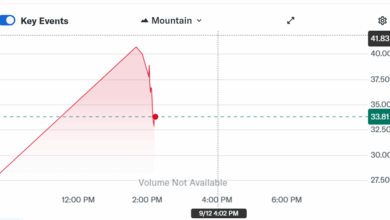

Prediction market Polymarket is pursuing new funding that would increase its valuation to $10 billion, as Enterprise Insider reported on Sept. 12.

Two individuals with data of the matter stated the valuation discussions signify at the very least a threefold improve from the $1 billion Polymarket achieved in a funding spherical that closed this summer time.

Based on one supply, at the very least one investor supplied a time period sheet valuing the corporate at $10 billion. A Polymarket spokesperson declined to touch upon the funding talks.

Strategic developments

The reported valuation surge follows a sequence of strategic developments positioning Polymarket for a US comeback.

The Commodity Futures Buying and selling Fee granted regulatory approval for the platform to renew US operations by means of a no-action letter issued Sept. 3 to QCX LLC, Polymarket’s regulatory companion, acquired for $112 million in July.

The regulatory greenlight permits Polymarket to function occasion contracts whereas sustaining compliance with federal derivatives laws. It additionally marks a return after the platform ceased US operations in 2022 following a $1.4 million CFTC settlement over unregistered derivatives buying and selling.

Moreover, Donald Trump Jr. joined Polymarket’s advisory board in August as his enterprise capital agency 1789 Capital made a strategic funding within the platform.

The partnership provides political experience as Polymarket prepares for US market entry. Trump Jr. lately praised the platform for slicing by means of “media spin and so-called skilled opinion.”

Enrollment Closing Quickly…

Safe your spot within the 5-day Crypto Investor Blueprint earlier than it disappears. Be taught the methods that separate winners from bagholders.

Dropped at you by CryptoSlate

Polymarket CEO Shayne Coplan characterised the 1789 Capital partnership as reinforcing the corporate’s function as a trusted data supply, whereas the agency’s founder, Omeed Malik, praised Polymarket’s intersection of monetary innovation and free expression.

Stoop in consumer progress

Polymarket operates as a prediction market the place customers place bets on outcomes starting from political elections to cultural occasions, producing market-driven predictions.

Information from a Dune dashboard by Varrock founder Richard Chen exhibits that Polymarket crossed $8.5 billion in year-to-date buying and selling quantity as of Sept. 12, surpassing final 12 months’s complete quantity.

The buying and selling quantity improve happens regardless of a droop in energetic and new customers. Polymarket’s month-to-month energetic merchants peaked in January at 454,664, step by step falling to achieve August’s 226,442 after a 20% fall from July.

In the meantime, new customers plunged 33% between July and August, reaching 66,160, the bottom degree in a 12 months.

The platform’s regulatory preparations and high-profile advisory additions place it for a possible pivot in these numbers with a US growth.