Constancy and Canary have moved a step nearer of their bid to launch altcoin-focused exchange-traded funds (ETFs) in america.

On Sept. 11, the Depository Belief & Clearing Company (DTCC) quietly added three spot ETF merchandise, together with Constancy’s Solana ETF (FSOL), Canary’s HBAR ETF (HBR), and Canary’s XRP ETF (XRPC), to its platform.

The itemizing doesn’t equate to regulatory approval. As an alternative, it represents a part of the routine preparation course of that issuers should full earlier than a possible market debut.

Nonetheless, the event has caught the crypto group’s consideration, which views it as an indication that issuers are severe about bringing these funds to market as soon as the Securities and Alternate Fee (SEC) grants permission.

Bloomberg ETF analyst Eric Balchunas highlighted the importance of the event, noting that it’s uncommon for tickers to achieve the DTCC system with out ultimately coming to market.

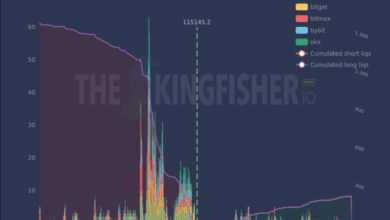

That procedural progress rapidly spilled into buying and selling exercise. Solana rose greater than 6% in 24 hours, outperforming XRP and HBAR, which every gained about 2%, in keeping with CryptoSlate knowledge.

Enrollment Closing Quickly…

Safe your spot within the 5-day Crypto Investor Blueprint earlier than it disappears. Study the methods that separate winners from bagholders.

Delivered to you by CryptoSlate

Crypto ETFs

This growth arrives because the SEC repeatedly postponed rulings on a wave of altcoin ETF filings, persevering with its cautious stance even after greenlighting Bitcoin and Ethereum spot funds final yr.

On Sept. 10, the regulator delayed three functions, together with BlackRock’s proposal for an Ethereum staking ETF and Franklin Templeton’s spot Solana and XRP funds filings.

The postponements prolong a broader assessment course of because the SEC develops a generic framework to streamline future approvals.

Analysts count on the fee to bundle selections in October, in line with earlier cycles the place a number of rulings landed inside the similar window.

The company at present has not less than 92 crypto-linked ETF proposals into consideration, highlighting the size of trade demand.