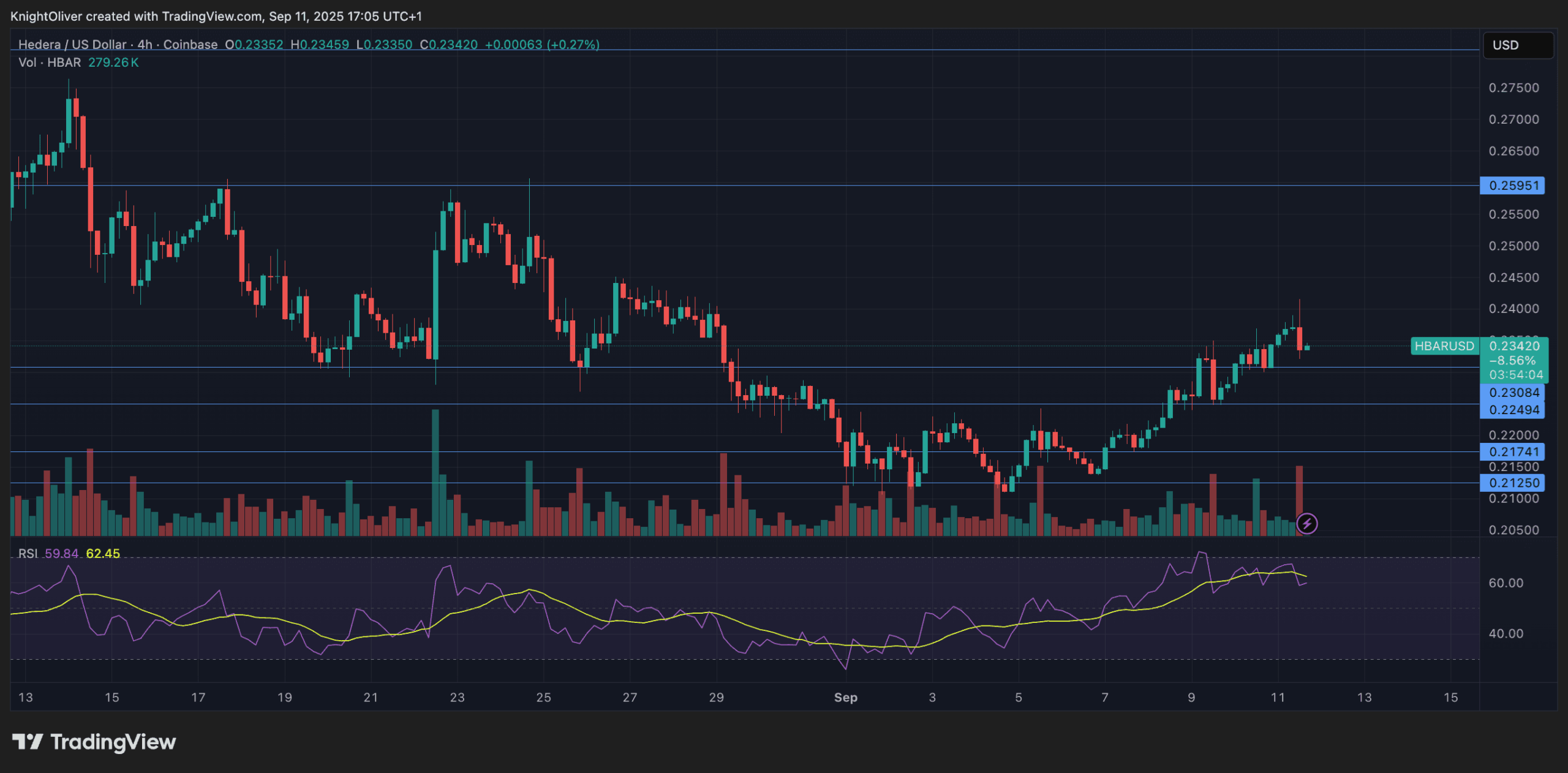

Hedera’s HBAR token noticed a unstable 23-hour stretch between Sept. 10 and 11, swinging in a slim 5% band between $0.23 and $0.24. The token dipped to its $0.23 assist stage early within the session earlier than rebounding on heavier-than-usual buying and selling volumes. Every day quantity averaged 35.4 million, however exercise surged to 156.1 million by noon Sept. 11 as institutional cash appeared to circulate in, propelling HBAR again towards the $0.24 ceiling.

Regardless of the rally, HBAR struggled to interrupt by means of resistance at $0.24, the place robust promoting stress emerged. The rejection at this technical stage underscored the importance of $0.23 as agency assist and $0.24 as a essential barrier for additional positive factors. Analysts notice {that a} shut above $0.24 may open the door to a 25% rally towards the $0.25 goal, however failure to breach resistance leaves the token range-bound within the $0.21–$0.23 hall.

The surge in buying and selling exercise coincided with regulatory developments. On Sept. 9, Grayscale filed with the U.S. Securities and Alternate Fee (SEC) to transform its Hedera HBAR Belief into an exchange-traded fund (ETF), alongside related filings for Bitcoin Money and Litecoin. The SEC has set a Nov. 12 deadline to determine on the proposed Nasdaq itemizing, making the subsequent two months pivotal for HBAR’s institutional adoption prospects.

The ETF submitting has stoked demand from conventional asset managers searching for broader publicity to digital belongings. With regulatory readability on the horizon, HBAR’s value motion displays a tug-of-war between bullish institutional curiosity and technical limitations. Market contributors will probably be watching intently whether or not the SEC’s determination offers the breakout catalyst HBAR wants to check larger ranges.

Technical Indicators Abstract

- $0.011 buying and selling vary equals 5% unfold from $0.23 low to $0.24 excessive over 23-hour interval.

- Sturdy $0.23 assist holds on 37.8 million quantity reversal.

- Breakout quantity hits 156.1 million throughout restoration. Institutional flows confirmed.

- Key $0.24 resistance triggers huge quantity reversal. Heavy promoting stress evident.

- Ultimate hour volatility September 11 13:14-14:13 reveals $0.0072 vary between $0.24 ranges.

- Sharp reversal at $0.24 resistance on 2.28 million quantity spike creates rejection sample.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.