The US is sitting atop a fiscal precipice. With the overall U.S. debt surpassing $37.43 trillion as of September 2025, the nation faces a historic actuality. Practically one-quarter of each tax greenback it collects is consumed by servicing the curiosity funds on its debt burden.

The relentless march of U.S. debt

Based on month-to-month updates from each the U.S. Treasury and Joint Financial Committee, the nationwide debt has soared to $37.43 trillion. This marks a rise of $2.09 trillion in simply the previous yr.

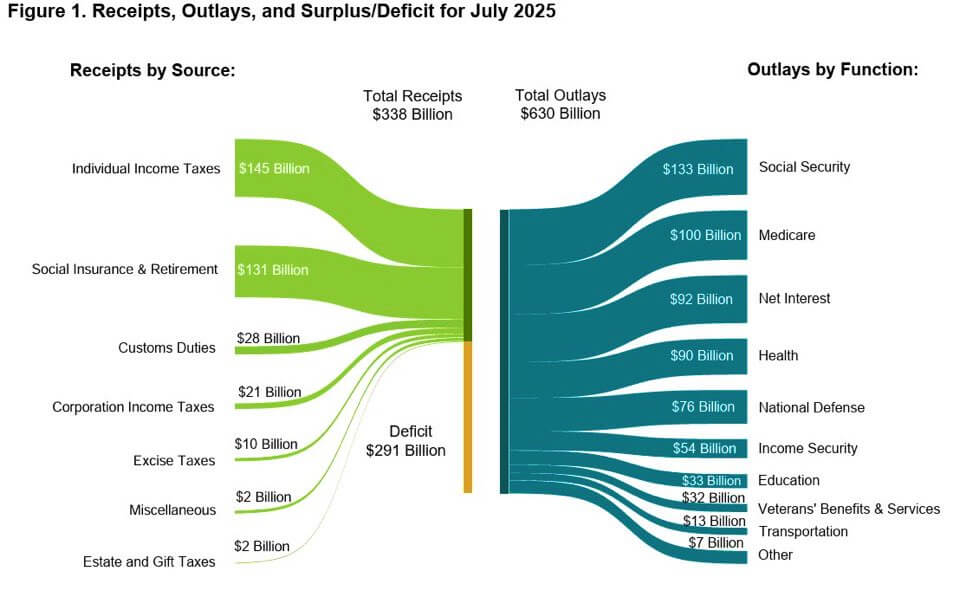

The curiosity funds alone for FY2025 exceed $478 billion year-to-date, up 17% from final yr, in line with CNBC.

This expense is projected to account for about 23 cents of each greenback collected by the IRS in income. It is a staggering proportion that has risen sharply as international rates of interest normalize following years of quantitative easing.

Tariffs: large numbers, small affect

Latest years have seen the U.S. authorities rack up record-breaking tariff revenues, particularly after a collection of latest import duties imposed below the Trump administration.

These tariffs are anticipated to bolster Treasury coffers and will scale back the nationwide deficit by $4 trillion over a decade.

But even such windfalls barely dent the mountain of nationwide U.S. debt, with rising curiosity prices outpacing tariff assortment good points. The IMF cautions that “the size of the rise in tariff income is extremely unsure,” whereas Eliant Capital posted:

“Regardless of tariff revenues, the deficit for July was $291B with the U.S. spending $630B and gathering $338B which means 46¢ was borrowed for each $1 spent.”

Nothing stops this practice

Macro analyst Lyn Alden has popularized the “nothing stops this practice” thesis, a phrase borrowed from popular culture however now synonymous with the U.S. debt dilemma.

Alden’s evaluation argues that persistent deficits and relentless spending make for an period of fiscal dominance and that substantive fiscal reform is politically not possible. In her view, the relentless accrual of debt is structurally constructed into the system, and nothing however a paradigm shift (akin to onerous cash) can break the cycle. Alden advised Slate Sundays:

“Simply structurally, it’s [U.S. debt] rising above goal nearly with none technique to cease it.”

Based on the Peterson Basis, curiosity funds are actually the third-largest spending class for the federal authorities. They surpass practically each different program besides Social Safety and Medicare.

As a share of revenues, federal curiosity funds will rise to 18.4 % by yr’s finish, a stage not seen because the early Nineteen Nineties.

Do not Get Left Holding the Bag

Be part of The Crypto Investor Blueprint — 5 days of pro-level methods to turbocharge your portfolio.

Dropped at you by CryptoSlate

As curiosity funds devour ever-larger shares of federal income and conventional cures like tariffs and spending cuts show inadequate, the dialog round “onerous cash” intensifies.

Bitcoin and different cryptos are more and more considered as store-of-value alternate options in an period of persistent financial enlargement.

As Alden’s thesis warns, nothing stops this practice, and this realization is fueling renewed consideration to onerous cash options like Bitcoin and gold.

Buyers search alternate options like Bitcoin and gold

Each gold and Bitcoin have seen sturdy demand as various shops of worth amid fiscal considerations and inflationary strain.

As of mid-September 2025, gold had reached an all-time excessive, buying and selling at over $3,600 per ounce, up greater than 41% year-over-year.

Some analysts count on gold’s rally to proceed, projecting costs towards $3,800 by the tip of the yr as international liquidity considerations drive buyers into protected havens.

Bitcoin, dubbed by many as “digital gold,” is buying and selling round $115,000–$118,000 after rebounding from its September lows close to $108,000.

Whereas Bitcoin’s worth motion has been risky, many analysts, together with Lyn Alden, count on to see it to hit at the least $150,000 by the tip of this cycle.

As fiscal pressures mount, these alternate options are more and more seen as key safeguards in diversified portfolios, in a time when U.S. debt is spinning uncontrolled.