- The US Greenback Index loses steam at 97.80 and retains the broader bearish development intact.

- Weak US employment and reasonable inflation figures pave the trail for Fed cuts.

- The DXY is approaching a key assist space above 97.00.

The US Greenback bounced up from lows earlier on Friday, however upside makes an attempt stay restricted under the 98.00 stage to this point, which retains worth motion trapped inside the day prior to this’s vary, and maintains the broader bearish development intact.

Information launched on Thursday confirmed a reasonable acceleration in shopper inflation, however the sharp improve within the weekly jobless claims gathered extra curiosity. The biggest improve in claims within the final 4 years confirms the weak momentum of the US labour market and paves the trail to a Fed charge reduce subsequent week, and a minimum of one other one earlier than the year-end.

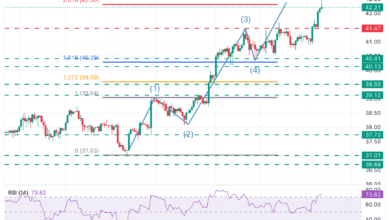

Technical Evaluation: The 97.10-97.25 is a key assist space

The technical image stays bearish. The Day by day and the 4-hour Relative Power Index stay under the 50 ranges, suggesting that rallies are prone to discover patrons. Current worth motion reveals a descending channel from the August 5 excessive, underpinning the bearish view.

The latest US Greenback’s restoration has discovered resistance on the 97.80 stage, under Thursday’s excessive, at 98.15. This stage and the channel high, now on the 98.50 space, have to be damaged to verify a development shift.

To the draw back, fast assist is on the intraday low of 97.50, with key assist space on the 9710-9725 space, which encloses the lows of July 24 and August 8, and the underside of the descending channel. Additional down, the July 4 and seven lows, close to 96.90, will come into focus.

US Greenback Worth This week

The desk under reveals the share change of US Greenback (USD) in opposition to listed main currencies this week. US Greenback was the strongest in opposition to the Canadian Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.15% | -0.35% | -0.28% | 0.06% | -1.44% | -1.02% | -0.21% | |

| EUR | 0.15% | -0.21% | -0.05% | 0.19% | -1.29% | -0.83% | -0.06% | |

| GBP | 0.35% | 0.21% | 0.08% | 0.41% | -1.08% | -0.59% | 0.16% | |

| JPY | 0.28% | 0.05% | -0.08% | 0.27% | -1.18% | -0.89% | 0.10% | |

| CAD | -0.06% | -0.19% | -0.41% | -0.27% | -1.40% | -1.03% | -0.26% | |

| AUD | 1.44% | 1.29% | 1.08% | 1.18% | 1.40% | 0.46% | 1.24% | |

| NZD | 1.02% | 0.83% | 0.59% | 0.89% | 1.03% | -0.46% | 0.78% | |

| CHF | 0.21% | 0.06% | -0.16% | -0.10% | 0.26% | -1.24% | -0.78% |

The warmth map reveals proportion modifications of main currencies in opposition to one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, in case you choose the US Greenback from the left column and transfer alongside the horizontal line to the Japanese Yen, the share change displayed within the field will signify USD (base)/JPY (quote).