Coinbase is escalating its dispute with US regulators over previous communications involving former Securities and Change Fee Chair Gary Gensler.

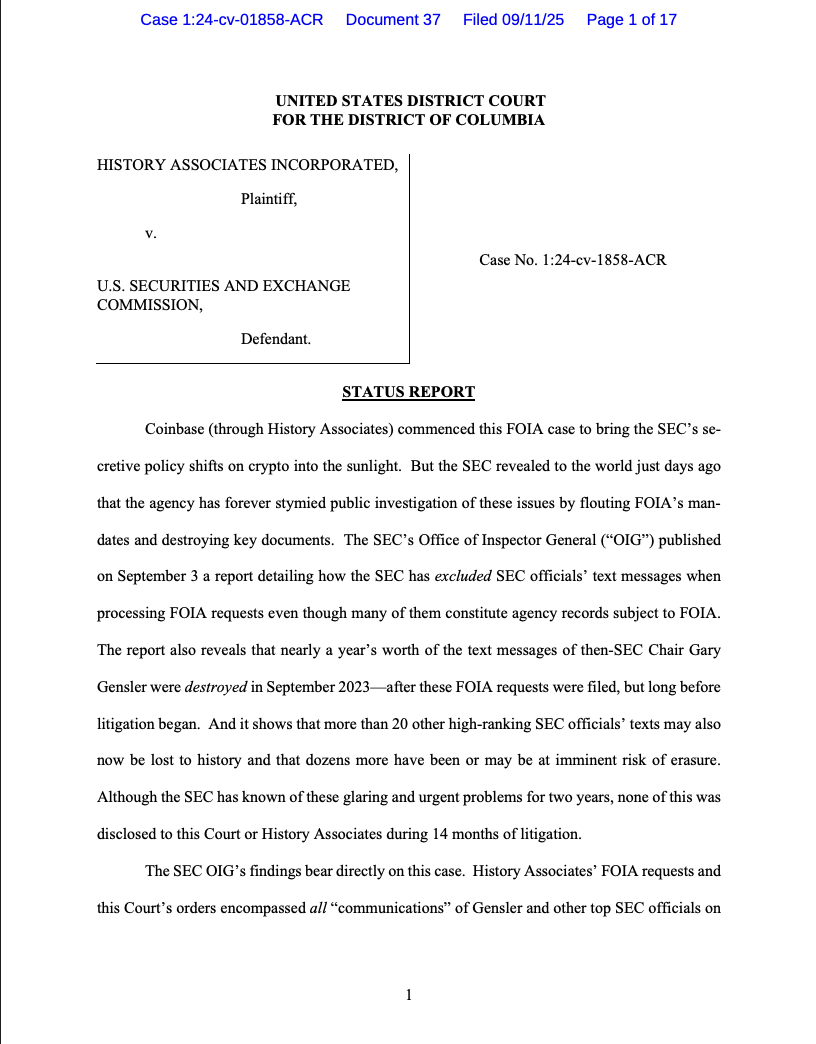

Coinbase filed a authorized movement on Thursday requesting a listening to to handle the SEC Workplace of the Inspector Normal’s investigation, which discovered that the company deleted practically one yr’s value of textual content messages from Gensler and different senior officers in “avoidable” errors.

The trade stated the SEC ought to clarify why it didn’t conduct a full search of company information, together with textual content messages from Gensler and senior SEC officers, when it requested the messages in a number of Freedom of Data Act (FOIA) filings from 2023 and 2024.

In line with the movement, Coinbase desires the court docket compel the SEC to go looking and produce all responsive communications initially requested, together with all messages and paperwork from Gensler and the company relating to Ethereum’s shift to proof-of-stake (PoS) consensus. The FOIA submitting learn:

This Court docket’s intervention is warranted to find out whether or not the SEC has actually violated the Court docket’s prior orders and to make sure that all accessible measures are taken to protect and produce responsive information.”

The trade additionally proposed a further listening to after the supplies have been produced and reviewed throughout authorized discovery to handle further treatments equivalent to lawyer charges, if wanted.

