Key takeaways:

-

Bitcoin broke $114,000 as knowledge confirmed PPI inflation cooled sharply in August.

-

Merchants consider the information may push the Federal Reserve to chop charges in September.

-

Lengthy-term onchain developments present short-term turbulence occurring after Fed price cuts, then longer-term upside.

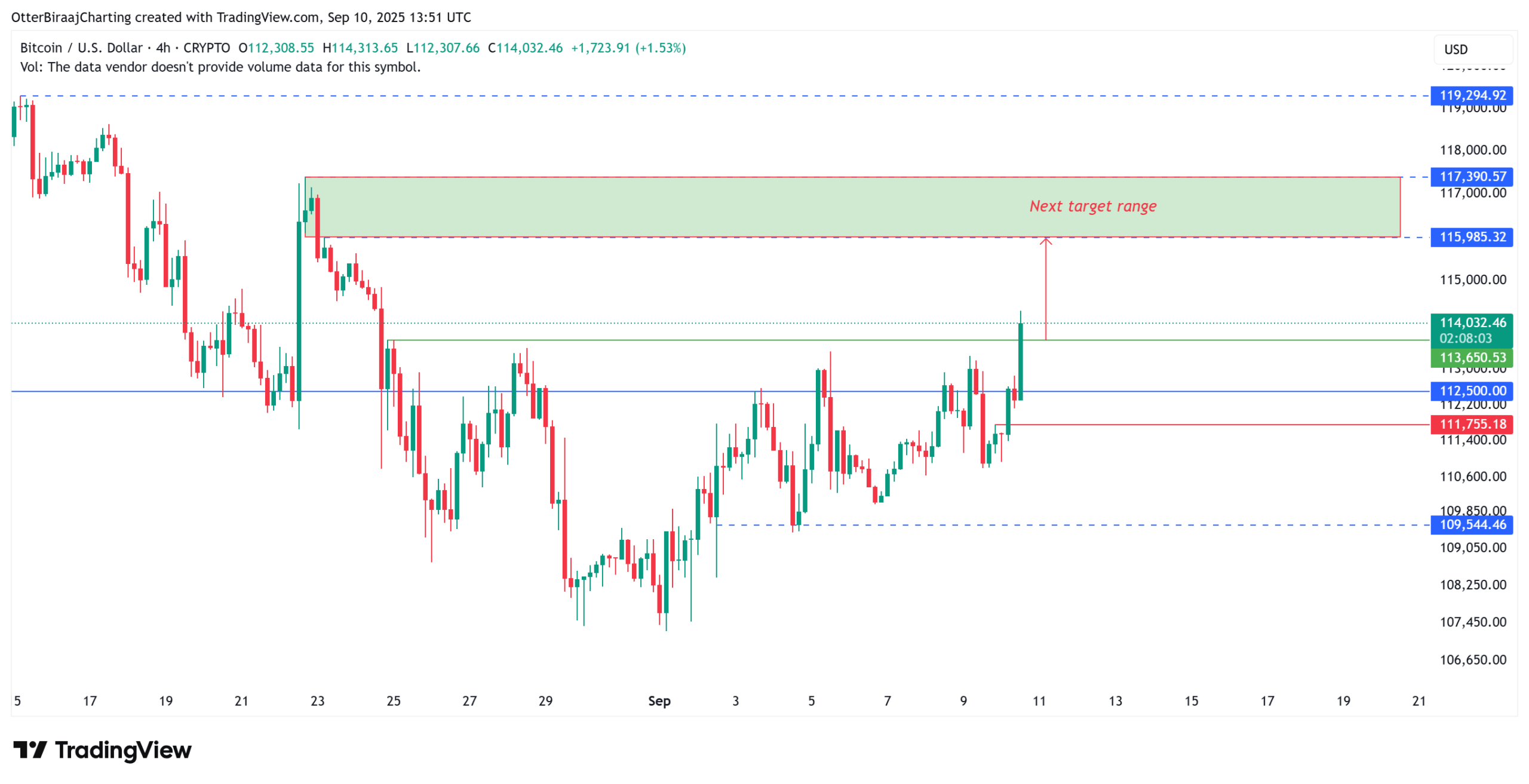

Bitcoin (BTC) surged above $114,000 for the primary time since Aug. 24, extending its current restoration as US inflation knowledge got here in far cooler than anticipated. The transfer follows the discharge of the August Producer Value Index (PPI), which dropped to 2.6% year-over-year versus forecasts of three.3%. Core PPI, which strips out meals and power, fell to 2.8%, nicely under the three.5% consensus.

