million and have affected Balancer v2 + various forks.”