U.S. inflation for August got here in hotter than anticipated, although doubtless not sufficient to derail the Federal Reserve from slicing rates of interest subsequent week.

The Shopper Worth Index (CPI) rose 0.4% final month versus expectations for 0.3% and 0.2% in July. On a year-over-year foundation, CPI was larger by 2.9% versus a forecast 2.9% and a pair of.7% in July.

Core CPI, which excludes the risky meals and vitality parts, climbed 0.3% in August in opposition to forecasts for 0.3% and July’s 0.3%. Yr-over-year core CPI rose 3.1% in contrast with the three.1% forecast and July’s 3.1%.

Bitcoin slipped about 0.5% from $114,300 to $113,700 within the quick aftermath of the information.

U.S. inventory index futures gave up modest floor, now larger by simply 0.1% throughout the board. The ten-year Treasury yield dipped about 5 foundation factors to 4.00% and the greenback strengthened a bit. Gold rose on the information, trimming an earlier lack of about 0.4% to 0.15% at $3,675 per ounce.

Maybe tempering any draw back transfer within the markets and absolutely answerable for that massive dip within the 10-year Treasury yield, was the weekly Preliminary Jobless Claims report, launched concurrently the CPI. In that, jobless claims rose to a far worse than anticipated 263,000 from 236,000 the earlier week. Forecasts had been for simply 235,000.

The 2 studies level to the troublesome state of affairs the U.S. central financial institution finds itself in, with the employment image worsening, however the inflation fee refusing to show decrease.

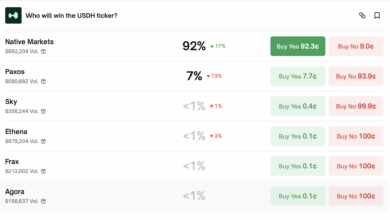

Previous to the CPI information, markets had been pricing in a 92% probability of a 25 foundation level reduce on the upcoming Fed assembly and an 8% probability of a 50 foundation level reduce, in line with CME FedWatch. The inflation quantity doubtless places to relaxation any thought of a 50 foundation level transfer, which had gained steam following final Friday’s mushy jobs report and Wednesday’s weak PPI numbers.