Key takeaways:

-

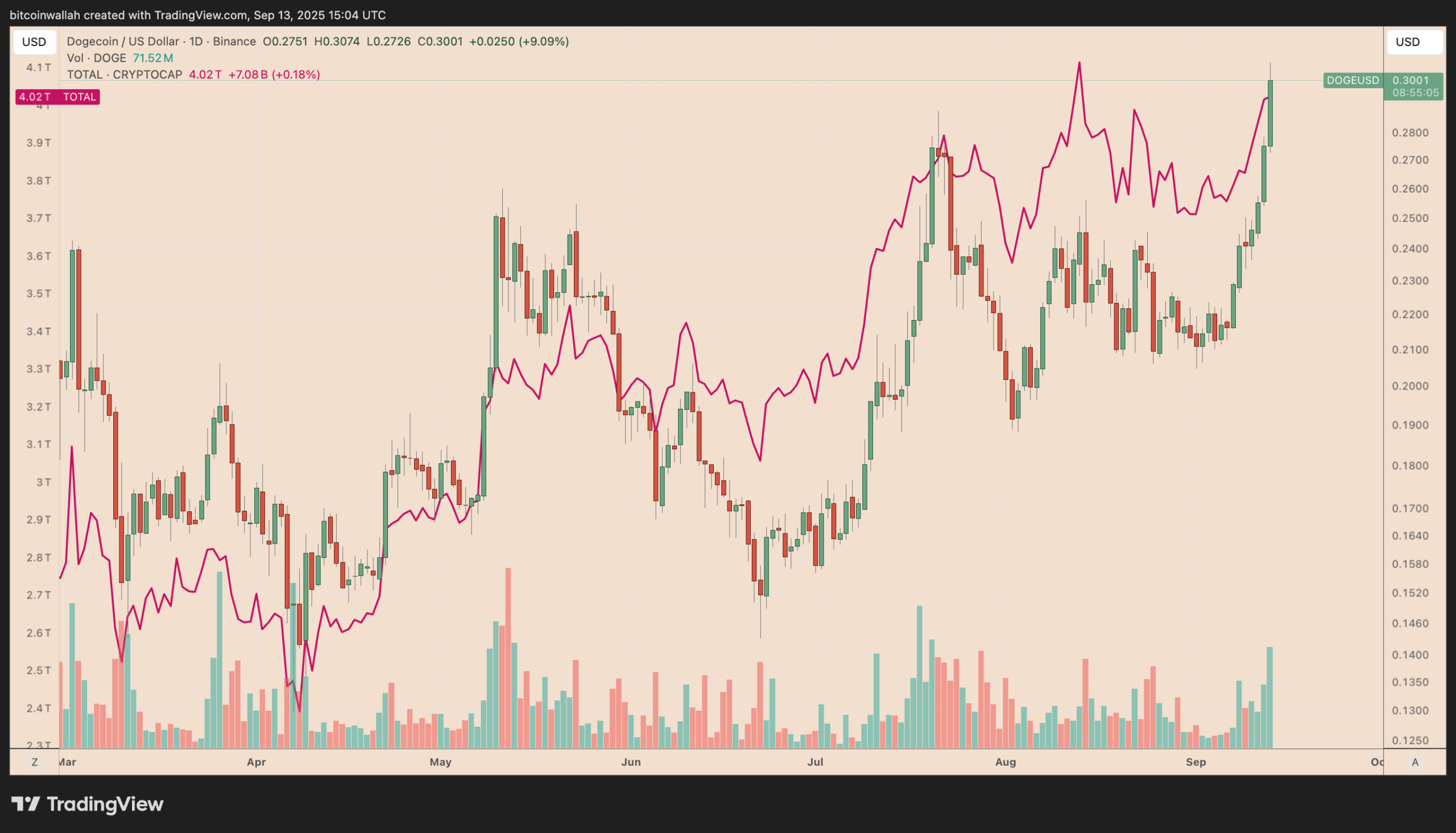

Dogecoin has damaged out of a multimonth symmetrical triangle.

-

Buying and selling volumes tripled in the course of the breakout, signaling robust bullish momentum.

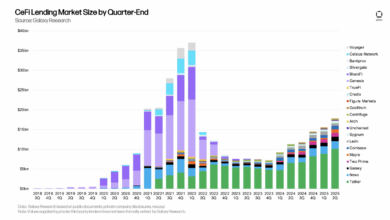

Dogecoin (DOGE) worth has rallied by practically 40% up to now seven days, beating the broader crypto market, which has gained practically 8% in the identical interval.

The highest memecoin now hints at additional worth development within the coming weeks, as a consequence of a mixture of technical and onchain components.

DOGE worth breakout hints at 95% positive factors forward

The weekly DOGE worth chart exhibits a breakout from a multimonth symmetrical triangle, a bullish continuation sample.

As of Saturday, it’s buying and selling at round $0.296. However extra importantly, its buying and selling volumes in the course of the breakout greater than tripled, signifying robust upside momentum.

DOGE worth can now rise as excessive because the triangle’s most peak, placing its breakout goal at round $0.60, up roughly 95% from the present worth ranges, by October.

Some chartists, together with CryptoKing and CryptoGoos, have put their symmetrical triangle targets barely decrease at $0.45. That aligns with the higher trendline of one other multiyear and far broader triangle sample, as proven under.

