By Francisco Rodrigues (All instances ET except indicated in any other case)

Bitcoin is up round 1.4% prior to now 24 hours as traders await key inflation knowledge within the U.S., which might form expectations for a much-discussed interest-rate lower by the Federal Reserve.

Earlier than that hits although, the European Central Financial institution declares its personal interest-rate determination. It is anticipated to maintain charges regular, a shock transfer might ruffle just a few feathers.

Economists are forecasting a modest rise within the U.S. Shopper Value Index (CPI) due at 8:30 a.m. That, coupled with the close to 1 million jobs revision from the Bureau of Labor Statistics earlier this week, factors to rising possibilities of price cuts.

On Polymarket, bettors now see a 79% likelihood of a 25 basis-point price lower this month, whereas perceived odds of a 50 bps drop have surged to 18% from 5.4% in every week. The CME’s FedWatch instrument reveals merchants positioned for a 92% likelihood of a 25 bps lower, and an 8% likelihood of an excellent deeper one.

A price lower would profit danger property, and the rising odds of such an occasion are being felt in the marketplace. Spot bitcoin and ether ETFs attracted a mixed $928 million in internet inflows yesterday and bitcoin hit $114,000 for the primary time since early August.

Nonetheless, some analysts are flashing warning. Jake Ostrovskis, the pinnacle of OTC Buying and selling at Wintermute, identified that persistent inflation and slowing progress are elevating stagflation issues.

Since late August, Ostrovskis stated, traders have been shifting away from ether after its outperformance and again into bitcoin. Choices exercise displays that shift, with merchants protectively shopping for places on ETH and danger reversals for March and June 2026 dipping into unfavourable territory.

This “creates a setup the place the market feels properly hedged” ought to pressures ease, Ostrovskis famous. “On the finish of the day, we’re near the start of a rate-cutting cycle.”

In the meantime, gold stays close to document highs, with the bitcoin-to-gold ratio approaching resistance ranges that beforehand signaled crypto bottoms, analysts at QCP Capital stated.

“If historical past rhymes, bitcoin might be within the course of of building one other backside, setting the stage for the subsequent main leg increased,“ they wrote.

Nonetheless, geopolitical turmoil shouldn’t be ignored. Russia violated Poland’s airspace this week, forcing NATO to scramble its jets and prompting Polish Prime Minister Donald Tusk to say this was “the closest we’ve been to open battle since World Struggle II.”

Tusk underlined there’s “no cause to imagine we’re on the point of battle,” and Moscow denied duty for the assault. Keep alert!

What to Watch

- Crypto

- Macro

- Sept. 11, 8:30 a.m.: August U.S. Core CPI YoY Est. 3.1%, MoM Est. 0.3%; CPI YoY Est. 2.9%, MoM Est. 0.3%.

- Earnings (Estimates primarily based on FactSet knowledge)

Token Occasions

- Governance votes & calls

- Unlocks

- Sept. 11: Aptos to unlock 2.2% of its circulating provide value $50.89 million.

- Token Launches

- Sept. 11: Sky to be listed on OKX.

- Sept. 12: Unibase (UB) to be listed on Binance Alpha, MEXC, and others.

Conferences

Token Speak

By Oliver Knight

- Mantle (MNT) led a wider altcoin leap on Thursday, rising to a document excessive of $1.62 on the again of great quantity on derivatives trade Bybit.

- The native token of its namesake’s layer-2 community is primarily a governance token, however can be extensively staked as traders look to safe a yield on their holdings.

- The annualized return of staking MNT on Coinbase stands at 71%, excess of the 1.86% return holders get for staking ether (ETH) on the identical platform.

- This has led to greater than two thirds of MNT’s whole provide being staked, leading to a scarcity of provide on exchanges amid a wave of demand.

- Buying and selling quantity on Bybit hit $195 million over the previous 24 hours, an 83% rise on the earlier 24 hours.

- Open curiosity can be up 20%, outpacing the 15% achieve in value, which might be attributed to merchants opening new leveraged positions to wager on additional upside.

