Key takeaways:

-

A basic BTC value chart sample places $170,000-$360,000 in play this cycle.

-

Spot Bitcoin ETFs publish the largest inflows in two months as institutional demand rebounds.

Bitcoin (BTC) value motion has painted two inverse head-and-shoulders patterns on the weekly time-frame, which trace at BTC’s “supercycle ignition” to $360,000, based on analysts.

BTC value technical evaluation places $360,000 in play

An inverse head-and-shoulders sample (IH&S) is a bullish chart formation that varieties with three troughs: a decrease “head” between two larger “shoulders.” As a technical rule, a breakout above the sample’s neckline is usually adopted by a parabolic value rise.

Associated: Bitcoin value can hit $160K in October as MACD golden cross returns

Bitcoin’s weekly chart exhibits two IH&S patterns, as proven within the determine under. The primary is a smaller one fashioned since November 2024 and resolved in July when the value broke above the neckline at $112,000. The latest rebound from this degree suggests the formation is enjoying out.

The measured goal for this sample, the peak added to the breakout level, is $170,000, or up 49% from the present degree.

The second is a much bigger IH&S sample that has been forming since March 2021, projecting an excellent larger goal for the asset.

Bitcoin broke above the neckline round $73,000 in November 2024 in a post-US election rally that pushed BTC value above $100,000 for the primary time.

Bitcoin’s drop to $74,400 in April retested this degree to verify the breakout. With the sample nonetheless in play, BTC value may proceed its uptrend towards the measured goal of $360,000, up 217% from the present ranges.

“The Bitcoin inverse head and shoulders of desires has now doubled,” mentioned analyst Merlijn The Dealer in a Wednesday X publish, including:

“This isn’t a sample. It’s the supercycle ignition.”

As Cointelegraph reported, an identical formation on the four-hour chart tasks a short-term goal of $120,000 for the Bitcoin value so long as bulls maintain above $113,000.

Institutional demand for Bitcoin recovers

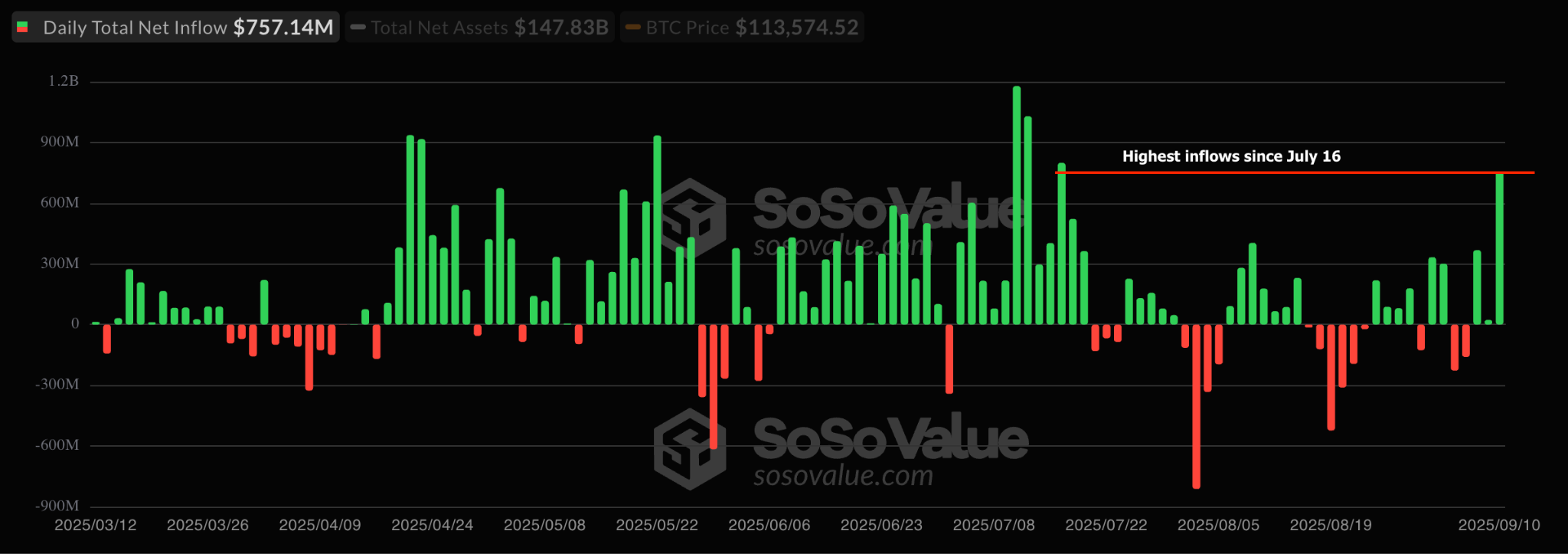

Bitcoin’s potential to rise larger is bolstered by the return of inflows into spot Bitcoin exchange-traded funds (ETFs).

These funding merchandise posted inflows for 3 consecutive days, between Monday and Wednesday, totaling $1.15 billion, per knowledge from SoSoValue.

The $752 million inflows recorded on Wednesday had been the best since mid-July, and present that institutional demand is rebounding.

“Cash is shifting again into Bitcoin ETFs at a speedy fee as retailers impatiently drop out of crypto,” mentioned market intelligence agency Santiment in a Wednesday X publish, including:

“Earlier crypto rallies had been boosted by influx spikes like this.”

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.