By Omkar Godbole (All instances ET except indicated in any other case)

A day after the U.S. CPI report, market sentiment stays bullish with merchants anticipating the Fed to chop rates of interest 3 times this yr, beginning subsequent week.

Crypto pundits count on bitcoin to achieve a brand new lifetime excessive. Remember, it is lower than a month because it hit a document round $124,500. Nevertheless, the true pleasure facilities on altcoins comparable to XRP and SOL that are prone to outperform the market leaders, BTC and ether (ETH).

“The bull market is way from exhausted. Robust public asset treasuries and expectations of Fed charge cuts present a supportive macro backdrop, whereas institutional inflows and rising regulatory readability proceed so as to add gas,” Ryan Lee, the chief analyst at Bitget, wrote in an electronic mail.

“The potential approval of XRP and SOL spot ETFs might function a significant catalyst, unlocking billions in contemporary demand and reinforcing confidence in digital property as a mainstream asset class,” Lee wrote.

They don’t seem to be the one ones, with Le Shi, the managing director at market making agency Auros, flagging BNB and HYPE as tokens of curiosity after they hit all-time highs.

“Past that, the broader [digital asset treasury] narrative continues to draw each capital and conviction, with SOL, HYPE and CRO among the many key tokens to trace,” Shi stated.

Different observers highlighted DeFi protocol Ethena’s ENA as a standout coin because the Fed cuts charges within the coming months.

Talking of institutional demand, Polygon Labs, the staff behind the Polygon ecosystem, is working with Cypher Capital, a digital property funding agency, to increase institutional entry to its native token, POL.

“We’re seeing sustained demand from institutional buyers for yield-generating digital property backed by actual community exercise,” Aishwary Gupta, international head of funds, exchanges and real-world property at Polygon Labs, stated in an announcement.

In different key information, the yield on the U.S. 10-year Treasury word seems set to drop under 4%, a bullish improvement for markets.

“… We goal 3.80%,” the founders of crypto e-newsletter service LondonCryptoClub stated on X. “That is fairly the reversal within the narrative of latest weeks and is one other good tailwind for bitcoin and danger typically.”

In the meantime, blockchain sleuth Lookonchain famous continued whale shopping for in HYPE, which has already gained over 5% in seven days to hit a document above $56.

In conventional markets, the greenback index is hovering in latest ranges regardless of the rising odds of sooner Fed charge cuts. Is the anticipated easing already baked in? Keep alert!

What to Watch

- Crypto

- Sept. 12: Gemini Area Station, the Winklevoss twins’ crypto trade, begins buying and selling on Nasdaq World Choose Market underneath ticker GEMI.

- Sept. 12: Rex-Osprey Dogecoin ETF begins buying and selling on Cboe BZX Trade underneath ticker DOJE.

- Macro

- Sept. 12: Uruguay Q2 GDP progress Est. N/A (Prev. 3.4%).

- Earnings (Estimates based mostly on FactSet knowledge)

Token Occasions

- Governance votes & calls

- Hyperliquid to vote on who points its USDH stablecoin. Voting takes place Sept. 14.

- Curve DAO is voting to replace donation-enabled Twocrypto contracts, refining donation vesting so unlocked parts persist after burns. Voting ends Sept. 16.

- Unlocks

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating provide price $17.09 million.

- Sept. 15: Sei to unlock 1.18% of its circulating provide price $18.06 million.

- Token Launches

- Sept. 12: Unibase (UB) to be listed on Binance Alpha, MEXC, and others.

Conferences

Token Discuss

By Oliver Knight

- One of many founders of Thorchain, a decentralized community that enables customers to ship property throughout blockchains, was hacked this week after being duped by a deepfake video name on Zoom.

- “Okay so this assault lastly manifested itself. Had an previous metamask cleaned out,” JPThor wrote on X.

- Peckshield famous that $1.2 million was stolen from a Thorchain person, with ZachXBT including that the perpetrator is linked to North Korean hackers.

- Thorchain emerged as one in all North Korea’s hottest laundering instruments earlier this yr; researchers estimated that 80% of the proceeds from a $1.4 billion hack on Bybit had been siphoned via Thorchain and protocols like Vultisig.

