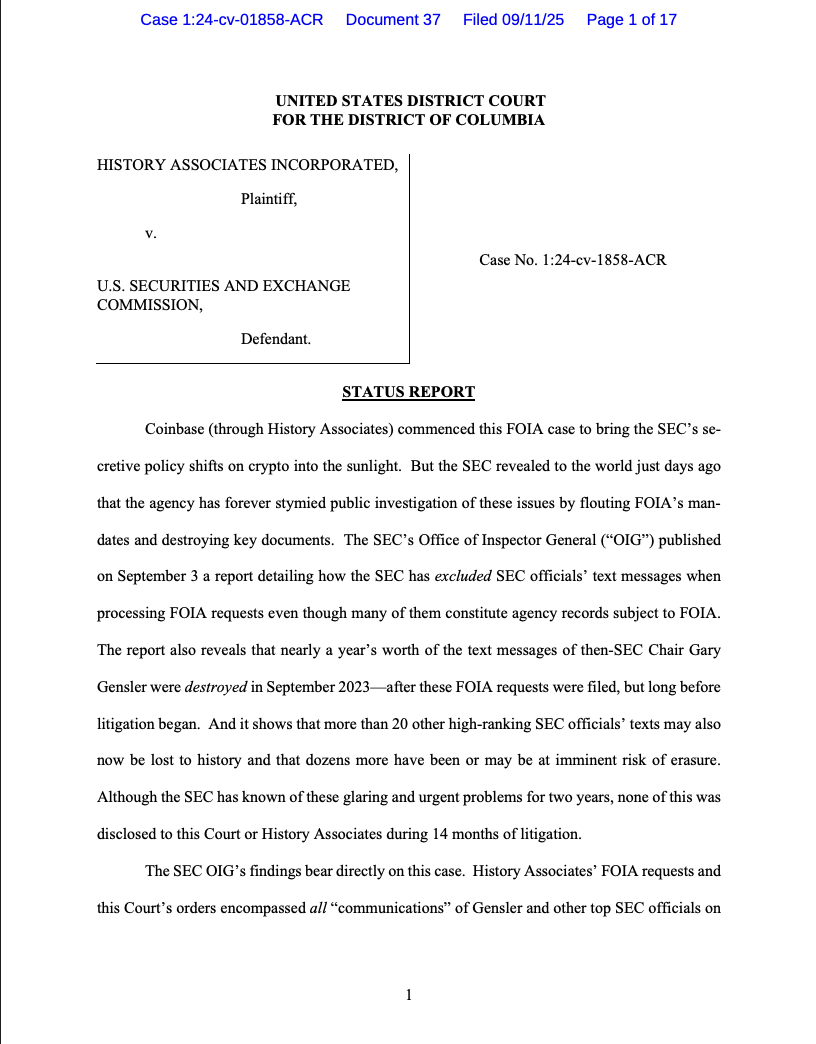

Coinbase is escalating its dispute with US regulators over previous communications involving former Securities and Trade Fee Chair Gary Gensler.

Coinbase filed a authorized movement on Thursday requesting a listening to to deal with the SEC Workplace of the Inspector Common’s investigation, which discovered that the company deleted practically one yr’s price of textual content messages from Gensler and different senior officers in “avoidable” errors.

The alternate stated the SEC ought to clarify why it didn’t conduct a full search of company data, together with textual content messages from Gensler and senior SEC officers, when it requested the messages in a number of Freedom of Data Act (FOIA) filings from 2023 and 2024.

In line with the movement, Coinbase needs the courtroom compel the SEC to look and produce all responsive communications initially requested, together with all messages and paperwork from Gensler and the company concerning Ethereum’s shift to proof-of-stake (PoS) consensus. The FOIA submitting learn:

This Courtroom’s intervention is warranted to find out whether or not the SEC has in truth violated the Courtroom’s prior orders and to make sure that all accessible measures are taken to protect and produce responsive data.”

The alternate additionally proposed an extra listening to after the supplies have been produced and reviewed throughout authorized discovery to deal with further cures similar to legal professional charges, if wanted.

