Immediately in crypto, prime Web3 white hats are incomes tens of millions uncovering DeFi flaws, a crypto researcher has excessive hopes the US authorities will nonetheless kind the Strategic Bitcoin Reserve this 12 months. In the meantime, Gemini shares soared on Nasdaq of their first day of buying and selling.

Web3 white hats earn tens of millions, crushing $300K conventional cybersecurity jobs

High white hats looking vulnerabilities throughout decentralized protocols in Web3 are incomes tens of millions, dwarfing the $300,000 wage ceiling in conventional cybersecurity roles.

“Our leaderboard reveals researchers incomes tens of millions per 12 months, in comparison with typical cybersecurity salaries of $150-300k,” Mitchell Amador, co-founder and CEO of bug bounty platform Immunefi, informed Cointelegraph.

In crypto, “white hats” refers to moral hackers paid to reveal vulnerabilities in decentralized finance (DeFi) protocols. In contrast to salaried company roles, these researchers select their targets, set their very own hours and earn based mostly on the influence of what they discover.

Up to now, Immunefi has facilitated greater than $120 million in payouts throughout 1000’s of studies. Thirty researchers have already turn out to be millionaires.

‘Robust likelihood’ US will kind Strategic Bitcoin Reserve this 12 months: Alex Thorn

There’s a excessive chance that the US authorities will kind the extremely anticipated Strategic Bitcoin Reserve by the tip of this 12 months, says Galaxy Digital’s head of firmwide analysis, Alex Thorn.

Nonetheless, different business executives are much less assured.

“I nonetheless suppose there’s a powerful likelihood the US authorities will announce this 12 months that it has fashioned the strategic Bitcoin reserve (SBR) and is formally holding BTC as a strategic asset,” Thorn stated in an X submit on Thursday.

“Market appears to be fully underpricing the chance of such an announcement,” Thorn added.

Whereas US President Trump signed the chief order formally establishing the Strategic Bitcoin Reserve and US Digital Asset Stockpile in March, a formalized strategic plan has not been confirmed but.

Gemini (GEMI) inventory soars in Nasdaq debut amid crypto IPO growth

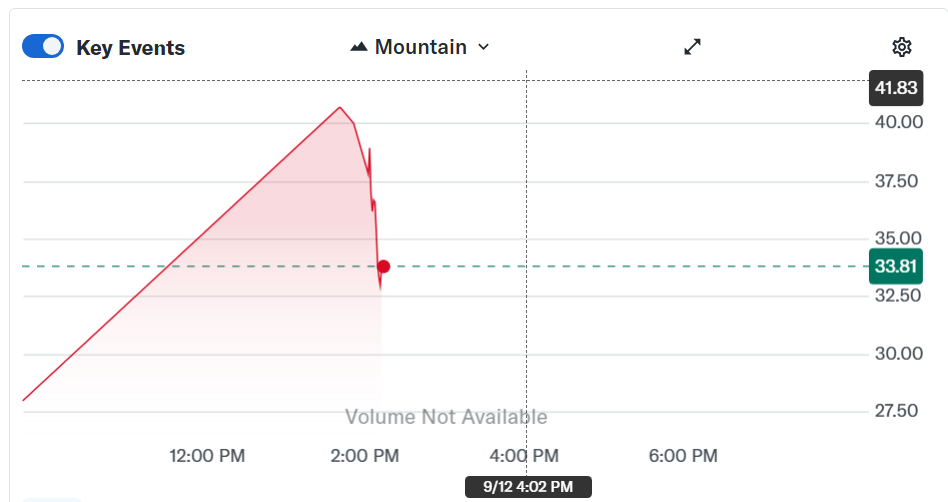

Shares of Gemini Area Station (GEMI), the digital asset trade based by Cameron and Tyler Winklevoss, surged of their market debut on Friday, signaling sturdy institutional urge for food for crypto-related equities.

Gemini shares briefly topped $40 on Friday, based on Yahoo Finance knowledge, earlier than retreating later within the session. By the afternoon, Gemini was buying and selling close to $35 a share, up 24% on the day, for a market cap of round $1.3 billion.

The corporate priced its preliminary public providing at $28 per share late Thursday — nicely above its preliminary goal vary of $17 to $19, and even increased than the upwardly revised $24 to $26 vary.

In response to CNBC, Gemini capped its providing at 15.2 million shares, elevating $425 million and signaling heightened investor demand.

The trade moved swiftly from submitting its Kind S-1 with the US Securities and Alternate Fee to debuting on the Nasdaq. As Cointelegraph reported, Gemini submitted its IPO registration on Sept. 2 and commenced buying and selling 10 days later.