Dogecoin rallied sharply through the September 9–10 session, reclaiming the $0.24–$0.25 vary with quantity surging above 1.5 billion tokens. The transfer comes as REX-Osprey prepares to debut the primary U.S. Dogecoin ETF on September 11 underneath the ticker “DOJE.”

Technical merchants flagged a bullish pennant breakout sample, whereas large-scale whale accumulation added to rising confidence that institutional demand is constructing across the launch.

Information Background

• REX-Osprey DOGE ETF is scheduled to start buying and selling September 11, making it the primary U.S. exchange-traded fund monitoring a memecoin with no declared utility.

• Whale addresses accrued roughly 280 million DOGE up to now week, indicating sturdy institutional-sized flows.

• Technical analysts spotlight a pennant breakout with upside targets of $0.28–$0.30 if the $0.25 degree is held.

• ETF hypothesis has pushed retail and social media enthusiasm, with DOGE trending closely on prediction markets and derivatives desks.

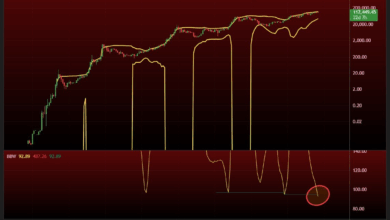

Value Motion Abstract

• DOGE superior 4% through the September 9 13:00–September 10 12:00 session, shifting from $0.236 to a peak of $0.245.

• Early decline noticed DOGE drop from $0.247 to $0.236 by 14:00, backed by huge 1.55B quantity that set a robust ground.

• Value consolidated inside $0.238–$0.242 by means of many of the day, suggesting strategic accumulation.

• Remaining hour breakout lifted DOGE from $0.240 to $0.245, underpinned by 114.7M quantity on the peak.

• Session closed at $0.244, simply shy of resistance, confirming bullish momentum into ETF launch week.

Technical Evaluation

• Help: $0.236–$0.238 vary validated by repeated high-volume rebounds.

• Resistance: $0.245–$0.247 stays the important thing ceiling; break above may goal $0.28.

• Quantity: Session highs of 1.55B and late-hour 114.7M considerably exceeded 24-hour common of 334M.

• Construction: Pennant breakout confirmed by increased lows and accelerating final-hour volumes.

• Indicators: RSI hovering mid-60s suggests room for additional upside earlier than overbought situations emerge.

What Merchants Are Watching

• Whether or not DOGE can maintain closes above $0.245 and arrange a push towards $0.28.

• ETF launch on September 11, anticipated to be a structural liquidity occasion for DOGE.

• Whale accumulation tendencies — continued inflows would validate institutional conviction.

• Derivatives positioning as ETF hype builds, with potential for heightened volatility round launch.

• Broader crypto market sentiment tied to Federal Reserve coverage selections later within the month.