- The Pound Sterling drops in opposition to its main forex friends after weak UK GDP and manufacturing facility knowledge for July.

- UK GDP development remained stagnant in August, as anticipated.

- US weekly Preliminary Jobless Claims ending September 5 got here in considerably increased at 263K.

The Pound Sterling (GBP) faces promoting stress in opposition to its main forex friends on Friday after the discharge of the UK Gross Home Product (GDP) and manufacturing facility knowledge for July. The UK (UK) Workplace for Nationwide Statistics (ONS) reported that the economic system remained stagnant in July, as anticipated, after rising by 0.4% in June.

Rising UK financial issues are prone to drive merchants to lift bets supporting extra rate of interest cuts by the Financial institution of England (BoE) within the the rest of the yr. At present, there’s a 33% probability that the BoE will cut back borrowing charges yet one more time this yr, in response to Reuters.

For contemporary cues on the rate of interest outlook, traders can pay shut consideration to the BoE’s financial coverage announcement on Thursday, wherein the central financial institution is anticipated to maintain borrowing charges regular at 4%. In its August financial coverage, the BoE lowered rates of interest by 25 foundation factors (bps) and guided a “gradual and cautious” financial enlargement steerage.

In the meantime, month-on-month Manufacturing Manufacturing has declined by 1.3%, whereas it was anticipated to stay flat after rising by 0.5% in June. The Industrial Manufacturing has contracted by 0.9% MoM, which was additionally anticipated to stay flat.

The subsequent key set off for the Pound Sterling would be the employment knowledge for the three months ending in July, which will probably be launched on Tuesday.

Pound Sterling Value At the moment

The desk beneath exhibits the proportion change of British Pound (GBP) in opposition to listed main currencies at this time. British Pound was the weakest in opposition to the US Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.13% | 0.27% | 0.50% | 0.06% | 0.14% | 0.38% | 0.25% | |

| EUR | -0.13% | 0.15% | 0.36% | -0.05% | 0.03% | 0.27% | 0.13% | |

| GBP | -0.27% | -0.15% | 0.22% | -0.22% | -0.16% | 0.12% | -0.02% | |

| JPY | -0.50% | -0.36% | -0.22% | -0.43% | -0.36% | -0.16% | -0.29% | |

| CAD | -0.06% | 0.05% | 0.22% | 0.43% | 0.12% | 0.34% | 0.19% | |

| AUD | -0.14% | -0.03% | 0.16% | 0.36% | -0.12% | 0.28% | 0.10% | |

| NZD | -0.38% | -0.27% | -0.12% | 0.16% | -0.34% | -0.28% | -0.14% | |

| CHF | -0.25% | -0.13% | 0.02% | 0.29% | -0.19% | -0.10% | 0.14% |

The warmth map exhibits proportion modifications of main currencies in opposition to one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, in case you choose the British Pound from the left column and transfer alongside the horizontal line to the US Greenback, the proportion change displayed within the field will signify GBP (base)/USD (quote).

US Preliminary Jobless Claims rose considerably in week ending September 5

- The Pound Sterling corrects to close 1.3550 in opposition to the US Greenback throughout European buying and selling hours after the UK GDP knowledge launch. Nonetheless, the outlook of the GBP/USD pair stays agency because the Federal Reserve (Fed) is for certain to chop rates of interest within the upcoming financial coverage assembly on Wednesday.

- Based on the CME FedWatch software, merchants see a 7.5% probability that the Fed will reduce rates of interest by 50 foundation factors (bps) to three.75%-4.00% on September 17, whereas the remainder level a normal 25-bps rate of interest discount.

- Fed dovish hypothesis has intensified about escalating draw back labor market dangers. America (US) Division of Labor confirmed on Thursday that Preliminary Jobless Claims for the week ending in September 5 rose to 263K, the best stage seen in nearly 4 years.

- This week, the Nonfarm Payrolls (NFP) benchmark revision report for 12 months ending on March 2025 additionally confirmed that the economic system created 911K fewer jobs than had been anticipated earlier.

- In the meantime, inflationary pressures within the US economic system have accelerated additional as enterprise homeowners proceed to cross on the influence of tariffs imposed by President Donald Trump to finish customers. The US headline Shopper Value Index (CPI) rose at an annual tempo of two.9% in August, as anticipated, quicker than the prior studying of two.7%.

- In Friday’s session, traders will deal with the College of Michigan’s preliminary Shopper Sentiment Index and Shopper Inflation Expectations knowledge for September, which will probably be revealed at 14:00 GMT.

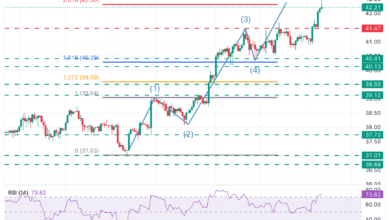

Technical Evaluation: Pound Sterling stays near 20-day EMA

The Pound Sterling retraces to close 1.3550 in opposition to the US Greenback on Friday. The near-term pattern of the Cable stays sideways because it trades near the 20-day Exponential Transferring Common (EMA), which is round 1.3487.

The GBP/USD pair trades contained in the Ascending Triangle sample, which signifies indecisiveness amongst traders. The horizontal resistance of the above-mentioned chart sample is plotted from the July 23 excessive round 1.3585, whereas the upward-sloping border is positioned from the August 1 low close to 1.3140.

The 14-day Relative Power Index (RSI) oscillates contained in the 40.00-60.00 vary, indicating a sideways pattern.

Wanting down, the August 1 low of 1.3140 will act as a key help zone. On the upside, the July 1 excessive close to 1.3800 will act as a key barrier.

Financial Indicator

Michigan Shopper Sentiment Index

The Michigan Shopper Sentiment Index, launched on a month-to-month foundation by the College of Michigan, is a survey gauging sentiment amongst customers in america. The questions cowl three broad areas: private funds, enterprise situations and shopping for situations. The information exhibits an image of whether or not or not customers are keen to spend cash, a key issue as shopper spending is a serious driver of the US economic system. The College of Michigan survey has confirmed to be an correct indicator of the longer term course of the US economic system. The survey publishes a preliminary, mid-month studying and a ultimate print on the finish of the month. Typically, a excessive studying is bullish for the US Greenback (USD), whereas a low studying is bearish.

Learn extra.

Subsequent launch:

Fri Sep 12, 2025 14:00 (Prel)

Frequency:

Month-to-month

Consensus:

58

Earlier:

58.2

Supply:

College of Michigan