- The brand new document excessive value might pave the way in which for different altcoins to rally too.

- The “altcoin season” index rose to 67/100 on Thursday, demonstrating dealer desire to commerce extra speculative and decrease liquidity property like MNT versus crypto majors BTC and ETH.

Derivatives Positioning

By Omkar Godbole

- Open curiosity (OI) in BTC futures and perpetual futures listed worldwide stays elevated at 736K BTC, simply wanting final month’s document excessive 748K BTC.

- Up to now 24 hours the tally has remained comparatively unchanged, alongside tentative buying and selling in futures tied to altcoins, as merchants adopted a cautious stance earlier than in the present day’s essential U.S. CPI report.

- Volmex’s one-day BTC implied volatility index continues to fluctuate inside a months lengthy vary of 25% to 50%, indicating that the market will not be anticipating vital volatility from the CPI announcement. The index just lately stood at 35.50%, suggesting an anticipated one-day value motion of about 1.85%.

- Volatility indices linked to ETH, SOL and XRP additionally stay locked in latest ranges.

- On the CME, OI in bitcoin futures stays depressed at multimonth lows, whereas OI in ether continues to recede from latest document highs.

- Choices, nonetheless, present the other development. BTC choices OI has elevated to over 50,000 BTC, probably the most since April. And ether choices OI has jumped to 260K ETH, the very best since August 2024.

- On Deribit, 25-delta danger reversals proceed to exhibit a bias towards put choices in bitcoin and ether. Flows on OTC desk Paradigm continued to lean bearish, with some merchants choosing up the September expiry $4,000 ETH put.

Market Actions

- BTC is up 0.26% from 4 p.m. ET Wednesday at $113,916.87 (24hrs: +1.5%)

- ETH is up 1.93% at $4,414.68 (24hrs: +2.32%)

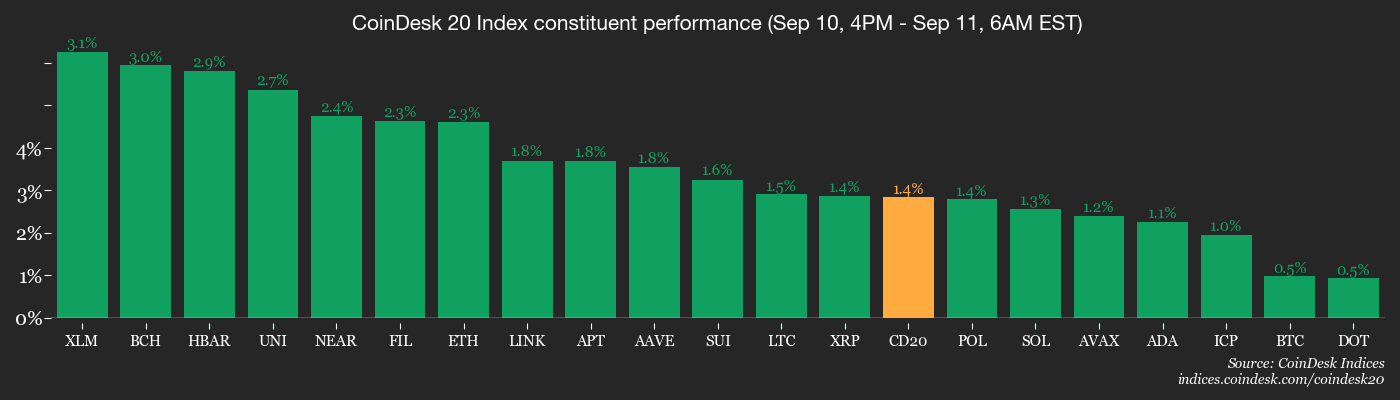

- CoinDesk 20 is up 1.24% at 4,209.95 (24hrs: +2.13%)