“Following discovery, the events can then return to the Court docket, and the Court docket can decide the suitable further remedial measures at the moment,” together with findings that may “set off a Particular Counsel investigation.”

Spokespeople for the SEC instructed Cointelegraph that transparency is “paramount” to the company’s operations and accountability to taxpayers.

“When Chairman Atkins was briefed on this matter, he instantly directed workers to look at and totally perceive what occurred and to take steps that can forestall it from occurring once more,” the SEC spokesperson stated.

Crypto corporations have lengthy demanded transparency from the SEC relating to its communication associated to enforcement actions in opposition to crypto initiatives, which led to an exodus of corporations from the US.

Associated: SEC chair says most tokens are usually not securities, backs ‘super-app’ platforms

SEC wiped away practically one yr’s value of messages that Coinbase sought

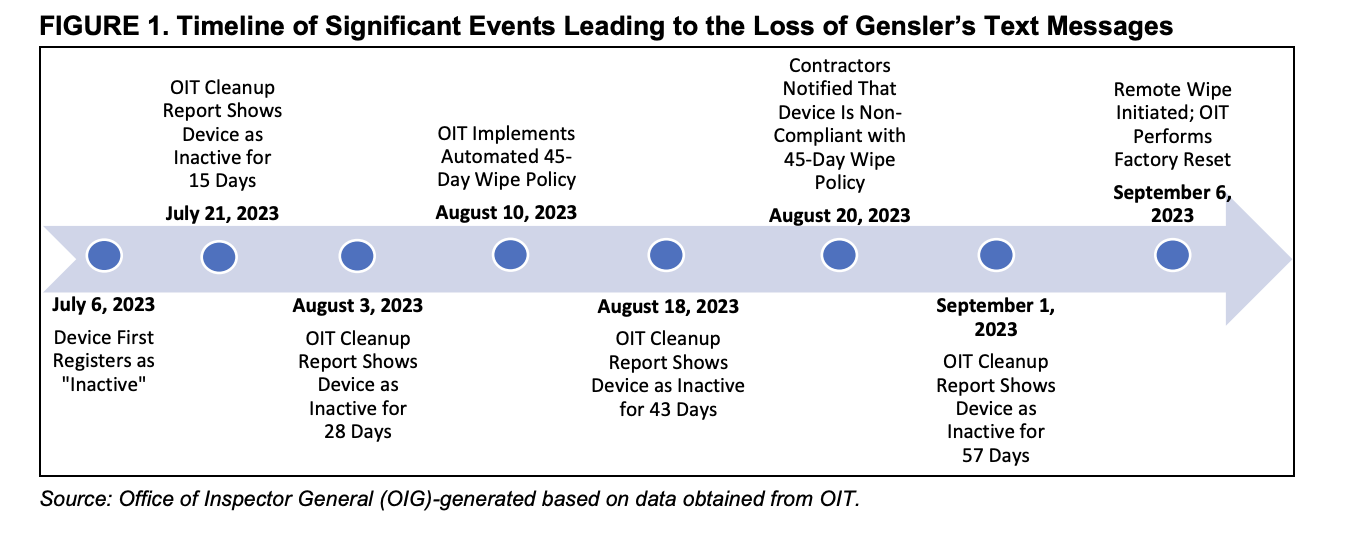

The SEC misplaced practically one yr’s value of Gensler’s textual content messages from October 2022 to September 2023, based on the SEC Inspector Normal’s investigative report.

Gensler’s messages have been mechanically deleted by the SEC’s data expertise division earlier than the messages have been backed up, based on the investigation.

The SEC sued Coinbase in 2023, alleging that the trade violated US securities legal guidelines by appearing as an unlicensed securities dealer, a declare the SEC levied in opposition to many crypto corporations throughout Gensler’s time period.

In response, Coinbase petitioned the US courts to compel the SEC at hand over Gensler’s personal e mail messages, arguing that the previous SEC chair’s private communications can be a big supply of discovery for its authorized battle with the SEC.

Journal: Godzilla vs. Kong: SEC faces fierce battle in opposition to crypto’s authorized firepower