Crypto-related shares together with Galaxy Digital (GLXY), Circle Web (CRCL) and Bitfarms (BITF) posted double-digit beneficial properties on Thursday as bitcoin rose the best since mid-August.

Galaxy, a digital asset funding and knowledge middle conglomerate led by Mike Novogratz, added 12%. The corporate was a lead investor in Ahead Industries’ $1.65 billion fundraising closed immediately to construct a Solana treasury car.

It may additionally be benefiting from rising urge for food for knowledge middle performs, as huge tech corporations make billion-dollar synthetic intelligence (AI) internet hosting contracts corresponding to Microsoft’s cope with Nebius on Tuesday.

The identical logic applies to bitcoin miner Bitfarms (BITF), which has got down to develop in high-performance computing and appointed Wayne Duso, a former govt of cloud service big Amazon Internet Companies, to the board final month. The inventory superior one other 18% immediately, extending beneficial properties to greater than 60% this week.

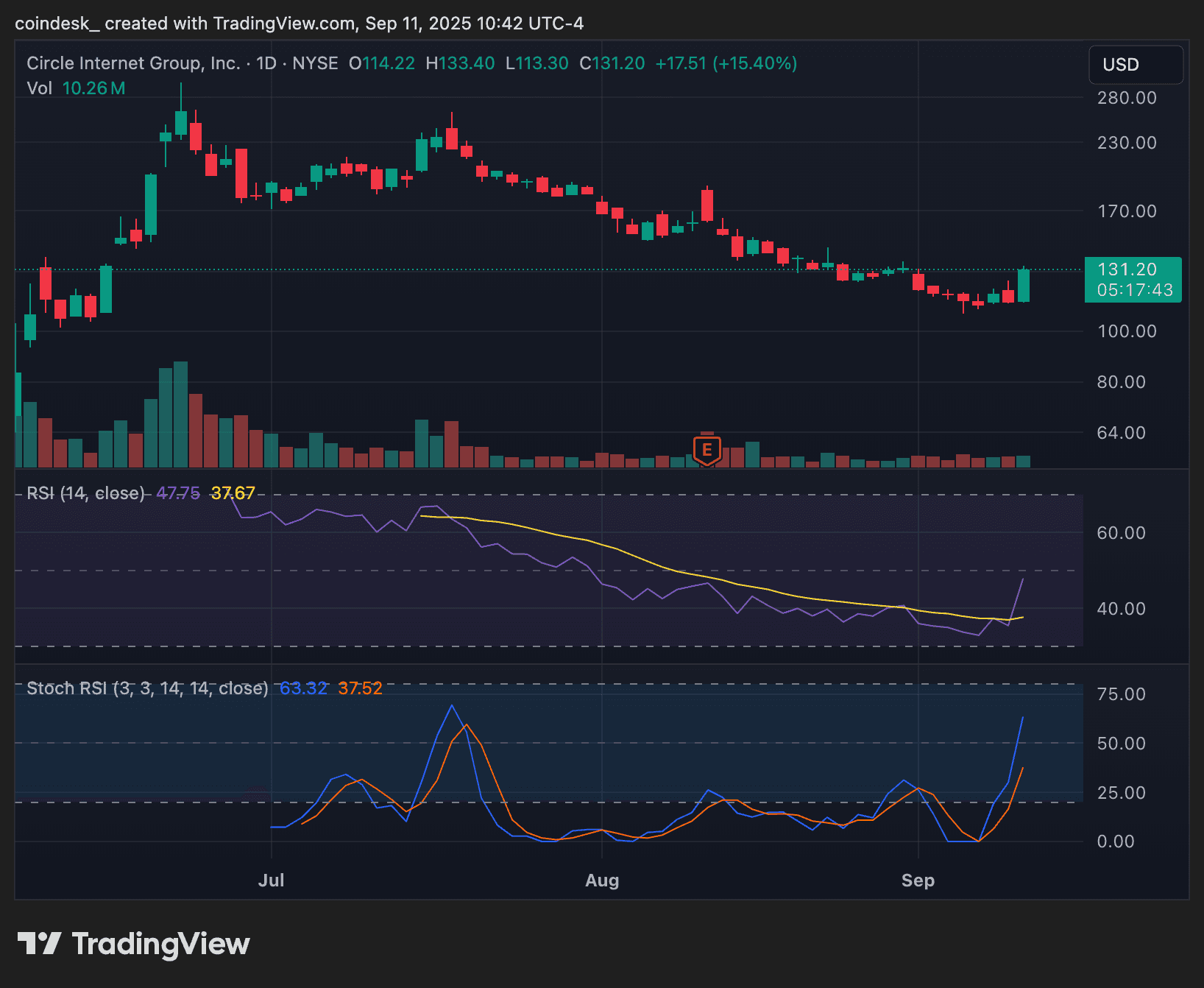

For USDC stablecoin issuer Circle, Thursday’s 16% rally could possibly be a technical rebound absent any clear information catalyst, breaking the downtrend that began in June and noticed the inventory decline roughly 60% from its post-IPO peak.

Crypto trade Coinbase (COIN), digital buying and selling platform Robinhood (HOOD) and bitcoin miners MARA Digital (MARA) and Riot Platforms (RIOT) additionally superior.

The businesses outpaced the broader fairness markets, with the S&P 500 index just lately up 0.82% and the Nasdaq 100 index 0.69% increased.

In the meantime, bitcoin treasury automobiles Metaplanet (3355) and Nakamoto (NAKA) declined 10% and 14%, respectively. Technique (MSTR), the most important company proprietor of BTC, was little modified.

The declines occurred at the same time as bitcoin superior towards $115,000, rebounding from an preliminary dip on rising CPI inflation and better jobless claims reviews within the early U.S. morning hours.

Learn extra: Technique’s S&P 500 Snub Is a Cautionary Sign for Company Bitcoin Treasuries: JPMorgan