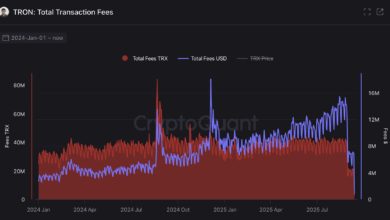

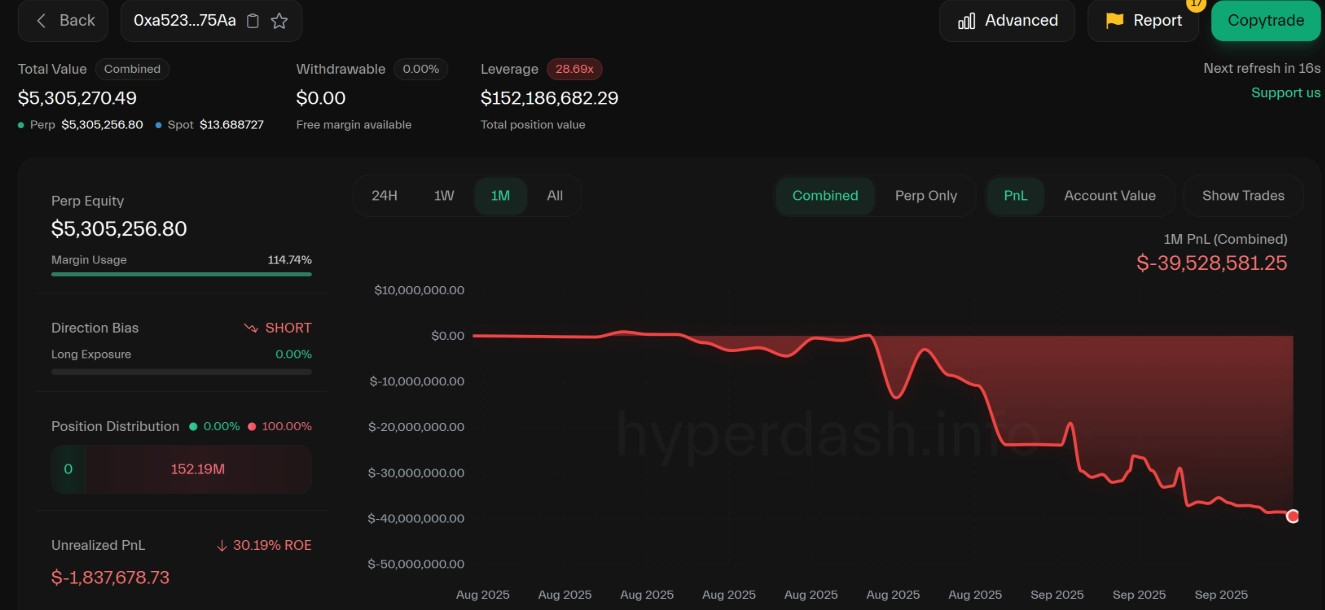

An unknown Hyperliquid dealer has surpassed James Wynn, turning into the buying and selling platform’s greatest shedding whale, with greater than $40 million in losses inside a month, in line with blockchain information.

Lookonchain revealed that the dealer made high-leverage trades, with almost $40 million loss on Hyperliquid (HYPE), after promoting about 900,000 tokens earlier than the asset rebounded.

The whale later misplaced one other $35 million on an Ether (ETH) place. After that, he pivoted to a brief place after which misplaced one other $614,000. His Bitcoin (BTC) place can also be underwater, with unrealized losses of almost $2 million.

Within the final month alone, Hyperdash information exhibits that the whale’s pockets has already misplaced $39.5 million. Regardless of this, the whale nonetheless has a $152 million place with almost 29x leverage.

Proceed studying

Kinto plunges 81% as ETH L2 set to wind down months after hack

The native token of the decentralized finance (DeFi) platform Kinto Community dropped over 80% after information that its Ethereum layer-2 blockchain is shutting down in September.

Kinto mentioned worsening market situations have pressured the venture to close down. The protocol mentioned they’ve operated with out salaries since July, and because it couldn’t undergo with its final financing try, they’ve made the choice to close down.

The choice to close down follows a $1.6 million hack ensuing from a vulnerability within the ERC-1967 Proxy customary.

Whereas the venture blamed the failure on the hack and rising monetary pressures, a neighborhood member pointed to the venture’s excessive annual proportion yield choices on stablecoins, even after the hack. The venture beforehand supplied a 130% annual yield on stablecoins, one of many highest in DeFi.

