Polymarket, a decentralized prediction market platform, is integrating Chainlink’s oracle community to enhance the accuracy and velocity of its market resolutions, the businesses introduced Friday.

Polymarket has partnered with Chainlink to combine its knowledge commonplace into Polymarket’s decision course of, based on a Friday press launch shared with Cointelegraph.

The collaboration will initially concentrate on enhancing the accuracy and velocity of asset pricing resolutions, with plans to develop into further markets.

Whereas Polymarket’s pricing prediction integration with Chainlink is dwell on the Polygon mainnet instantly, the events count on to discover further prediction markets utilizing Chainlink sooner or later.

Polymarket makes use of Polygon by default

Chainlink’s integration marks a major growth for Polymarket because the platform makes use of the Polygon blockchain — a layer-2 (L2) Ethereum scaling resolution — as its underlying community.

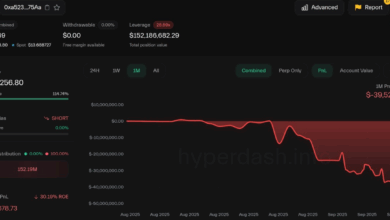

Launched in 2020, Polymarket has emerged as a significant crypto-enabled prediction market platform, the place customers can place bets on the outcomes of future occasions utilizing digital property like Circle’s USDC (USDC) stablecoin on the Polygon blockchain.

Whereas Polygon is targeted on delivering sooner and cheaper transactions by processing transactions off the primary Ethereum chain, Chainlink supplies an oracle community that connects good contracts on the blockchain with real-world exterior knowledge.

As such, whereas Polygon is Polymarket’s chain by default, Chainlink shall be sending knowledge to settle the markets into the Polygon chain in manufacturing.

Associated: US Authorities faucets Chainlink, Pyth to publish financial knowledge onchain

“Polymarket’s resolution to combine Chainlink’s confirmed oracle infrastructure is a pivotal milestone that vastly enhances how prediction markets are created and settled,” Chainlink co-founder Sergey Nazarov stated, including:

“When market outcomes are resolved by high-quality knowledge and tamper-proof computation from oracle networks, prediction markets evolve into dependable, real-time indicators the world can belief.”

“Subjective” markets explored

Along with pricing market integration, which has a transparent, definitive decision, Polymarket and Chainlink will discover methodologies to herald further prediction markets, the announcement stated.

Past pricing predictions, Polymarket and Chainlink are additionally exploring how you can apply oracle networks to extra subjective questions, which have usually relied on social voting mechanisms. The businesses say increasing to those markets might additional reduce bias and strengthen decision integrity.

The corporations didn’t instantly reply to Cointelegraph’s request for additional particulars.

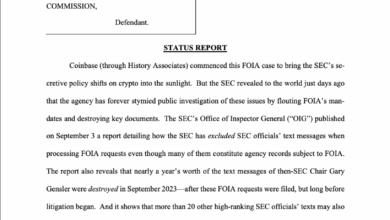

The information got here quickly after the US Commodity Futures Buying and selling Fee issued a no-action letter to a clearinghouse acquired by Polymarket in early September, marking one other case of US regulators softening their method to crypto enforcement in 2025.

In late August, Polymarket added Donald Trump Jr. to its advisory board after securing funding from 1789 Capital, which tied the prediction market extra carefully to US politics.

Journal: Meet the Ethereum and Polkadot co-founder who wasn’t in Time Journal