Polygon Labs companions with Cypher Capital to spice up institutional entry within the Center East

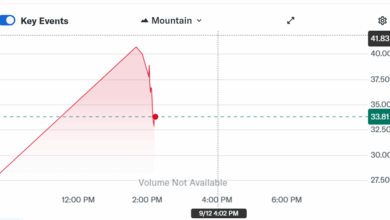

Polygon Labs introduced Sept. 12 that it’s partnering with Dubai-based Cypher Capital to develop institutional entry to POL, the native asset powering the Polygon blockchain, throughout the Center East.

The initiative marks the primary in a collection of efforts to deliver skilled traders into direct engagement with Polygon’s infrastructure.

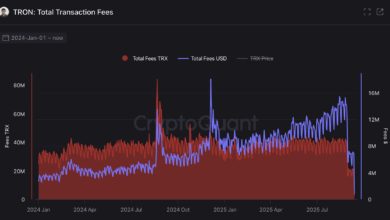

POL will likely be positioned as an institutional-grade asset providing actual yield, with roundtables, liquidity enhancements, and structured alternatives aimed toward funds, corporates, and different giant allocators.

Polygon co-founder Sandeep Nailwal mentioned in a press release:

“Institutional demand for actual yield on crypto is already in excessive demand, and retains rising.”

He added that this system is designed to “translate that worth into institutional-grade alternatives, providing a path for traders to earn actual yield by participating straight with the financial engine of the Polygon ecosystem.”

Cypher Capital, a enterprise and funding agency lively within the area, will assist Polygon navigate regulatory and capital market settings.

3 Seconds Now. Beneficial properties That Compound for Years.

Act quick to hitch the 5-day Crypto Investor Blueprint and keep away from the errors most traders make.

Dropped at you by CryptoSlate

This system is anticipated to focus on POL as a core portfolio asset for skilled traders in search of publicity to blockchain infrastructure, world funds, and real-world asset transactions.

The announcement comes as Polygon continues to advance its “GigaGas” roadmap, which Nailwal mentioned has already delivered sub-five-second finality and throughput of as much as 1,000 transactions per second.

Future milestones goal to determine Polygon as a high-performance settlement layer for the “trustless web of worth.”

The rollout illustrates a broader push by main blockchain initiatives to construct institutional pipelines in development markets, the place curiosity in digital property and tokenized merchandise continues to climb.