Public holding firm Mega Matrix (MPU) has made the Ethena stablecoin ecosystem the centerpiece of its digital asset technique, betting that the artificial greenback venture can seize market share from incumbents like Circle.

The corporate’s push comes on the heels of the US GENIUS Act, a complete stablecoin invoice that establishes federal oversight of issuers, units capital and liquidity necessities and creates a framework for banks and fintechs to subject dollar-pegged tokens underneath regulatory supervision.

Nonetheless, Circle is presently the one publicly traded choice to capitalize on the large development of stablecoins, Colin Butler, Mega Matrix’s govt vp and world head of markets, informed Cointelegraph.

Circle went public in June, with its shares up 87% since itemizing. The corporate generated $1.68 billion in income and reserve earnings in fiscal 2024, with $155.7 million in web earnings, pushed largely by curiosity earnings from reserves backing its USDC (USDC) provide.

Butler mentioned Mega Matrix sees comparable potential in Ethena: “We predict Ethena can do $150 million within the subsequent 6–12 months. That will indicate a 6x upside to Ethena.”

He credited Ethena’s development to USDe, its artificial stablecoin that generates yield by way of a mixture of staking and hedging methods. Not like USDC and USDt (USDT), USDe presents holders a return and, Butler argued, “serves as extra enticing collateral,” making it higher positioned to seize share in a fast-expanding market.

To offer traders entry, Mega Matrix has positioned its inventory as the primary publicly traded digital asset treasury devoted to the Ethena ecosystem, concentrating reserves in Ethena’s governance token, ENA.

“This additionally opens the door for retail traders to get direct publicity to the stablecoin thesis for the primary time,” Butler mentioned. “Till now, the one actual method to play it has been Circle, or not directly by way of Coinbase.”

Earlier than shifting into digital property, Mega Matrix operated primarily as an leisure and recreation publishing enterprise. The corporate started exploring blockchain in 2021 and formally repositioned itself as a digital asset treasury in 2025.

The corporate is funding its digital asset technique with a $2 billion shelf registration, giving it flexibility to lift capital over time and steadily construct its holdings of Ethena’s ENA governance token.

Associated: Crypto Biz: Japan’s quiet stablecoin coup

Ethena fee-switch mechanism

When submitting its shelf registration, Mega Matrix highlighted Ethena’s “fee-switch” mechanism as a possible worth driver. As soon as activated, the mechanism would redirect a portion of protocol revenues to ENA stakers, permitting tokenholders to share within the protocol’s earnings.

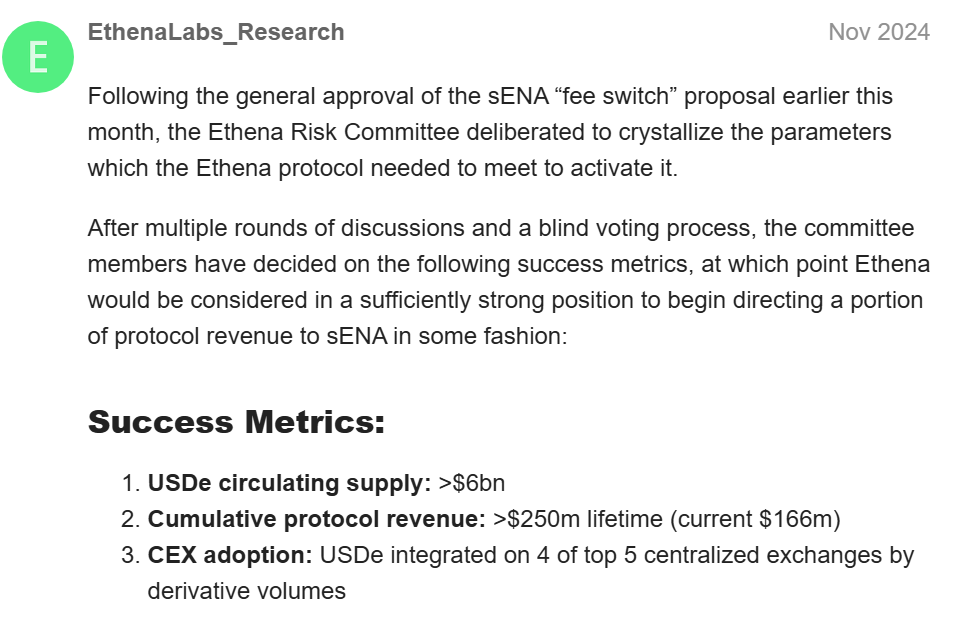

The proposal was launched by Wintermute Governance in November 2024, requesting that Ethena’s Danger Committee define parameters underneath which tokenholders would profit from income distribution. Elements included USDe circulating provide, common protocol revenues and adoption on centralized exchanges.

Later that month, the final proposal was authorised, with Ethena Labs setting out a sequence of “success metrics” tied to circulating provide, cumulative revenues and trade adoption.

Though these benchmarks have been outlined, no activation date for the payment change has been introduced, a spokesperson for the Ethena Basis informed Cointelegraph.

Market watchers notice that Ethena’s development has already exceeded a number of the unique thresholds. Cumulative protocol revenues seem near qualifying ranges, and USDe’s market capitalization has surged previous $13 billion, making it the world’s third-largest stablecoin. Nonetheless, the protocol has but to specify when the mechanism might be applied.

Associated: Banks ought to provide higher charges to counter stablecoins: Bitwise CIO