- The thorchain token (RUNE) is buying and selling round $1.28, having misplaced 14% of its worth up to now month and greater than 90% since hitting its March 2024 excessive of $12.95.

- The hack concerned a mix of social engineering and phishing, two strategies that contributed to the $2.5 billion stolen by hackers within the first half of 2025.

Derivatives Positioning

- Open curiosity in futures tied to the highest 10 cryptocurrencies elevated 3%-5% up to now 24 hours as strengthening expectations of Fed charge cuts immediate merchants to take extra danger.

- Nonetheless, the market doesn’t seem overheated, with annualized perpetual funding charges for main cash persevering with to hover round 10%. Constructive funding charges point out a bullish bias amongst merchants. Extraordinarily excessive values usually sign market froth.

- OI in PENGU, one of many best-performing tokens of the previous seven days, hit a document excessive 7.78 billion cash, validating the value rise. Funding charges for the coin are barely elevated at round 15%.

- Smaller tokens, like SKY and PYTH, have deeply unfavourable funding charges, an indication of bias in direction of bearish, quick positions.

- CME’s bitcoin futures are lastly seeing an uptick in OI, ending a multiweek decline whereas ether OI has pulled again to a one-month low of 1.78 million ETH. These diverging tendencies might be an indication of renewed dealer give attention to BTC. Choices OI in BTC and ETH stays elevated at multimonth highs.

- On Deribit, BTC and ETH choices proceed to point out a bias towards places as much as the December expiry, regardless of merchants pricing roughly 5 U.S. interest-rate cuts by July subsequent yr.

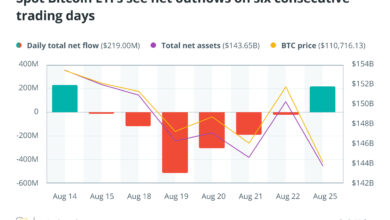

Market Actions

- BTC is up 0.53% from 4 p.m. ET Thursday at $115,049.85 (24hrs: +0.79%)

- ETH is up 2.21% at $4,515.82 (24hrs: +1.89%)

- CoinDesk 20 is up 1.82% at 4,289.35 (24hrs: +1.72%)

- Ether CESR Composite Staking Price is up 6 bps at 2.86%

- BTC funding charge is at 0.0085% (9.2549% annualized) on Binance

- DXY is up 0.22% at 97.75

- Gold futures are up 0.23% at $3,682.20

- Silver futures are up 1.68% at $42.85

- Nikkei 225 closed up 0.89% at 44,768.12

- Dangle Seng closed up 1.16% at 26,388.16

- FTSE is up 0.32% at 9,327.33

- Euro Stoxx 50 is down 0.3% at 5,370.54

- DJIA closed on Thursday up 1.36% at 46,108.00

- S&P 500 closed up 0.85% at 6,587.47

- Nasdaq Composite closed up 0.72% at 22,043.07

- S&P/TSX Composite closed up 0.78% at 29,407.89

- S&P 40 Latin America closed up 1.31% at 2,859.93

- U.S. 10-Yr Treasury charge is up 2.5 bps at 4.036%

- E-mini S&P 500 futures are down 0.12% at 6,584.75

- E-mini Nasdaq-100 futures are unchanged at 24,013.25

- E-mini Dow Jones Industrial Common Index are down 0.2% at 46,049.00

Bitcoin Stats

- BTC Dominance: 57.95% (-0.55%)

- Ether to bitcoin ratio: 0.03930 (1.75%)

