Key takeaways:

-

Bitcoin’s Bollinger Bands indicator reached a vital turning level for bulls.

-

Bitcoin’s cup-and-handle sample targets $300,000, backed by a number of tailwinds.

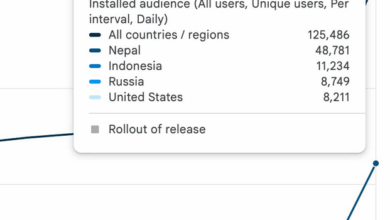

A Bitcoin indicator utilized by merchants to evaluate volatility has reached a vital turning level, suggesting {that a} important worth transfer could also be underway.

Crypto dealer and analyst Matthew Hyland famous that Bitcoin’s (BTC) Bollinger Bands — a instrument that measures the momentum and volatility of an asset inside a sure vary — have reached their “most excessive degree” within the month-to-month timeframe since its inception in January 2009.

He wasn’t the one dealer to identify the rising sample.

“The Bitcoin Bollinger Bands on the 1M (month-to-month) are at historic tightness,” widespread analyst Crypto Ceasar stated, including,

“This has beforehand led to heavy volatility to the upside. Bitcoin could possibly be in for a spicy This autumn.”

The Bollinger Bands on the 1M (month-to-month) are at historic tightness. This has beforehand led to heavy volatility to the upside (see chart).

Bitcoin could possibly be in for a spicy This autumn 🐂🫡 pic.twitter.com/sOmeLIYPgT

— 👑Crypto Caesar👑™️ (@crypto_caesar1) September 6, 2025

Earlier contractions in 2012, 2016, and 2020 all “preceded explosive worth expansions,” crypto investor Giannis Andreou stated in an X submit final week, including that the present setup is even tighter, indicating the potential for the biggest transfer ever seen in BTC worth.

“Big volatility forward!”

It isn’t the primary time on this bull market that the Bands have pointed to main BTC worth upside. As Cointelegraph reported, in early July, a squeeze on the three-day chart precluded the run to the present all-time highs above $124,500 reached on Aug. 14.

Bitcoin’s cup-and-handle sample targets $300,000

As Cointelegraph continues to report, a number of components are placing Bitcoin in an excellent place for extra upside regardless of current failed makes an attempt to maintain a restoration above $112,000.

Along with impending Fed rate of interest cuts and bullish onchain metrics, Bitcoin might mirror gold’s rally and regain momentum towards $185,000 and past.

Associated: Bitcoin wobbles after stunning US jobs revision: What’s subsequent for BTC?

