The REX-Osprey Solana staking ETF (SSK) surpassed $200 million in cumulative flows for the primary time on Sept. 11, amid Solana’s (SOL) sturdy value motion.

Buying and selling underneath ticker SSK, the fund struggled with adoption throughout its preliminary months, recording zero exercise on 4 of six buying and selling days by way of Aug. 8, in response to Farside Traders knowledge.

The sample mirrored broader institutional hesitation towards Solana-focused funding merchandise in comparison with Bitcoin and Ethereum alternate options.

Analysts attributed the gradual begin to structural complexity quite than demand deficiencies.

Moreover, the fund operates exterior customary SEC-registered spot ETF frameworks, incorporating staking mechanisms and offshore ETF allocations that differentiate it from conventional cryptocurrency merchandise.

At 0.75% yearly, SSK’s administration charge positions on the increased finish of crypto ETF expense ratios in comparison with main Bitcoin and Ethereum funds charging 0.15% to 0.25%.

Shifting tides

Nonetheless, institutional sentiment shifted in late August, following bulletins about company Solana treasury methods.

Galaxy Digital, Multicoin Capital, and Leap Crypto introduced they have been pursuing $1 billion to assemble a Solana treasury by way of a public firm automobile, with Cantor Fitzgerald serving as lead banker.

3 Seconds Now. Features That Compound for Years.

Act quick to affix the 5-day Crypto Investor Blueprint and keep away from the errors most traders make.

Dropped at you by CryptoSlate

The businesses dedicated money and stablecoins to Ahead Industries, which closed a $1.65 billion non-public placement on Sept. 11.

As well as, SOL Methods secured Nasdaq approval to start buying and selling on Sept. 9 as a Solana-first funding automobile.

Institutional flows

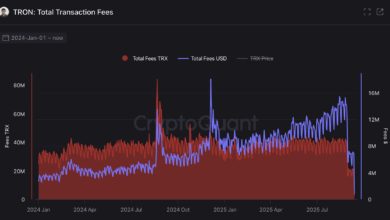

Institutional flows mirrored the momentum shift. Solana exchange-traded merchandise (ETPs) registered $177 million in inflows throughout the week of Aug. 25-29, representing the most important altcoin stream excluding Ethereum.

The primary week of the month noticed Solana merchandise dominate altcoin flows with $16.1 million, whereas Ethereum ETPs skilled $912.4 million in outflows. The institutional curiosity coincided with Solana’s progress in its DeFi ecosystem.

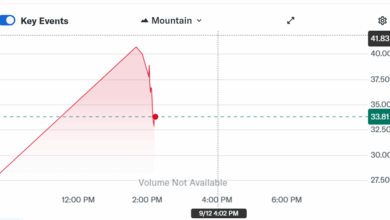

DefiLlama knowledge exhibits that Solana crossed $13 billion in whole worth locked for the primary time on Sept. 12.

This backdrop supplied basic help for a value advance that lifted SOL by 20% in September. On Sept. 12, SOL grew 5.5% to achieve a $241.84 excessive, its highest value degree since Jan. 30.