- Hashrate (seven-day shifting common): 1,046 EH/s

- Hashprice (spot): $53.67

- Whole Charges: 3.96 BTC / $453,051

- CME Futures Open Curiosity: 139,355 BTC

- BTC priced in gold: 31.6 oz

- BTC vs gold market cap: 8.94%

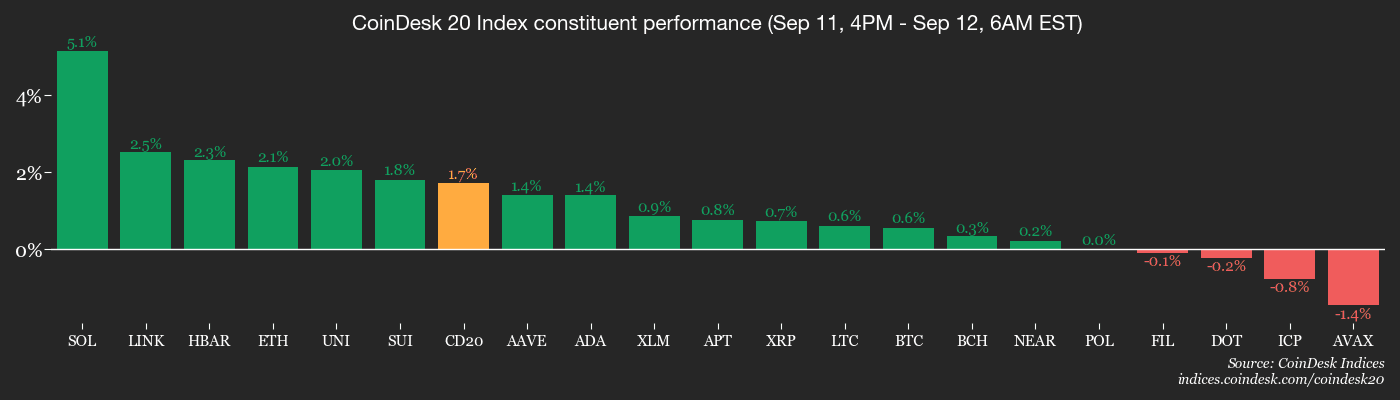

Technical Evaluation

- XRP’s value is seeking to set up a foothold above the higher finish of a monthslong descending triangle consolidation sample.

- Ought to it succeed, momentum chasers will doubtless be part of the market, accelerating the rise towards document highs.

Crypto Equities

- Coinbase World (COIN): closed on Thursday at $323.95 (+2.73%), +0.66% at $326.10 in pre-market

- Circle (CRCL): closed at $133.7 (+17.6%), +0.88% at $134.88

- Galaxy Digital (GLXY): closed at $28.87 (+10.7%), +1.7% at $29.36

- Bullish (BLSH): closed at $53.99 (+2.6%), +2.2% at $55.18

- MARA Holdings (MARA): closed at $15.71 (-0.95%), +0.57% at $15.80

- Riot Platforms (RIOT): closed at $15.65 (-4.57%), +0.58% at $15.74

- Core Scientific (CORZ): closed at $15.55 (-2.75%), +0.64% at $15.65

- CleanSpark (CLSK): closed at $10.2 (+1.69%), +0.1% at $10.21

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $35.67 (+0.51%)

- Exodus Motion (EXOD): closed at $28.86 (+4.98%), -1.18% at $28.52

Crypto Treasury Corporations

- Technique (MSTR): closed at $326.02 (-0.13%), +0.81% at $328.65

- Semler Scientific (SMLR): closed at $28.54 (+1.86%), +1.51% at $28.97

- SharpLink Gaming (SBET): closed at $16.36 (+1.68%), +3.06% at $16.86

- Upexi (UPXI): closed at $5.68 (+4.03%), +13.73% at $6.46

- Lite Technique (LITS) (previously Mei Pharma): closed at $3.07 (+10.43%)