Proceed studying

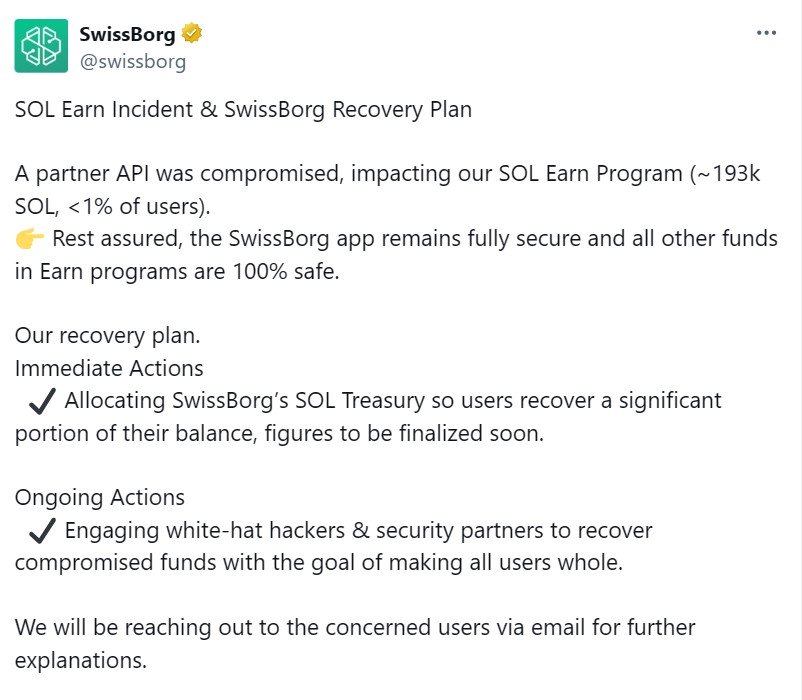

SwissBorg hacked for $41 million SOL after third-party API compromise

Change platform SwissBorg misplaced almost $41 million in an exploit due to a vulnerability within the API of its staking accomplice Kilin.

The venture mentioned about 193,000 Solana tokens, value $41 million, had been stolen from its Earn program. Regardless of this, the venture mentioned its app and different Earn merchandise weren’t impacted.

The corporate additionally mentioned that it stays in good monetary well being regardless of struggling hundreds of thousands in losses. It mentioned day by day operations had been unaffected, and customers who misplaced funds will likely be contacted straight by the platform.

SwissBorg CEO Cyrus Fazel assured customers that whereas it’s an enormous sum of money, it doesn’t put the platform in danger.

Proceed studying

Ethereum L2 MegaETH introduces a yield-bearing stablecoin to fund protocol

Ethereum layer-2 protocol MegaETH, a venture backed by Vitalik Buterin, introduced the launch of a yield-bearing stablecoin that will differentiate its enterprise mannequin from conventional layer-2s.

The protocol mentioned it’s creating the USDm stablecoin in partnership with Ethena, a protocol with over $13 billion in whole worth locked (TVL). The token will launch on Ethena’s infrastructure, which channels reserves into BUIDL, BlackRock’s tokenized US Treasury invoice fund.

Yield from the stablecoin’s reserves will likely be used to offset sequencer charges, that are the prices a layer-2 has to pay when publishing batches of transactions on the Ethereum mainnet.

MegaETH co-founder Shuyao Kong mentioned the stablecoin would decrease customers’ charges and permit for extra expressive design for functions.

Proceed studying

Bubblemaps alleges the biggest Sybil assault in crypto historical past on MYX airdrop

Blockchain analytics agency Bubblemaps claimed that it had recognized the biggest Sybil assault in crypto historical past, pointing to 100 funded wallets that claimed $170 million in MYX tokens from a latest airdrop.

In a sequence of X posts, the analytics agency confirmed that the wallets obtained related BNB quantities from OKX inside minutes of one another, nearly a month after the airdrop. Bubblemaps mentioned that whereas MYX hit a $17 billion absolutely diluted valuation, they noticed one thing uncommon.

Bubblemaps claimed that the wallets had no prior exercise and claimed their airdrop at almost the identical time. “It’s exhausting to consider this was random,” Bubblemaps mentioned, suggesting this could possibly be the “greatest airdrop Sybil of all time.”

A Sybil assault is a safety menace in decentralized networks the place one attacker creates and controls a number of pretend identities to realize affect over the system.

