Traders are counting all the way down to the Federal Reserve’s Sept. 17 financial coverage choice; markets count on a quarter-point fee minimize that might set off short-term volatility however probably gas longer-term positive factors throughout danger property.

The financial backdrop highlights the Fed’s delicate balancing act.

In response to the newest CPI report launched by the U.S. Bureau of Labor Statistics on Thursday, client costs rose 0.4% in August, lifting the annual CPI fee to 2.9% from 2.7% in July, as shelter, meals, and gasoline pushed prices larger. Core CPI additionally climbed 0.3%, extending its regular tempo of current months.

Producer costs advised an analogous story: per the newest PPI report launched on Wednesday, the headline PPI index slipped 0.1% in August however remained 2.6% larger than a yr earlier, whereas core PPI superior 2.8%, the biggest yearly enhance since March. Collectively, the studies underscore cussed inflationary stress at the same time as development slows.

The labor market has softened additional.

Nonfarm payrolls elevated by simply 22,000 in August, with federal authorities and vitality sector job losses offsetting modest positive factors in well being care. Unemployment held at 4.3%, whereas labor power participation remained caught at 62.3%.

Revisions confirmed June and July job development was weaker than initially reported, reinforcing indicators of cooling momentum. Common hourly earnings nonetheless rose 3.7% yr over yr, maintaining wage pressures alive.

Bond markets have adjusted accordingly. Per knowledge from MarketWatch, 2-year Treasury yield sits at 3.56%, whereas the 10-year is at 4.07%, leaving the curve modestly inverted. Futures merchants see a 93% likelihood of a 25 foundation level minimize, in accordance with CME FedWatch.

If the Fed limits its transfer to simply 25 bps, buyers might react with a “purchase the rumor, promote the information” response, since markets have already priced in aid.

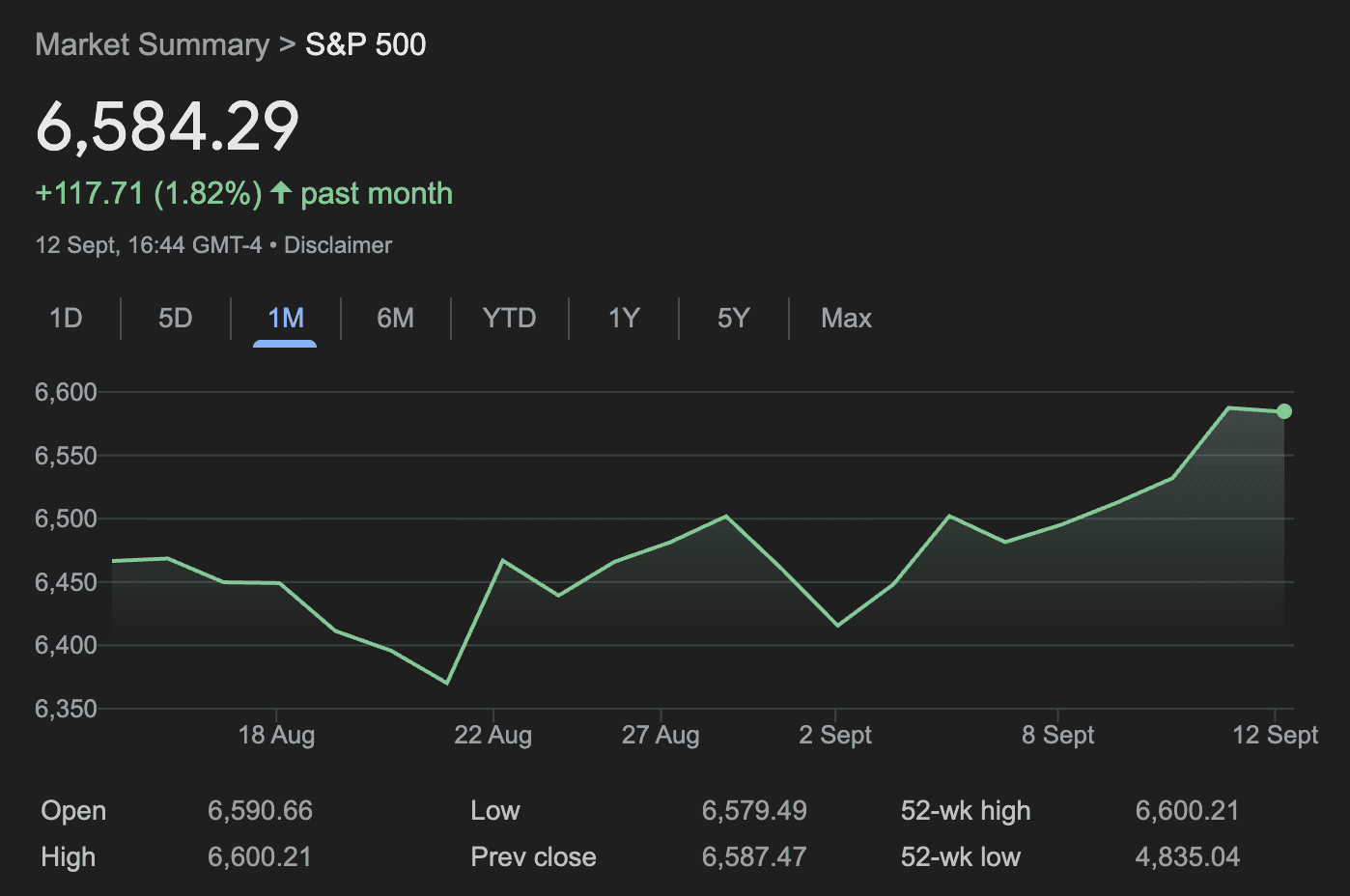

Equities are testing file ranges.

The S&P 500 closed Friday at 6,584 after rising 1.6% for the week, its greatest since early August. The index’s one-month chart exhibits a powerful rebound from its late-August pullback, underscoring bullish sentiment heading into Fed week.

The Nasdaq Composite additionally notched 5 straight file highs, ending at 22,141, powered by positive factors in megacap tech shares, whereas the Dow slipped under 46,000 however nonetheless booked a weekly advance.

Crypto and commodities have rallied alongside.

Bitcoin is buying and selling at $115,234, under its Aug. 14 all-time excessive close to $124,000 however nonetheless firmly larger in 2025, with the worldwide crypto market cap now $4.14 trillion.

Gold has surged to $3,643 per ounce, close to file highs, with its one-month chart exhibiting a gradual upward trajectory as buyers value in decrease actual yields and search inflation hedges.

Historic precedent helps the cautious optimism.

Evaluation from the Kobeissi Letter — reported in an X thread posted Saturday — citing Carson Analysis, exhibits that in 20 of 20 prior circumstances since 1980 the place the Fed minimize charges inside 2% of S&P 500 all-time highs, the index was larger one yr later, averaging positive factors of almost 14%.

The shorter time period is much less predictable: in 11 of these 22 cases, shares fell within the month following the minimize. Kobeissi argues this time might comply with an analogous sample — preliminary turbulence adopted by longer-term positive factors as fee aid amplifies the momentum behind property like equities, bitcoin and gold.

The broader setup explains why merchants are watching the Sept. 17 announcement carefully.

Slicing charges whereas inflation edges larger and shares hover at information dangers denting credibility, but staying on maintain might spook markets which have already priced in easing. Both approach, the Fed’s message on development, inflation, and its coverage outlook will possible form the trajectory of markets for months to return.