Gemini shares hit $40 inside hours of Nasdaq debut, showcasing Wall Avenue’s crypto urge for food

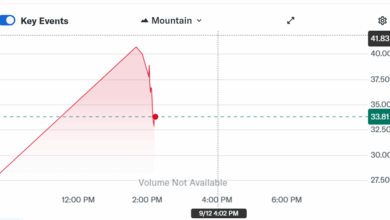

Gemini made a robust entrance on Wall Avenue on Sept. 12, with its inventory worth surging over 50% inside the intial hours of their first day of buying and selling on the Nasdaq.

The inventory, listed beneath the image GEMI, opened at $28 per share and shortly superior within the opening hours.

Costs briefly touched $40 earlier than settling close to $33 by midafternoon, leaving Gemini with a market capitalization of roughly $1.3 billion, in accordance with Yahoo Finance.

The closing worth represented a acquire of about 24% from its providing stage.

Robust debut

Gemini raised roughly $425 million by promoting 15.2 million shares. The ultimate supply worth exceeded each its unique vary of $17 to $19 per share and a later revision that set expectations between $24 and $26.

Following just a few weeks of rumors, the alternate filed its registration assertion with the Securities and Trade Fee on Sept. 2 and reached the general public market simply 10 days later, reflecting investor demand for digital asset publicity.

3 Seconds Now. Positive factors That Compound for Years.

Act quick to affix the 5-day Crypto Investor Blueprint and keep away from the errors most traders make.

Dropped at you by CryptoSlate

Whereas not among the many largest exchanges by buying and selling exercise, Gemini has constructed a popularity within the U.S. for emphasizing compliance and safety. Buying and selling on its platform accelerated within the days earlier than the IPO.

Wave of crypto listings

The debut provides to a string of profitable crypto-linked listings in 2025. Stablecoin operator Circle launched on the New York Inventory Trade earlier this 12 months, with shares climbing from a $31 debut worth to above $60, valuing the agency at greater than $33 billion.

Blockchain monetary agency Determine Expertise Options additionally accomplished its IPO this week, notching a 24% first-day leap adopted by extra positive aspects.

Taken collectively, the listings spotlight a resurgence of Wall Avenue curiosity in digital-asset equities, with traders looking for publicity to crypto corporations after years of market volatility.