- Ether CESR Composite Staking Fee is down 7 bps at 2.8%

- BTC funding price is at 0.0072% (7.9245% annualized) on Binance

- DXY is up 0.2% at 97.98

- Gold futures are down 0.62% at $3,659.30

- Silver futures are down 0.34% at $41.46

- Nikkei 225 closed up 1.22% at 44,372.50

- Grasp Seng closed down 0.43% at 26,086.32

- FTSE is up 0.38% at 9,260.84

- Euro Stoxx 50 is up 0.18% at 5,371.28

- DJIA closed on Wednesday down 0.48% at 45,490.92

- S&P 500 closed up 0.3% at 6,532.04

- Nasdaq Composite closed unchanged at 21,886.06

- S&P/TSX Composite closed up 0.40% at 29,179.39

- S&P 40 Latin America closed up 0.81% at 2,822.97

- U.S. 10-12 months Treasury price is up 1.3 bps at 4.045%

- E-mini S&P 500 futures are up 0.12% at 6,547.50

- E-mini Nasdaq-100 futures are up 0.17% at 23,917.75

- E-mini Dow Jones Industrial Common Index are up 0.11% at 45,592.00

Bitcoin Stats

- BTC Dominance: 58.14% (-0.37%)

- Ether-bitcoin ratio: 0.03872 (1.45%)

- Hashrate (seven-day shifting common): 1030 EH/s

- Hashprice (spot): $53.17

- Whole charges: 4.04 BTC / $456,196

- CME Futures Open Curiosity: 137,110 BTC

- BTC priced in gold: 31.5 oz.