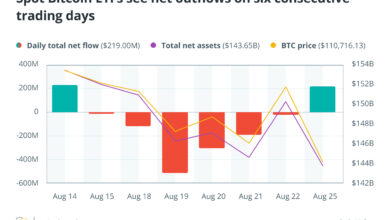

ETF Flows

Spot BTC ETFs

- Each day web move: $552.7 million

- Cumulative web flows: $56.15 billion

- Whole BTC holdings ~ 1.30 million

Spot ETH ETFs

- Each day web move: $113.1 million

- Cumulative web flows: $12.97 billion

- Whole ETH holdings ~ 6.42 million

Supply: Farside Traders

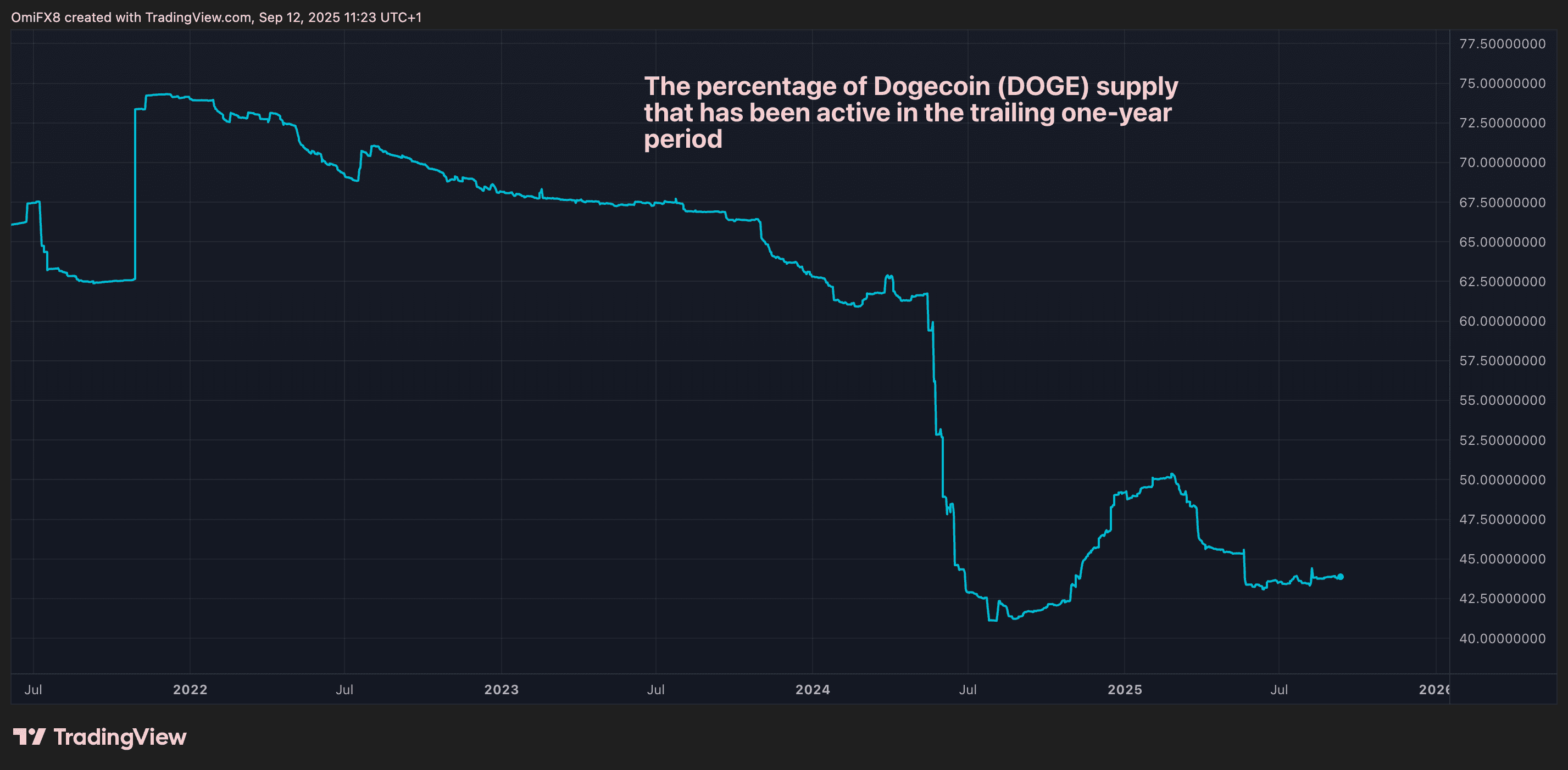

Chart of the Day

- The chart reveals the the proportion of dogecoin’s (DOGE) circulating provide that has been lively within the trailing one-year interval.

- The variety of cash which have moved or been transacted throughout the previous yr stays at multimonth lows close to 43%. The tally peaked at practically 75% in November 2021 and has been dropping ever since.

- The decline signifies an investor shift to holding technique and lowered speculative buying and selling.