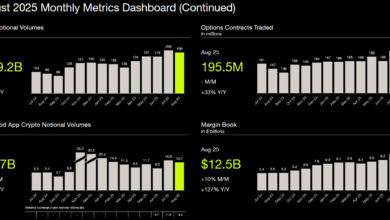

Crypto protocols raised $1.9 billion in August, down 30% from July’s $2.67 billion, in line with DefiLlama knowledge.

Regardless of the month-to-month drop, August numbers for raises from enterprise capital funds align with the numbers recorded in July, with $600 million captured from PUMP’s public sale final month.

DeFi protocols dominated August funding with a number of main raises, together with Portal’s $50 million spherical, M0’s $40 million Sequence B, and aPriori’s $20 million strategic funding.

The sector attracted constant institutional capital throughout infrastructure and buying and selling platforms.

Moreover, the third quarter already surpassed the second quarter’s $4.54 billion totals with $4.57 billion captured in simply two months.

AI and infrastructure progress

AI protocols secured substantial funding, with Everlyn elevating $15 million and a number of AI-focused tasks finishing seed rounds.

The convergence of crypto and AI continues attracting enterprise curiosity as protocols develop decentralized computing and knowledge options. Cybersecurity emerged as one other main class with IVIX finishing a $60 million Sequence B, the month’s largest conventional enterprise spherical.

Stablecoin infrastructure additionally drew capital, with Rain securing $58 million in Sequence B funding.

3 Seconds Now. Beneficial properties That Compound for Years.

Act quick to hitch the 5-day Crypto Investor Blueprint and keep away from the errors most buyers make.

Delivered to you by CryptoSlate

Cost infrastructure attracted numerous funding. OrangeX accomplished a $20 million Sequence B and a number of smaller rounds supporting cross-border and service provider cost options. The class advantages from growing crypto adoption in industrial functions.

Gaming protocols additionally obtained some consideration, similar to Overtake’s $7 million spherical and continued improvement funding throughout a number of tasks.

The sector advantages from elevated adoption of blockchain-based gaming mechanics and token economies.

Public token gross sales lose floor

And not using a high-profile token sale, similar to Pump.enjoyable’s, public token gross sales represented solely $30.7 million throughout seven tasks, together with Lombard’s $6.75 million and Almanak’s twin raises totaling almost $11 million.

Public token gross sales present direct neighborhood participation whereas lowering dependence on institutional enterprise capital.

Layer-2 options secured strategic investments with Bitlayer elevating $5 million via public token gross sales and Hemi Labs finishing a $15 million progress spherical.

The third quarter’s efficiency demonstrates sustained institutional curiosity regardless of month-to-month fluctuations.