Switzerland-based 21Shares, certainly one of Europe’s largest issuers of crypto exchange-traded merchandise, has launched the primary fund tied to dYdX, a decentralized trade (DEX) specializing in perpetual futures.

In response to an announcement shared with Cointelegraph, dYdX has processed over $1.4 trillion in cumulative buying and selling quantity and lists over 230 perpetual markets. The dYdX Treasury subDAO helps the bodily backed product via a decentralized finance (DeFi) treasury supervisor, kpk.

By positioning dYdX inside a regulated exchange-traded product (ETP), 21Shares stated it’s creating an on-ramp for establishments.

“This launch represents a milestone second in DeFi adoption, permitting establishments to entry dYdX via the ETP wrapper – using the identical infrastructure already in use for conventional monetary belongings,” Mandy Chiu, head of monetary product growth at 21Shares, stated within the assertion.

Staking, or locking up tokens to assist safe a blockchain community in trade for rewards, might be added shortly after launch, a 21Shares spokesperson informed Cointelegraph. “Will introduce DYDX staking and an auto-compounding characteristic — producing rewards auto-compound into DYDX token buybacks.”

The discharge additionally outlined dYdX’s growth roadmap, together with Telegram-based buying and selling later this month, a forthcoming spot market beginning with Solana, perpetual contracts tied to real-world belongings resembling equities and indexes, together with a charge low cost program for dYdX stakers and broader deposit choices spanning stablecoins and fiat.

The 21Shares dYdX ETP will launch on Euronext Paris and Euronext Amsterdam underneath the ticker image DYDX.

Associated: Hyperliquid token good points institutional entry with new 21Shares ETP

Kraken, Cboe and Bitget spotlight demand for crypto derivatives

The launch of the dYdX ETP comes as each conventional and centralized crypto exchanges are increasing their crypto derivatives choices — monetary contracts that allow merchants speculate on the value of digital belongings with out proudly owning them instantly.

Within the US, Kraken launched its CFTC-regulated derivatives arm in July following a $1.5 billion acquisition of futures dealer NinjaTrader. The derivatives platform supplies entry to CME-listed crypto futures.

On Tuesday, Cboe, one of many world’s largest trade operators, introduced its plans to launch “steady futures” for Bitcoin and Ether on Nov. 10, pending regulatory assessment. The contracts might be listed on the Cboe Futures Trade and designed as single, long-dated merchandise with 10-year expirations.

Cboe stated the contracts are modeled on perpetual-style futures that dominate offshore markets however haven’t been accessible in a US-regulated setting till now. The trade described them as giving institutional and retail merchants long-term crypto publicity inside a centrally cleared, intermediated framework.

In the meantime, Bitget, a Singapore-based cryptocurrency trade, reported $750 billion in derivatives quantity for August, bringing its cumulative whole to $11.5 trillion since launch.

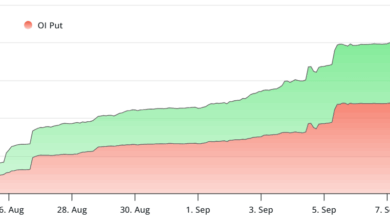

The trade ranked among the many prime three international futures venues for Bitcoin and Ether open curiosity throughout the month, with BTC futures surpassing $10 billion and ETH open curiosity trending above $6 billion.

The primary regulated crypto derivatives have been launched in December 2017, when Cboe and CME launched cash-settled Bitcoin futures. Whereas Cboe exited the market in 2019 because of low volumes, CME’s contracts grew to dominate US crypto derivatives buying and selling.

Open curiosity in crypto derivatives, the overall worth of lively futures and perpetual contracts that merchants maintain, is presently about $3.96 billion in futures and $984 billion in perpetuals, in response to CoinMarketCap knowledge.

Journal: Transfer to Portugal to turn out to be a crypto digital nomad — All people else is