Right now in crypto, Chinese language regulators are reportedly making ready to limit mainland state-owned enterprises and banks from pursuing stablecoin and crypto initiatives in Hong Kong, Goldman Sachs’ CEO says the US Federal Reserve possible gained’t minimize rates of interest by 50 foundation factors, and the Polygon Basis restored consensus and finality capabilities after a software program bug knocked some nodes out of sync.

Chinese language corporations might face limits on stablecoin exercise in Hong Kong: Report

Chinese language web giants, state-owned enterprises and monetary establishments working in Hong Kong might face restrictions on stablecoin and crypto actions.

In response to a Thursday report by native information outlet Caixin, mainland Chinese language corporations working in Hong Kong could also be compelled to withdraw from cryptocurrency-related actions. The Hong Kong branches of a number of state-owned enterprises and Chinese language banks are additionally anticipated to not take part within the race to acquire a Hong Kong stablecoin license.

The information follows studies that HSBC and the Industrial and Industrial Financial institution of China (ICBC), the world’s largest financial institution by complete belongings, plan to use for stablecoin licenses in Hong Kong. Hong Kong’s new stablecoin regulatory framework got here into impact on Aug. 1 with a six-month transition interval. Regulators mentioned 77 establishments had expressed curiosity in making use of.

In response to Caixin, latest coverage shifts imply that Chinese language banks and different establishments making use of for a Hong Kong stablecoin license will possible withdraw from the race. An nameless senior monetary trade insider reportedly advised the outlet that these gamers might postpone their purposes for stablecoin licenses.

The report follows one other Caixin article suggesting the Hong Kong Financial Authority (HKMA) might ease capital necessities for banks dealing with crypto.

In response to a Thursday Caixin report, the HKMA is reportedly contemplating easing capital guidelines for banks holding crypto by reducing financial institution capital necessities.

Goldman Sachs CEO doubts Fed will minimize 50 foundation factors

Goldman Sachs CEO David Solomon mentioned on Wednesday that it’s unlikely the Federal Reserve will minimize rates of interest by 50 foundation factors subsequent week, simply days after Normal Chartered Financial institution mentioned it anticipated an even bigger minimize resulting from August’s weaker-than-expected jobs report.

“Whether or not or not now we have a 50 foundation minimize, I don’t assume that’s in all probability on the playing cards,” he advised CNBC. “I’m fairly assured we’ll have a 25 foundation fee minimize.”

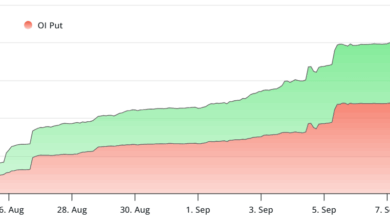

His take aligns with the broader market consensus, as CME FedWatch reveals 92.2% anticipate a smaller minimize, whereas 7.8% count on a 0.5% fee minimize on the Fed’s Sept. 17 assembly.

Solomon mentioned he “may see one or two different cuts, relying on how financial situations play out from right here.”

This month’s Fed fee minimize assembly is important not only for the broader market but in addition for crypto, as decrease rates of interest make riskier belongings akin to crypto extra engaging to buyers.

Polygon fixes RPC node bug, consensus returns to regular

The Polygon Basis, the group that oversees growth of the layer-2 scaling community within the Ethereum ecosystem, mentioned on Wednesday that consensus and finality capabilities have been restored, following a software program bug that triggered some nodes to fall out of sync with the blockchain.

Polygon efficiently executed a tough fork following the software program bug that disrupted some distant process name (RPC) nodes, that are used to relay info between purposes and the blockchain layer, the Polygon workforce mentioned in Wednesday’s replace.

The bug was brought on by a “defective” proposal from a validator, which pushed among the Bor nodes, used for transaction ordering and block manufacturing, onto divergent community forks, based on Polygon co-founder Sandeep Nailwal. Nailwal mentioned:

“We rolled out fixes on each Heimdall v0.3.1 — a brand new model with a tough fork to delete the recognized milestone — and Bor 2.2.11 beta2, purging the milestone from the database. With these fixes now reside, nodes should not caught, checkpoints and milestones are finalizing usually.”

Software program bugs proceed to trigger blockchain outages. As cryptographic protocols change into extra advanced by internet hosting sensible contract performance, file storage and crosschain interoperability, bugs might change into extra frequent, disrupting the onchain person expertise.