Blockchain tech agency BitMine Immersion Applied sciences has added to its huge Ether holdings for the second time this week, shopping for $200 million price from digital asset belief Bitgo.

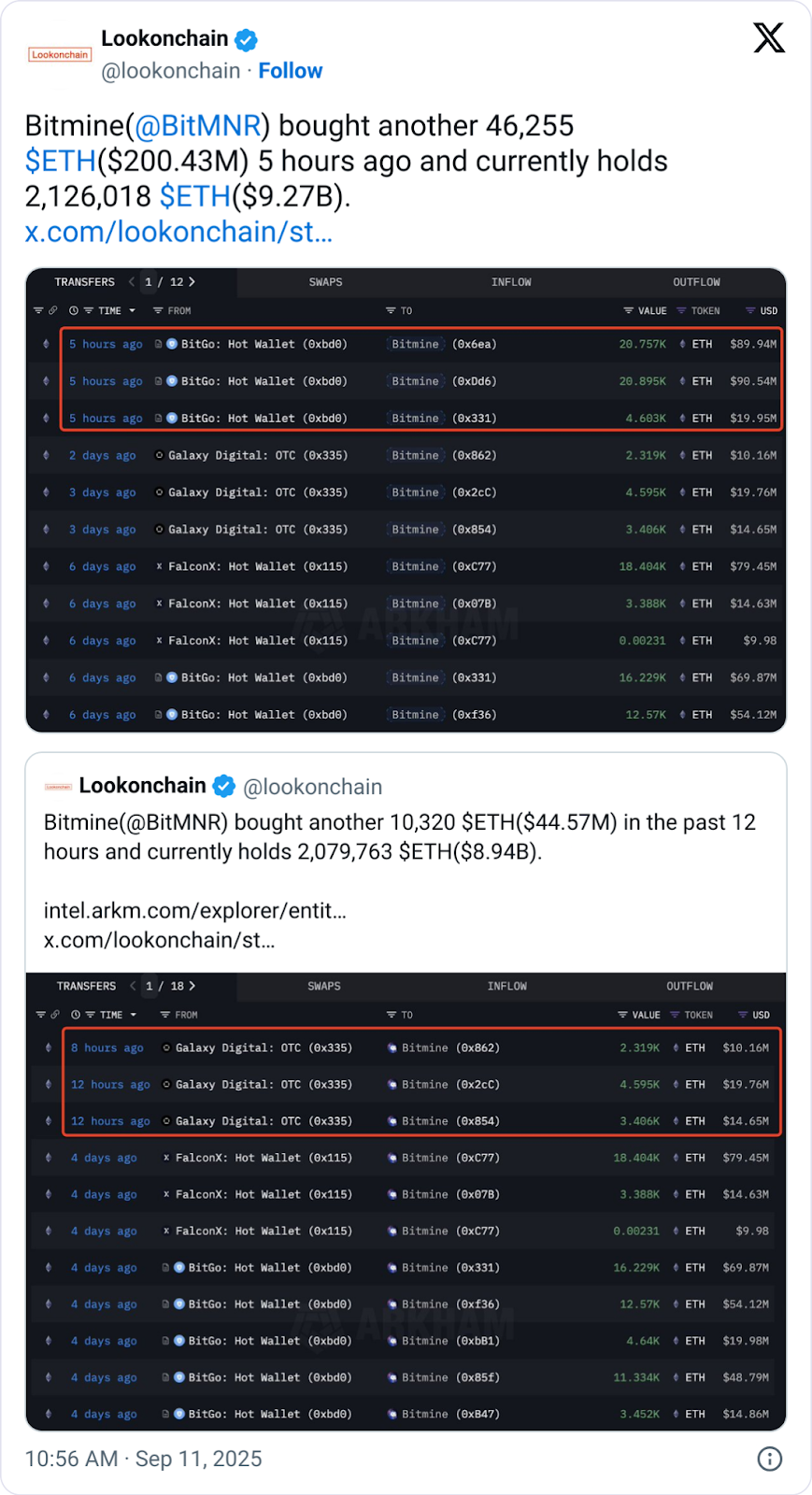

Blockchain knowledge reviewed by Lookonchain reveals BitMine bought 46,255 Ether (ETH) throughout three transactions with Bitgo on Wednesday.

BitMine has the biggest ETH holdings of any public firm, and its two purchases this week alone virtually match the quantity of ETH purchased by treasury companies final week, per Strategic ETH Reserve knowledge.

It comes amid every week of crypto shopping for from different non-Ethereum-related treasury corporations, which have despatched their respective shares hovering.

BitMine’s buys lead ETH treasury companies

BitMine began the week with a purchase order of 202,500 Ether on Monday, which despatched its holdings over a milestone 2 million ETH for the primary time.

Its newest buy brings its complete holdings to over 2.1 million ETH, valued at over $9.2 billion, which was helped by a 2% acquire within the token’s value over the past day. It additionally places it additional forward of the second-largest ETH holding firm, Sharplink Gaming, which has greater than 837,000 ETH in its treasury.

Final week, ETH shopping for corporations scooped up a complete of 273,300 ETH, led by a 150,000 ETH buy from The Ether Machine, adopted by a 74,300 ETH purchase from BitMine.

Bitcoin shopping for lags, however share costs nonetheless soar

In the meantime, Bitcoin (BTC) treasury shopping for slowed this week.

Cointelegraph discovered that public companies made solely 4 Bitcoin buys since Monday, with a complete worth of round $60 million, far beneath the week prior.

Pop Tradition Group (CPOP), a agency that promotes Chinese language hip hop, is the biggest purchaser up to now this week with a $33 million buy of 300 BTC on Wednesday.

The announcement boosted its share value by over 40% in early buying and selling, and it completed the day at a acquire of 12.5% at $1.62.

The oil and fuel shipper Robin Power (RBNE) noticed its inventory acquire over 150% in early buying and selling on Wednesday after it stated it purchased $5 million price of Bitcoin, although it later fell to only a 21% acquire on the finish of the buying and selling day and fell one other 25% after the bell to $1.73.

In the meantime, the UK-based The Smarter Internet Firm bought $3.4 million (2.5 million British kilos) of Bitcoin on Wednesday, the identical day Sweden’s H100 Group purchased 21 BTC for $2.4 million.

Japan’s Metaplanet made the week’s first purchase, saying a 136 BTC purchase price round $15 million on Monday.

Public companies see inventory boosts on crypto buys

Different corporations gained on guarantees to purchase cryptocurrency.

Hong Kong’s QMMM Holdings closed buying and selling on Tuesday at an over 1,700% acquire after saying it’d initially spend $100 million shopping for Bitcoin, ETH and Solana (SOL). Its shares closed down almost 50% on Wednesday.

The e-commerce stock administration platform Eightco Holdings noticed its shares shut buying and selling on Monday up over 3,000% after it deliberate a $270 million increase to purchase Worldcoin (WLD). Its shares dropped 40% throughout Wednesday’s buying and selling.

Nevertheless, NYDIG international head of analysis Greg Cipolaro stated on Friday that the premiums of crypto shopping for corporations are falling, including a “bumpy experience could also be forward” for such companies as many await merger and capital offers to go public, which might see a “substantial wave of promoting” from shareholders.

Journal: How Ethereum treasury corporations might spark ‘DeFi Summer time 2.0’