U.S. spot Bitcoin ETFs took in over a billion {dollars} of internet inflows over the previous week as Bitcoin value confirmed power above $110,000, establishing a clear take a look at of provide and demand if the Federal Reserve cuts charges subsequent week.

Farside Buyers exhibits $741.5 million on the day, with Constancy’s FBTC at $299.0 million and BlackRock’s IBIT at $211.2 million, whereas intraday vendor tallies fluctuate barely because of timing and processing of creations and redemptions.

Bitcoin traded round $114,132 on Sept. 11, following August’s file above $124,000 reported by Reuters.

At present costs, the arithmetic is simple. A $757 million internet influx buys about 6,640 BTC, which equates to almost 15 days of recent issuance on the post-halving tempo of roughly 450 BTC per day.

The halving final April minimize the block subsidy to three.125 BTC, and with about 144 blocks mined per day, baseline issuance sits close to that 450 BTC mark, topic to small fluctuations in block occasions.

| Web ETF circulation (USD) | Implied BTC purchased (at $114,000) | Days of issuance absorbed (~450 BTC/day) |

|---|---|---|

| $500,000,000 | ≈4,386 BTC | ≈9.7 days |

| $757,000,000 | ≈6,640 BTC | ≈14.8 days |

| $1,000,000,000 | ≈8,772 BTC | ≈19.5 days |

| $5,000,000,000 (monthly) | ≈43,860 BTC | ≈97.5 days |

The set-up for an additional demand shock hinges on coverage. A Reuters ballot of economists performed Sept. 8–11 factors to a 25 foundation level minimize on Sept. 17, and the survey notes markets already absolutely anticipate that transfer.

CME’s FedWatch software exhibits how fed funds futures embed these odds in actual time, with messaging that its possibilities needs to be attributed to FedWatch. If the Fed cuts and 10-year actual yields drift decrease from the 1.79 p.c print final week, the macro backdrop that supported file gold ETF inflows in current months would rhyme with bitcoin’s ETF period, since decrease actual yields cut back the carry hurdle for long-duration property.

Flows are already constructing once more. Farside’s each day desk exhibits the strongest one-day consumption since July, led by FBTC and IBIT. SoSoValue’s issuer-level dashboard corroborates the management break up, with its newest 1-day readings itemizing IBIT 1D internet influx close to $211 million and FBTC close to $299 million, per the totals above. Information distributors differ on the margin due to cut-off occasions and share-count updates, however the order of magnitude is evident.

The provision facet has turn into mechanical after the halving.

Mined issuance now displays the three.125 BTC block subsidy and a mean cadence close to 144 blocks each day, which locations a ceiling on natural provide into ETF demand home windows.

The halving block at peak 840,000 on April 20, 2024, is a verifiable on-chain reference for the subsidy change (block 840,000). Frictions inside ETF plumbing have additionally eased. In late July, the SEC authorised in-kind creations and redemptions for crypto ETPs, aligning bitcoin and ether merchandise with the mechanics utilized by commodity ETPs.

That change reduces money drag and might tighten the arbitrage band, which might affect how shortly major market demand transmits into spot shopping for.

Enrollment Closing Quickly…

Safe your spot within the 5-day Crypto Investor Blueprint earlier than it disappears. Study the methods that separate winners from bagholders.

Dropped at you by CryptoSlate

A minimize would take a look at how a lot of that demand is rate-sensitive versus structural. One solution to body it’s in “days of issuance absorbed per day.” If each day internet inflows run at $250 million, $500 million, then $1 billion, the absorption price spans about 4.9, 9.7, then 19.5 days of issuance per day at a $114,000 value.

A value shift adjustments the maths; the identical $757 million would take up about 16.0 days at $105,000 and about 14.0 days at $120,000, reflecting the less cash bought when costs are increased. That sensitivity is fast within the major market, and it’ll work together with vendor inventories, cross-venue liquidity, and futures foundation prices.

Derivatives carry prices stay average by 2025’s requirements. Aggregated three-month charges throughout main venues usually cluster within the mid-single digits, a zone that neither provides a big headwind to hedged ETF-related stock nor invitations excessive carry compression.

If a minimize pulls funding and foundation decrease, the relative attraction of unhedged, spot-only publicity inside ETFs can rise in asset allocation fashions that handle monitoring error and gross leverage.

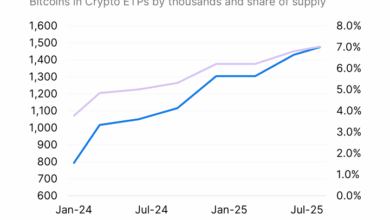

The inventory of accessible cash issues alongside circulation.

Glassnode’s illiquid provide metric, which tracks cash held by entities with little or no spending historical past, rose to a file above 14.3 million BTC in late August. This stock is traditionally sluggish to mobilize, so major ETF demand typically leans on change balances and vendor warehousing slightly than fast LTH distribution.

Mining economics sit within the background as a launch valve. Luxor’s hashprice work exhibits post-halving income per unit of hash stays compressed, and whereas community issue hit new highs by way of August, the direct contribution to circulating provide is capped by the protocol. Stress on miner treasuries can liberate some stock, however that channel is finite relative to ETF consumption on the speeds cited above.

Situation body for subsequent week is due to this fact slender and testable. If the Fed cuts 25 bps and ETF internet inflows migrate right into a $500 million to $1 billion each day vary for a number of periods, the first market would take up roughly 10 to twenty days of issuance every day at present costs, which tightens out there float until change balances replenish.

If the Fed holds and actual yields agency, flows might fade towards flat to $250 million, which means zero to about 5 days of issuance absorbed per day, a setting the place miner and dealer provide can meet demand with out seen dislocations.

The in-kind regime, the current foundation time period construction, and the illiquid provide share all level to how shortly any imbalance would present up in spreads and value impression slightly than in a drawn-out squeeze.

For now, the tape affords a easy benchmark. Sooner or later, the U.S. spot ETF circulation matched practically two weeks of the brand new Bitcoin, and the coverage determination on Sept. 17 will decide whether or not that ratio turns into a routine characteristic or an outlier of a robust week.