Key takeaways:

-

Bitcoin value rose 1.5% to over $115,000, with onchain indicators suggesting market momentum is choosing up.

-

BTC should maintain above $115,000 to safe the restoration, with resistance at $116,000-$121,000.

Bitcoin (BTC) value was up on Friday, rising 1.5% over the previous 24 hours to commerce above $115,000. A number of technical and onchain indicators counsel the BTC market is “advancing on firmer footing” to greater ranges, based on Glassnode.

Bitcoin derivatives “set the tone” for BTC value

Bitcoin’s capacity to stage a sustained restoration has been curtailed by weak spot demand and softening ETF inflows.

“Consideration now shifts to derivatives markets, which frequently set the tone when spot flows weaken,” Glassnode wrote in its newest Week Onchain report.

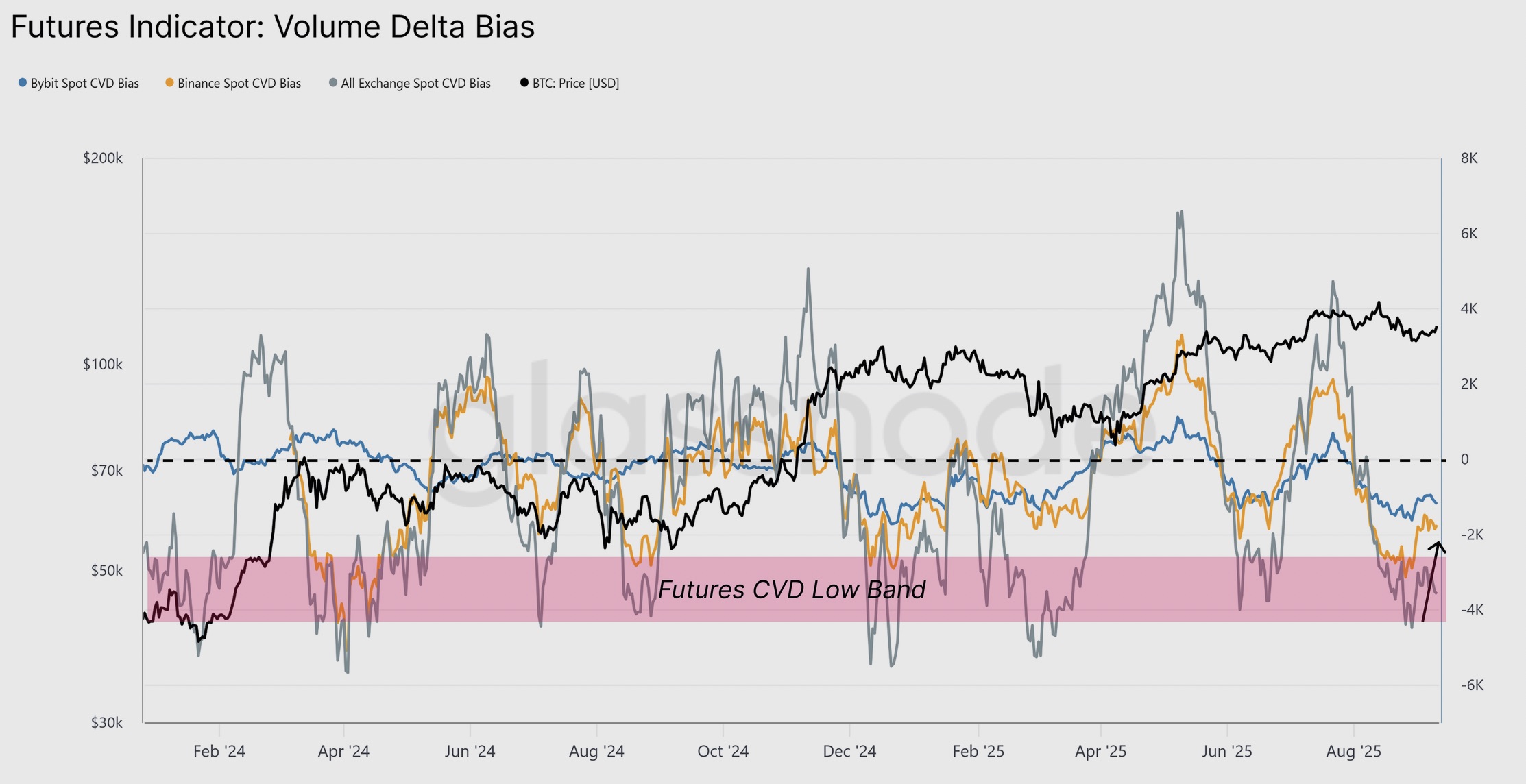

The chart beneath reveals that Bitcoin’s quantity delta bias, measuring the imbalance between shopping for and promoting stress, recovered in the course of the rebound from $108,000, signaling vendor exhaustion throughout exchanges like Binance and Bybit.

Associated: Bitcoin‘s ‘supercycle ignition’ hints at $360K: New value evaluation

This means that futures merchants “helped take up latest promote stress,” stated the market intelligence agency, including:

“Going ahead, the evolution of derivatives positioning will probably be important to navigating the market on this low spot-liquidity setting.”