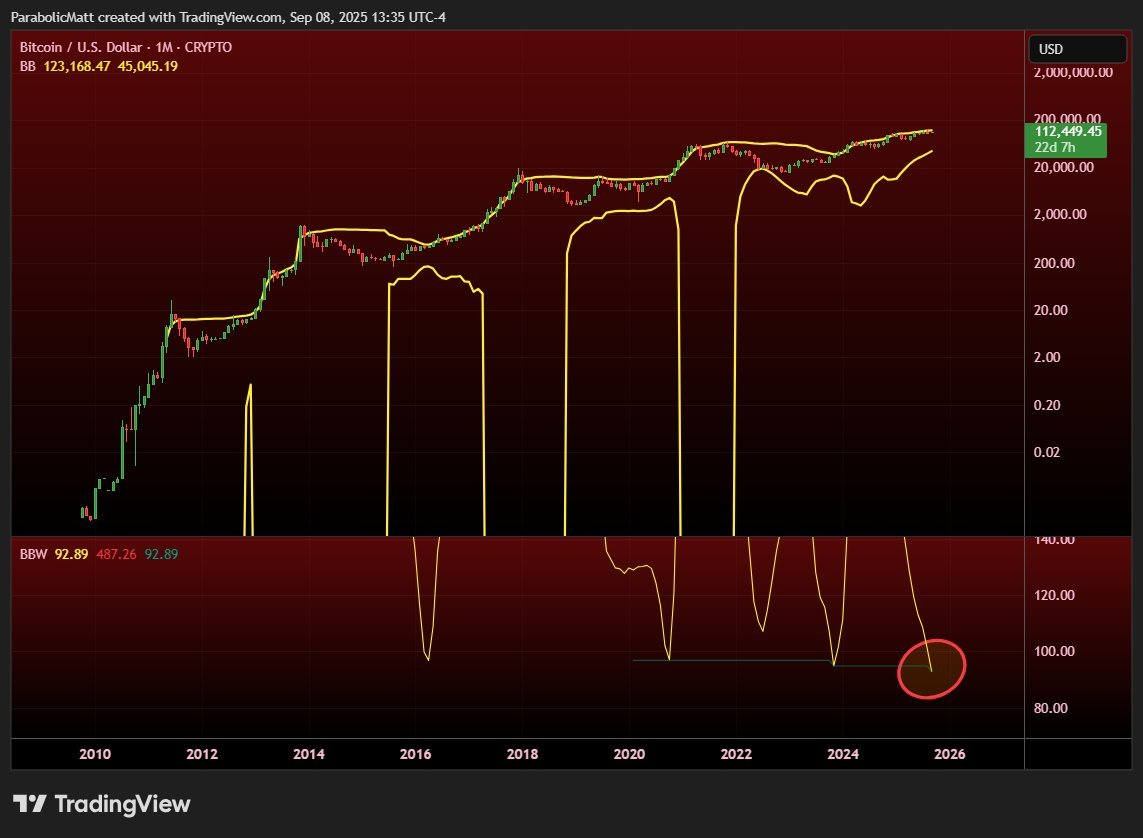

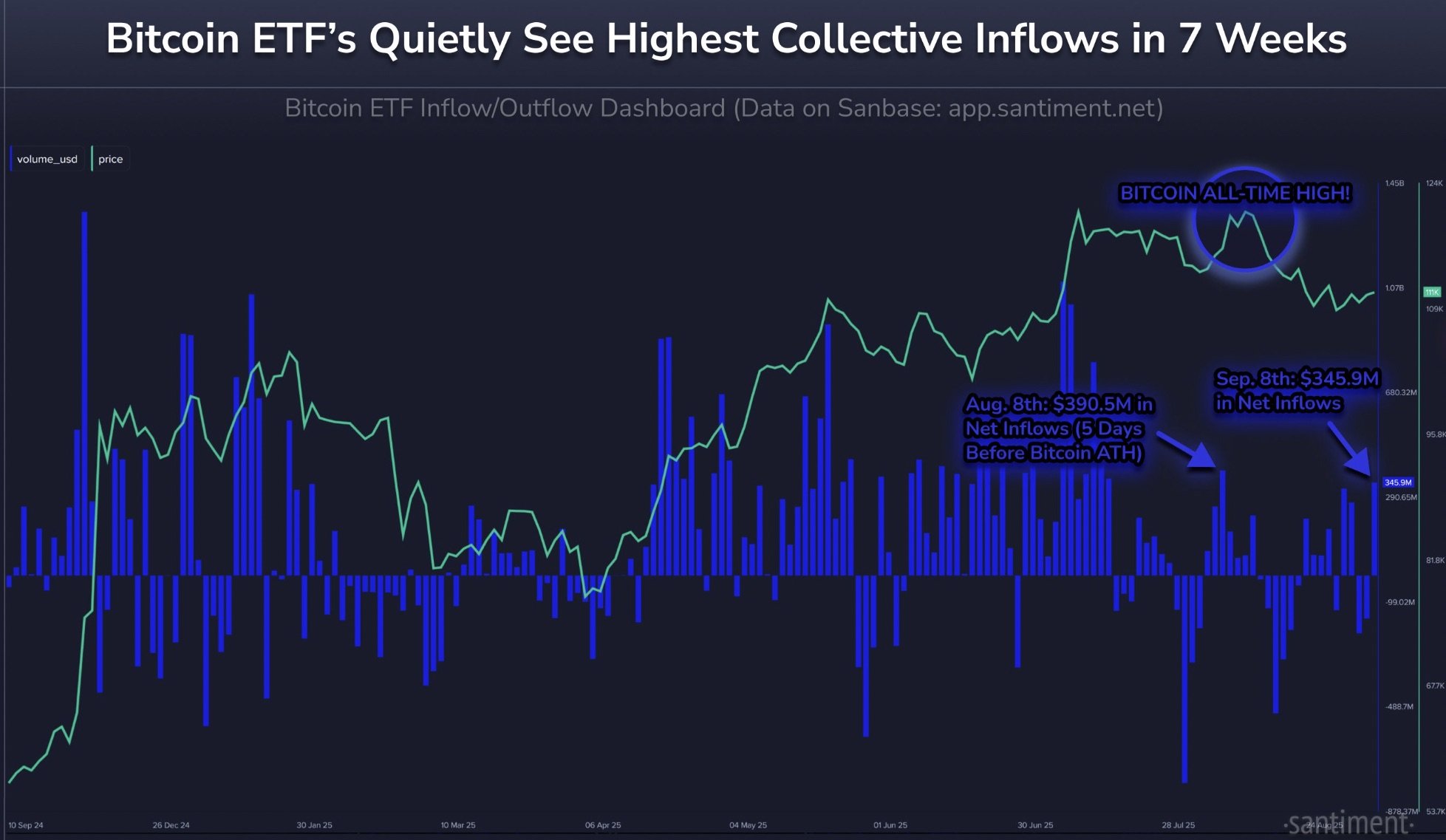

Persistent institutional demand by spot Bitcoin ETFs and treasury firms reinforces Bitcoin’s upside as spot BTC ETF in flows flipped constructive on Monday.

“Cash is transferring again into Bitcoin ETFs at a fast price as retailers impatiently drop out of crypto,” stated market intelligence agency Santiment in a Wednesday X submit, including:

“Earlier crypto rallies have been boosted by influx spikes like this.”

The month-to-month chart exhibits that the worth broke above the cup-and-handle neckline at $69,000 in November 2024. Bitcoin remains to be validating the breakout and will rise to finish the utmost distance between the cup’s trough and the neckline.

That places Bitcoin’s cup-and-handle breakout goal for 2025–2026 at round $305,000, up by greater than 170% from present worth ranges.

Nonetheless, it is very important be aware {that a} cup-and-handle doesn’t at all times assure the complete upside transfer. A examine by veteran analyst Thomas Bulkowski discovered that solely 61% of those setups attain their anticipated targets.

As Cointelegraph reported, Bitcoin is in the course of a traditional bull cycle correction section after all-time highs, which can backside out round $104,000 earlier than one other leg increased.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.