- BTC vs gold market cap: 8.86%

Technical Evaluation

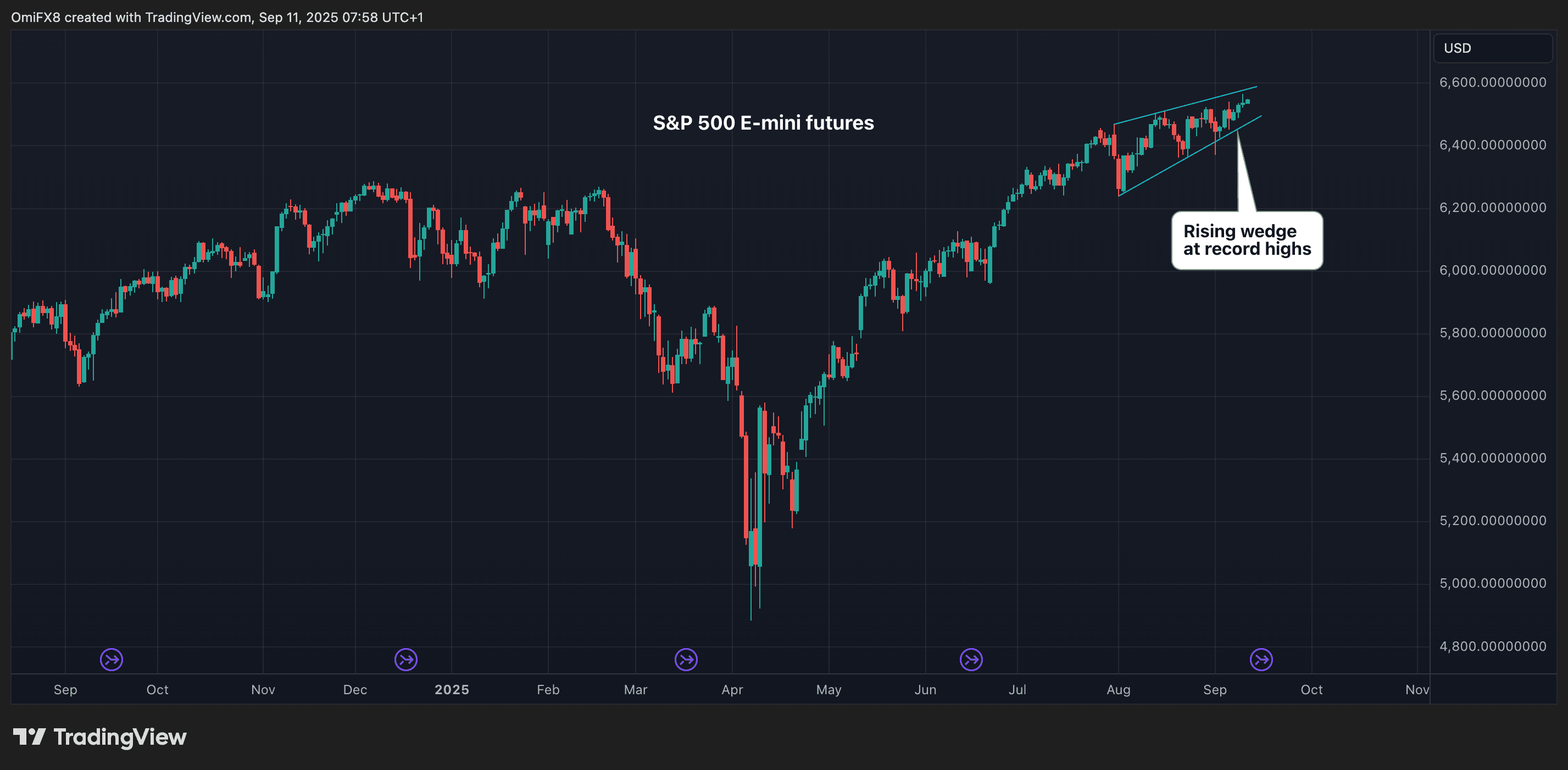

- S&P 500 e-mini futures have carved out a rising wedge sample in a transfer to document highs.

- When a rising wedge, which is a bearish reversal sample, seems after an prolonged rally to document highs, it considerably will increase the likelihood of a pointy draw back transfer. It means that patrons are exhausted and the rally is working on fumes.

- A possible sell-off in futures might weigh over bitcoin and wider crypto market.

Crypto Equities

- Coinbase World (COIN): closed on Wednesday at $315.34 (-1.08%), +0.7% at $317.55 in pre-market

- Circle (CRCL): closed at $113.69 (-3.64%), +1.46% at $115.35

- Galaxy Digital (GLXY): closed at $26.08 (-1.88%), +0.73% at $26.27

- Bullish (BLSH): closed at $52.62 (-2.21%), +0.72% at $53

- MARA Holdings (MARA): closed at $15.86 (-0.44%), +0.82% at $15.99

- Riot Platforms (RIOT): closed at $16.4 (+7.82%), +0.24% at $16.44

- Core Scientific (CORZ): closed at $15.99 (+10.05%), +0.81% at $16.12

- CleanSpark (CLSK): closed at $10.03 (+3.72%), +0.5% at $10.08

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $35.49 (+7.12%)

- Exodus Motion (EXOD): closed at $27.49 (+2.77%), unchanged in pre-market

Crypto Treasury Corporations

- Technique (MSTR): closed at $326.45 (-0.63%), +0.57% at $328.30

- Semler Scientific (SMLR): closed at $28.02 (-0.18%)

- SharpLink Gaming (SBET): closed at $16.09 (-3.6%), +2.05% at $16.42

- Upexi (UPXI): closed at $5.46 (-0.73%), +2.75% at $5.61

- Mei Pharma (MEIP): closed at $3.07 (+10.43%)

