Michigan Sentiment Index set to say no in September, reflecting persistent US shopper pessimism

- September’s preliminary Michigan Client Sentiment Index is anticipated to have eased to 58.0 from 58.2 in August.

- US customers are more likely to keep a pessimistic view of the financial outlook.

- Friday’s Client Sentiment is anticipated to strengthen the case for Fed easing.

The College of Michigan (UoM) is anticipated to launch the preliminary figures of its month-to-month Client Confidence Index for September on Friday. This survey covers U.S. customers’ views on their private funds, enterprise situations, and buying plans, and is usually launched alongside the College of Michigan Client Expectations Index and the College of Michigan Client Inflation Expectations.

Consumption is a key contributor to the US Gross Home Product (GDP). In that sense, the UoM Client Sentiment Index and Inflation Expectation figures have a strong fame as forward-looking indicators for US financial developments, and their launch tends to have a big impression on US Greenback (USD) crosses.

Relating to preliminary September’s studying, the UoM Client Sentiment is anticipated to point out additional deterioration, to 58, from an already smooth 58.2 degree seen in August.

Market members may even concentrate on the five-year Client Inflation Expectation studying, which rose to three.5% in August from July’s 3.4%.

What to anticipate from September’s UoM Client Sentiment Index report?

September’s Client Sentiment knowledge comes after a raft of grim employment indicators, with the final episode being a pointy downward revision of US job creation. The US Bureau of Labor Statistics (BLS) reported on Tuesday that the preliminary revision of the Present Employment Statistics (CES) nationwide benchmark to complete Nonfarm employment for the 12-month interval via March 2025 was -911,000, or -0.6% fewer jobs than initially reported.

Later within the week, a pointy improve in US Preliminary Jobless Claims added to proof of the labour market deterioration. This, coupled with a average uptick in shopper costs in August, has virtually confirmed a September Fed rate of interest lower and one or two extra cuts earlier than the year-end.

With this in thoughts, immediately’s shopper sentiment figures are more likely to assist these views. If August’s report mirrored an growing pessimism in regards to the present financial situations and the general financial outlook, issues appear to have solely worsened in September.

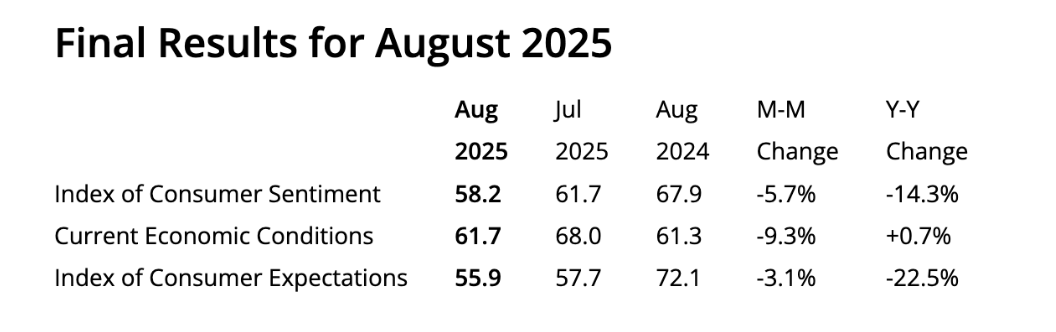

Client Sentiment is anticipated to have dropped to 58.0 in September from 58.2 in August and 61.7 in July. These figures are almost 15% under the degrees of August final 12 months, which highlights the unfavourable impression of US President Donald Trump’s commerce insurance policies on US consumption.

Supply: College of Michigan

All in all, not the most effective information for the US Greenback, which is struggling amid rising issues that the Federal Reserve might need fallen behind the curve with price cuts. A mixture of weak employment, comparatively average inflation, and deteriorating shopper sentiment offers a super state of affairs for the US central financial institution to renew its financial easing cycle.

When will the UoM Client Sentiment Index be launched, and the way may it have an effect on EUR/USD?

The College of Michigan will launch its Client Sentiment Index, along with the Client Inflation Expectations survey, on Friday at 14:00 GMT. The market consensus factors to additional deterioration in US shopper sentiment, which might add draw back strain to the US Greenback. Nonetheless, geopolitical tensions within the Eurozone would possibly offset the impression on the EUR/USD pair as frictions between Russia and Poland have undermined confidence within the widespread forex.

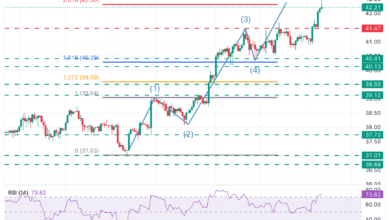

The EUR/USD rally has been halted under late July highs of 1.1790, however draw back makes an attempt have been contained above the 1.1700 space to date, which maintains the quick constructive pattern in place.

To the draw back, the early September lows, close to 1.1610 and 1.1630, are key ranges for bears, whereas, on the upside, resistance at 1.1780 (September 9 excessive) and 1.1790 (July 24 excessive) have to be damaged to increase the broader bullish pattern in the direction of the year-to-date highs, at 1.1830.

Financial Indicator

Michigan Client Sentiment Index

The Michigan Client Sentiment Index, launched on a month-to-month foundation by the College of Michigan, is a survey gauging sentiment amongst customers in the US. The questions cowl three broad areas: private funds, enterprise situations and shopping for situations. The info exhibits an image of whether or not or not customers are keen to spend cash, a key issue as shopper spending is a significant driver of the US financial system. The College of Michigan survey has confirmed to be an correct indicator of the long run course of the US financial system. The survey publishes a preliminary, mid-month studying and a remaining print on the finish of the month. Typically, a excessive studying is bullish for the US Greenback (USD), whereas a low studying is bearish.

Learn extra.

Subsequent launch:

Fri Sep 12, 2025 14:00 (Prel)

Frequency:

Month-to-month

Consensus:

58

Earlier:

58.2

Supply:

College of Michigan

Financial Indicator

Subsequent launch:

Fri Sep 12, 2025 14:00 (Prel)

Frequency:

Month-to-month

Consensus:

–

Earlier:

3.5%

Supply:

College of Michigan