“Following discovery, the events can then return to the Courtroom, and the Courtroom can decide the suitable further remedial measures at the moment,” together with findings that might “set off a Particular Counsel investigation.”

Spokespeople for the SEC instructed Cointelegraph that transparency is “paramount” to the company’s operations and accountability to taxpayers.

“When Chairman Atkins was briefed on this matter, he instantly directed workers to look at and absolutely perceive what occurred and to take steps that may stop it from occurring once more,” the SEC spokesperson stated.

Crypto firms have lengthy demanded transparency from the SEC concerning its communication associated to enforcement actions towards crypto initiatives, which led to an exodus of firms from the US.

Associated: SEC chair says most tokens usually are not securities, backs ‘super-app’ platforms

SEC wiped away practically one yr’s price of messages that Coinbase sought

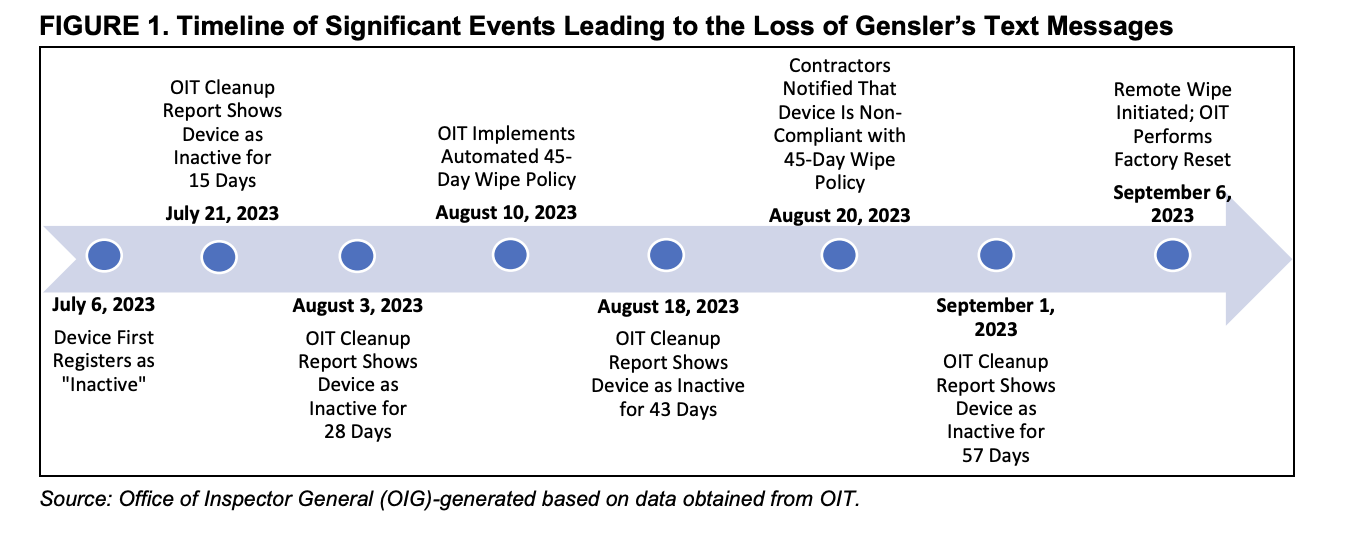

The SEC misplaced practically one yr’s price of Gensler’s textual content messages from October 2022 to September 2023, in line with the SEC Inspector Common’s investigative report.

Gensler’s messages have been robotically deleted by the SEC’s info know-how division earlier than the messages have been backed up, in line with the investigation.

The SEC sued Coinbase in 2023, alleging that the alternate violated US securities legal guidelines by appearing as an unlicensed securities dealer, a declare the SEC levied towards many crypto firms throughout Gensler’s time period.

In response, Coinbase petitioned the US courts to compel the SEC at hand over Gensler’s personal electronic mail messages, arguing that the previous SEC chair’s private communications could be a major supply of discovery for its authorized battle with the SEC.

Journal: Godzilla vs. Kong: SEC faces fierce battle towards crypto’s authorized firepower