WisdomTree has launched a brand new tokenized fund specializing in non-public credit score.

The brand new fund, referred to as the WisdomTree Non-public Credit score and Different Revenue Digital Fund (CRDT), tracks a basket of 35 publicly traded closed-end funds, enterprise improvement corporations, and actual property funding trusts, Bloomberg reviews.

It’s accessible with a minimal funding of simply $25 and provides two-day redemption. WisdomTree, it’s price including, launched an ETF monitoring the identical benchmark in 2021, the WisdomTree Non-public Credit score and Different Revenue Fund.

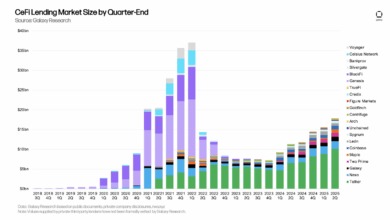

Non-public credit score, lending achieved exterior conventional banks, has ballooned in recent times as buyers chase yield-focused funding choices.

“It’s actually nearly bringing the asset class to a complete universe of various buyers,” stated Will Peck, head of digital belongings at WisdomTree.

The agency has launched quite a few tokenized funding autos to date, together with ones providing publicity to cash market funds, fastened earnings securities, and equities.

The brand new fund joins a rising pattern amongst Wall Road’s largest asset managers. BlackRock, for instance, manages a $2 billion cash market fund, whereas Constancy’s tokenized cash market fund not too long ago rolled out on Ethereum.

WisdomTree joins a broader pattern. BlackRock’s tokenized $2 billion cash market fund and experiments from Constancy and VanEck recommend conventional finance is taking real-world asset tokenization severely, even when it’s nonetheless small in comparison with the trillions in ETFs and mutual funds.