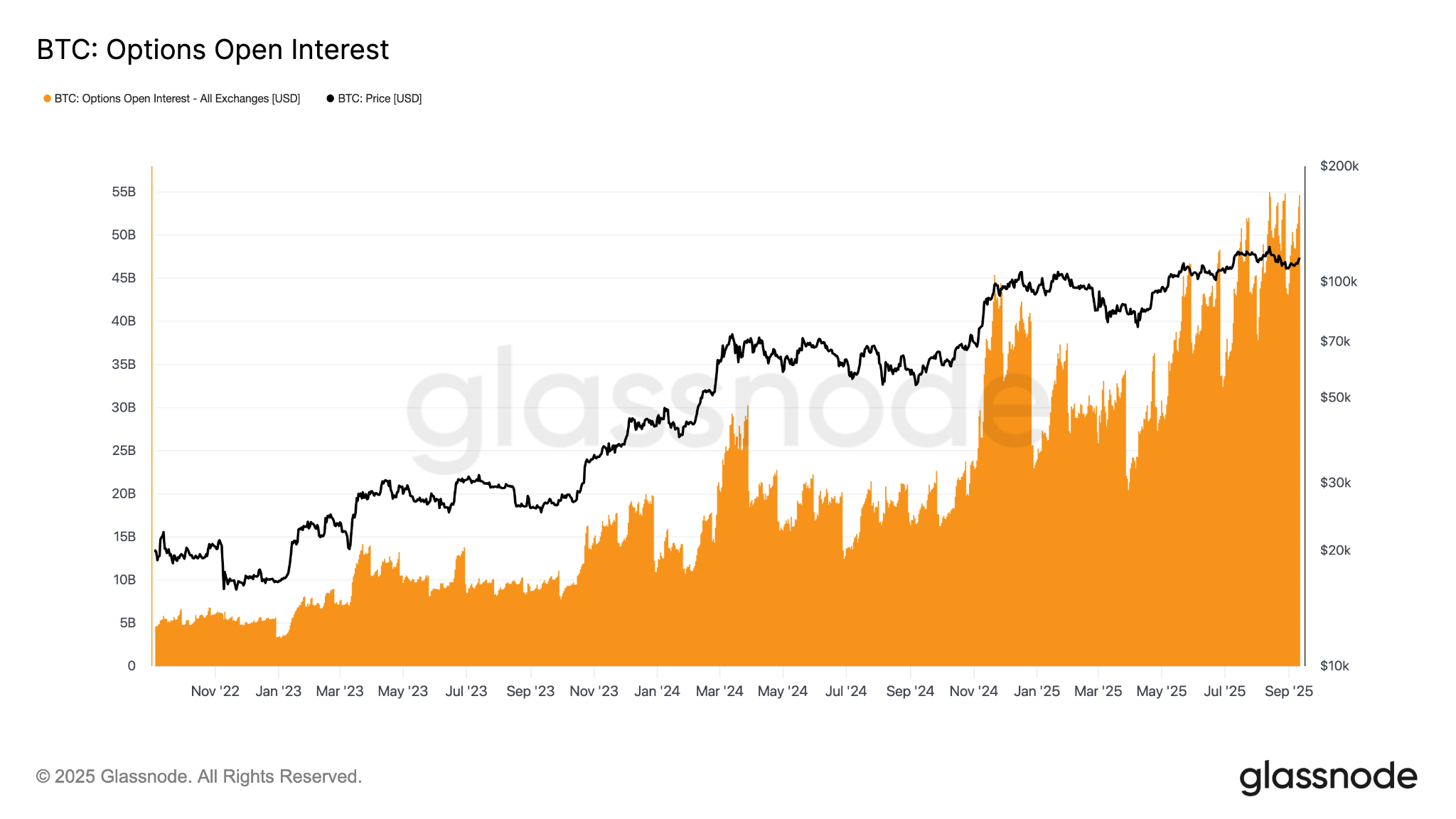

In the meantime, choices open curiosity (OI) reached $54.6 billion, an all-time excessive, up 26% from $43 billion on Sept. 1. This displays rising investor curiosity within the derivatives market, which may positively have an effect on BTC value.

Word that when choices OI reached its earlier file excessive in mid-August, it was accompanied by Bitcoin’s rise to new all-time highs above $124,500.

Extra choices OI knowledge reveals a transparent bias towards calls over places, “highlighting a market that leans bullish whereas nonetheless managing draw back danger,” Glassnode stated, including:

“Each futures foundation and choices positioning mirror a extra balanced construction than in previous overheated phases, pointing to a market advancing on firmer footing.”

As Cointelegraph reported, Bitcoin’s $4.3 billion choices expiry on Friday favors bullish bets, and will open the door for BTC rally to $120,000 so long as the worth stays above $113,000.

Key Bitcoin value ranges to observe subsequent

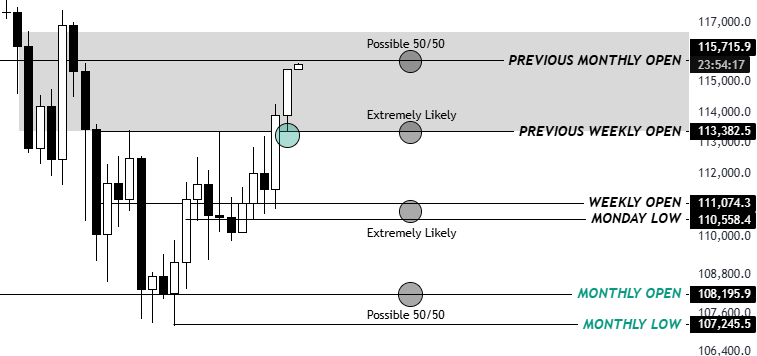

Knowledge from Cointelegraph Markets Professional and TradingView reveals Bitcoin value buying and selling at $115,400 after operating into resistance round $116,000. The BTC/USD pair should maintain above $115,000 for a sustained restoration.

There’s a main provide zone stretching from $116,000 to $121,000, which Bitcoin must overcome to proceed its uptrend towards all-time highs.

Conversely, the bears will try to defend the $116,000 stage and push the worth again down. A key space of curiosity lies between $114,500, the place the 50-day easy shifting common (SMA) presently sits, and $112,200, embraced by the 100-day SMA.

One other space of significance stretches from the native low at $107,200 (reached on Sept. 1) to the $110,000 psychological stage.

Bitcoin is “now pushing to the earlier month-to-month open,” stated pseudonymous dealer KillaXBT in an evaluation on X, referring to the August open round $115,700.

“It is a essential pivot level by way of pattern course. We might see some deviation above, as all the time.”

The BTC/USDT liquidation heatmap reveals the liquidity clusters between $116,400 and $117,000, per knowledge from CoinGlass.

If damaged, this stage might spark a liquidation squeeze, forcing brief sellers to shut positions and driving costs towards $120,000.

On the draw back, heavy bid orders are sitting round $114,700, with the subsequent main cluster sitting between $113,500 all the way down to $112,000.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.