XRP surged previous the $3 threshold in the course of the September 9–10 session as institutional flows accelerated on the again of regulatory readability in Europe.

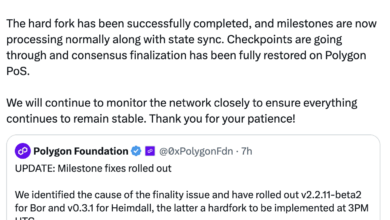

Ripple’s new partnership with BBVA underneath MiCA compliance fueled optimism that conventional banks might deepen adoption of blockchain settlement.

Whereas bulls defended $2.99 help, analysts be aware rising alternate reserves may nonetheless weigh on sustained upside momentum.

Information Background

• Ripple Labs introduced an expanded partnership with BBVA, enabling digital asset custody and settlement options underneath EU MiCA compliance requirements.

• Institutional ETF hypothesis continues within the U.S., with merchants pricing October SEC selections as a possible structural catalyst.

• Derivatives merchants present robust bullish positioning with 3-to-1 call-to-put ratios concentrated between $2.90–$3.50 into September 12 expiry.

• Alternate reserves for XRP rose to 12-month highs, suggesting potential distribution strain regardless of robust partnership information.

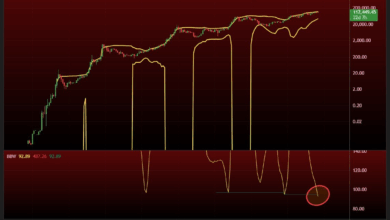

Worth Motion Abstract

• XRP climbed from $2.97 to $3.02 throughout September 9 15:00–September 10 14:00, marking an 8% achieve.

• Session excessive hit $3.02 in the course of the 13:47–13:48 window with 4.36M and three.44M quantity spikes.

• Assist consolidated at $2.94–$2.95 on robust quantity validation.

• Token defended $3.00 regardless of intraday dip to $2.99, signaling institutional protection.

• Closing value of $3.01–$3.02 saved XRP inside bullish continuation zone.

Technical Evaluation

• Quantity: Peaks of 116.76M and 119.07M throughout surges, almost 3x day by day common of 42.18M.

• Assist: Sturdy base at $2.94–$2.95; a number of profitable retests affirm accumulation.

• Resistance: Break above $3.00 validated; subsequent upside ranges sit at $3.05–$3.10 Fibonacci extension.

• Momentum: Larger lows into breakout reinforce institutional shopping for curiosity.

• Construction: Breakout from consolidation zone suggests potential continuation if $3.00 flooring holds.

What Merchants Are Watching

• Whether or not XRP can maintain day by day closes above $3.00 to substantiate breakout energy.

• The SEC’s October ETF rulings as a structural catalyst for institutional capital inflows.

• Choices expiry on September 12, the place call-heavy positioning may amplify volatility.

• Alternate reserves climbing to 12-month highs — will inflows flip into sustained promote strain?

• Observe-through from the BBVA–Ripple partnership as a sign for European financial institution adoption.