Dogecoin’s relative energy index (RSI) reinforces the bullish setup after treading under its overbought threshold of 70.

Nonetheless, DOGE bulls should defend assist at its 50-week exponential transferring common (50-week EMA; the crimson wave) close to $0.227 to validate the setup. A decisive shut under the ground could push Dogecoin decrease towards the 200-week EMA at round $0.215.

Can DOGE repeat final November’s 230% positive factors?

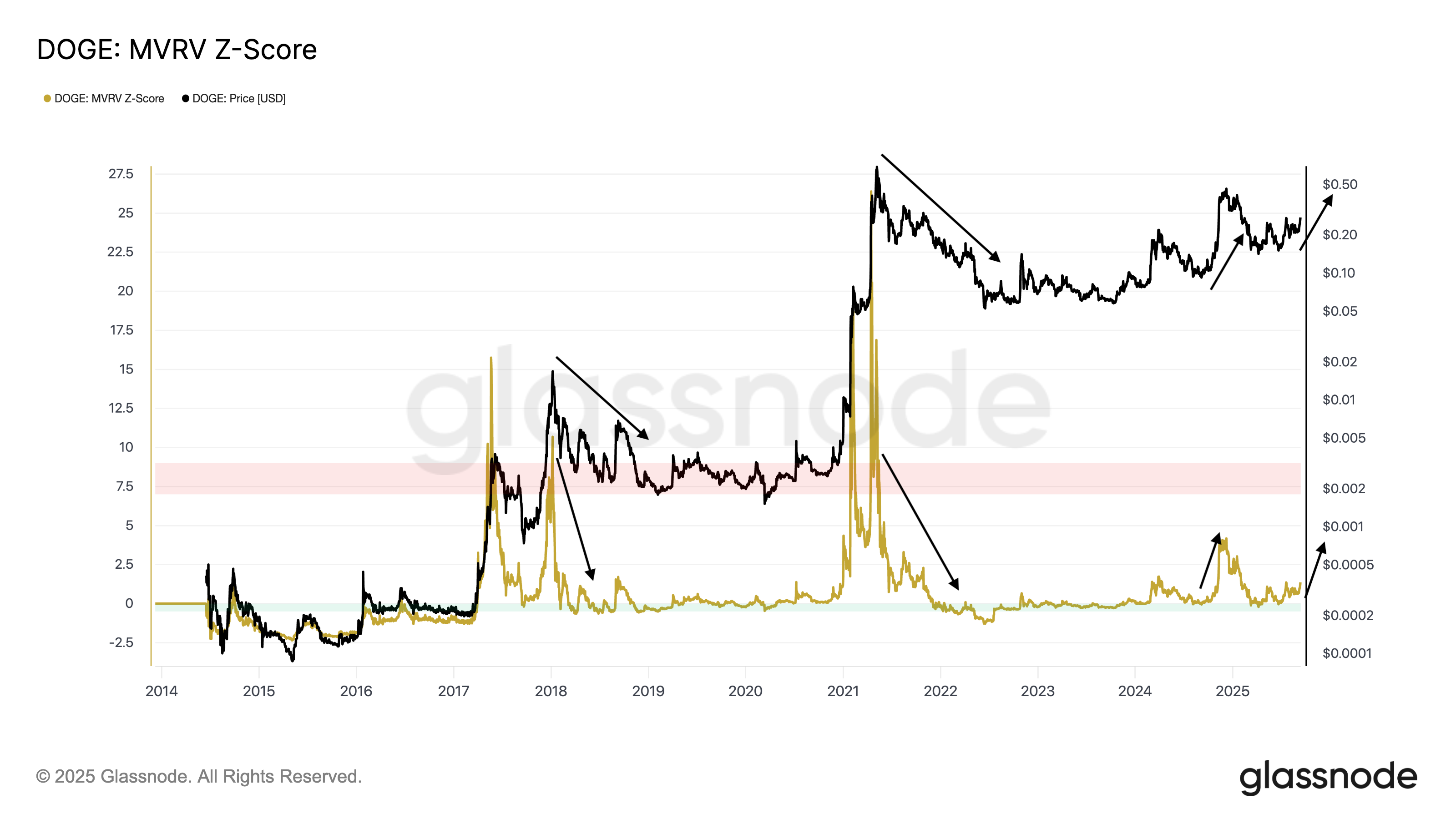

Dogecoin’s MVRV Z-Rating sits close to 1.35 as of Saturday, a stage that in previous cycles has typically appeared simply earlier than main rallies, together with final November’s 230% positive factors.

The MVRV Z-Rating measures whether or not DOGE is overpriced or underpriced in comparison with what most holders initially paid.

A really excessive rating (significantly above the crimson space) means the market is overheated as a result of traders are sitting on large unrealized earnings. A really low rating (under the inexperienced space) suggests undervaluation, the place most holders are at or under their price foundation.

In 2021, for instance, the Z-Rating surged above 20 when DOGE hit its $0.70 peak, flashing clear indicators of market extra.

Associated: Dogecoin worth rises regardless of newest delay of US DOGE ETF launch

In the present day’s modest 1.35 studying alerts the other: holders aren’t sitting on excessive positive factors, leaving loads of room for worth to climb earlier than overbought circumstances come up.

This additional signifies DOGE nonetheless has important room to develop within the coming weeks.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.