ETF Flows

Spot BTC ETFs

- Day by day internet flows: $741.5 million

- Cumulative internet flows: $55.6 billion

- Whole BTC holdings ~1.3 million

Spot ETH ETFs

- Day by day internet flows: $171.5 million

- Cumulative internet flows: $12.86 billion

- Whole ETH holdings ~6.38 million

Supply: Farside Buyers

Chart of the Day

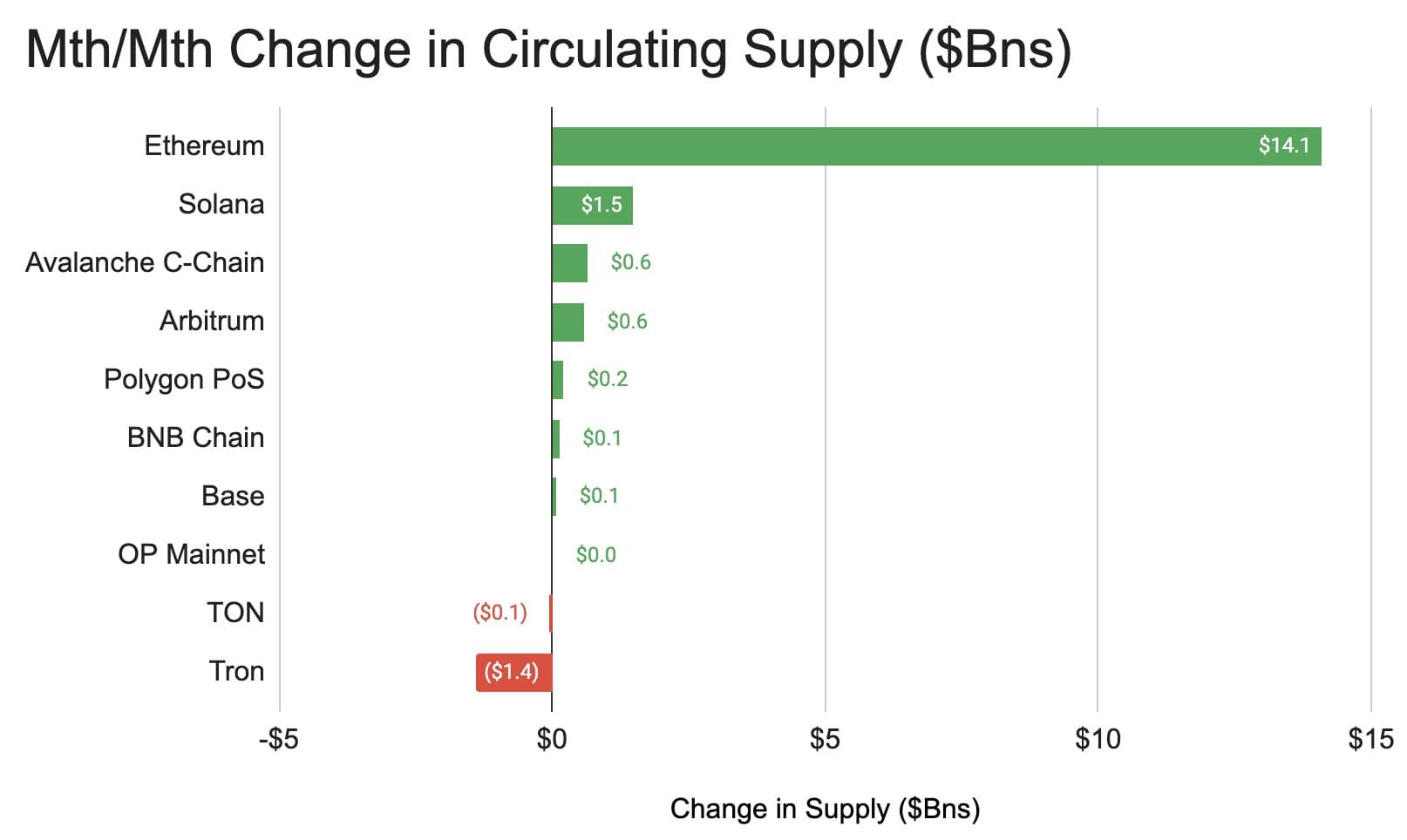

- The whole circulating provide of stablecoins on Ethereum rose greater than $14 billion in August, the largest achieve amongst high blockchains.

- The expansion was led by USDC, UDST, USDe.

- The information highlights Ethereum’s dominance in stablecoins, which stands out as one of many few crypto sectors with sturdy real-world purposes.