Solana has been a current outperformer amongst main cryptos — forward 24% over the previous month — however that would simply be precursor to an epic finish of yr run, writes Bitwise CIO Matt Hougan.

“For the final 18 months, the recipe for sturdy returns in crypto has been clear,” mentioned Hougan. “Take one half ETP inflows, add sturdy company treasury purchases, and voilà — you get huge returns.”

Hougan reminded that “recipe” despatched bitcoin from $40,000 to its present stage and ether greater than tripling, and the identical setup is forming round SOL.

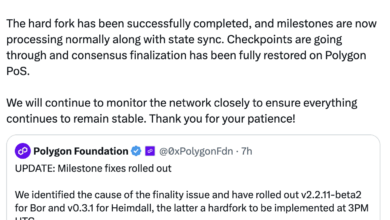

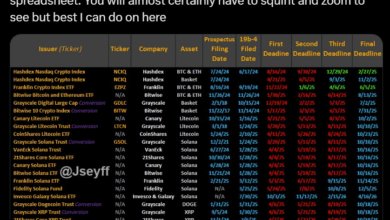

Seven main asset managers — together with Bitwise itself, alongside Grayscale, Constancy, and VanEck — have filed to launch spot Solana ETPs. The U.S. Securities and Trade Fee is because of rule on them by October 10. If even just a few are authorized, retail and institutional buyers might quickly be shopping for SOL the identical method they’d a inventory.

That’s not the one tailwind, mentioned Hougan. This previous weekend, a beforehand quiet publicly traded microcap, Ahead Industries (FORD), introduced it had raised $1.65 billion from crypto funding heavyweights Galaxy Digital, Bounce Crypto, and Multicoin Capital.

The corporate’s playbook is easy: purchase SOL, stake it, and generate yield — turning solana itself right into a revenue-generating asset on a public stability sheet. On the helm is Kyle Samani, co-founder of Multicoin and considered one of Solana’s earliest champions.

Hougan likens Samani to the Michael Saylor of Bitcoin or Tom Lee of Ethereum — seen, vocal, and able to turning a technical narrative right into a mainstream headline. Nonetheless, Solana has to earn the eye.

Its pitch is pace. In contrast to Ethereum, which makes use of further layers to scale, Solana runs every thing on one chain. A brand new improve — quickly to go stay — will shrink transaction finality time from 12 seconds to 150 milliseconds. Transaction charges stay below a cent.

These positive factors do include tradeoffs, Hougan allowed. Solana’s critics argue that its construction is extra centralized than different blockchains, probably leaving it uncovered to community failures. Supporters counter that it’s the one chain quick and low cost sufficient to help high-volume use instances — like tokenized belongings or stablecoins — at a worldwide scale.

And development is going on. Solana is now third in stablecoin liquidity and fourth in tokenized belongings, with asset quantity up 140% this yr, mentioned Hougan.

Then there’s its measurement. With a market cap of $116 billion, Solana remains to be a small fish in comparison with Bitcoin’s $2.2 trillion or Ethereum’s $519 billion. Which means smaller inflows can transfer the needle in larger methods. In line with Hougan, Ahead Industries’ $1.65 billion might have the identical impression on SOL as a $33 billion funding would on BTC.

That’s why he’s watching intently. “My suggestion?” Hougan wrote. “Hold your eye on Solana.”