Proceed studying

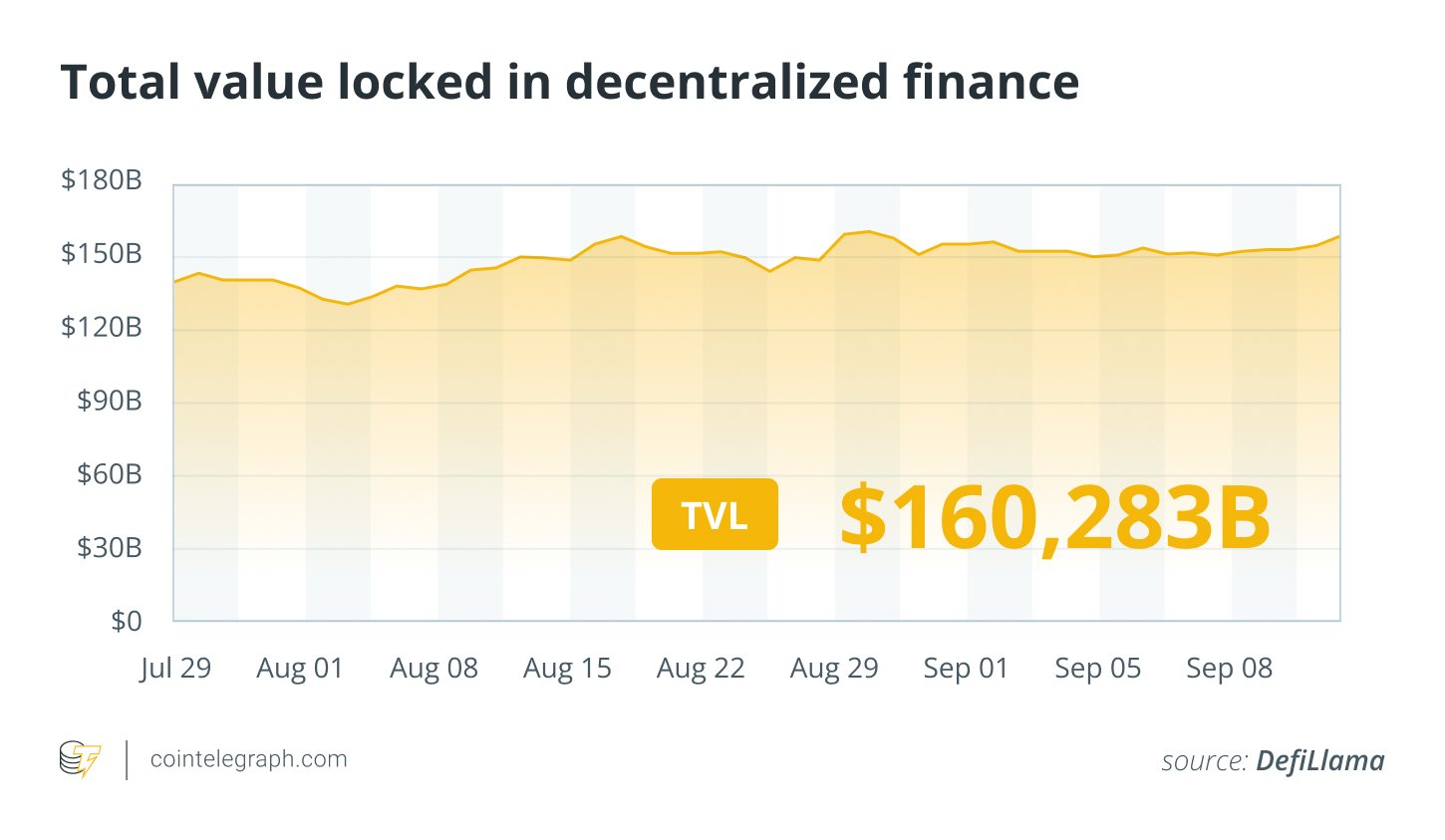

DeFi market overview

Based on information from Cointelegraph Markets Professional and TradingView, a lot of the 100 largest cryptocurrencies by market capitalization ended the week within the inexperienced.

MYX Finance (MYX) had a 1,100% seven-day achieve, turning into the week’s largest gainer. The token is adopted by Worldcoin (WLD), which recorded over 90% in features final week.

Thanks for studying our abstract of this week’s most impactful DeFi developments. Be part of us subsequent Friday for extra tales, insights and training concerning this dynamically advancing house.