On a month-to-month foundation, PPI even turned destructive, marking solely the second contraction since March 2024, based on the Kobeissi publication. Including to the dovish tone, inflation figures from July had been revised decrease as nicely, with headline PPI adjusted to three.1% from 3.4% and core PPI to three.4% from 3.7%. Along with the historic US jobs knowledge revision earlier this week, which erased 911,000 jobs from the previous 12 months, markets are viewing rate of interest cuts as more and more imminent.

Market analyst Skew famous that producer inflation developments typically lag behind these of the Shopper Value Index (CPI) by one to a few months. This implies sticky CPI readings may nonetheless seem within the quick run, although the broader trajectory factors to cooling inflation into This autumn. Whereas the PPI slowdown is encouraging, hedge flows might proceed till CPI confirms the easing development.

Associated: Bitcoin should hit $104K to repeat previous bull market dips: Analysis

Bitcoin’s historic response to Fed price cuts

With Federal Reserve rate of interest cuts wanting extraordinarily probably, Bitcoin’s historical past exhibits a constant sample of turbulence adopted by upside. Two onchain metrics, Market Worth to Realized Worth (MVRV) and Whale Ratio, shed additional gentle.

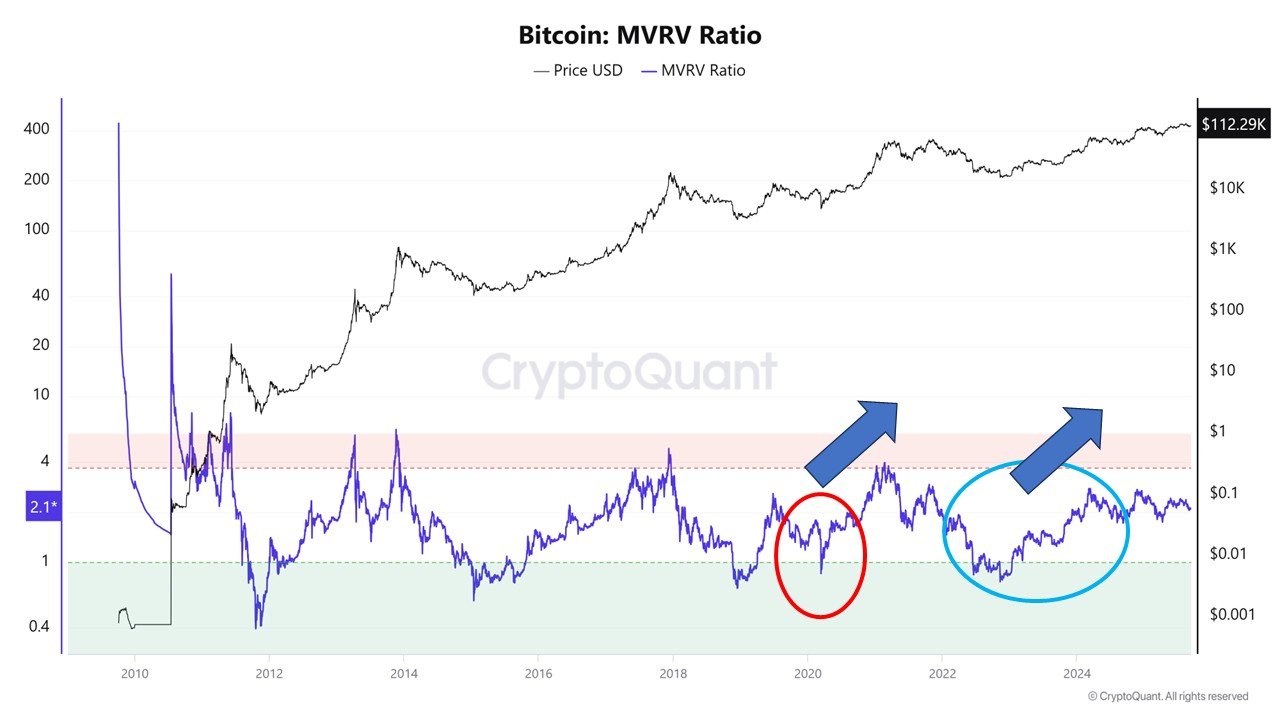

MVRV compares Bitcoin’s market capitalization to its realized capitalization (the mixture worth at which cash final moved). When MVRV hovers close to 1, BTC is often undervalued, and ranges close to 3–4 recommend overheated valuations.

In the meantime, Whale Ratio measures the share of enormous holder transactions in trade flows, displaying when whales are sending cash to promote or pulling them again for storage.

Information from CryptoQuant highlights that in March 2020, rate of interest cuts despatched MVRV collapsing towards 1 as panic worn out buyers’ speculative positive aspects, whereas the Whale Ratio spiked on heavy whale promoting.

As liquidity flooded in, the MVRV rebounded, and whales shifted to accumulation, fueling Bitcoin’s 2020–2021 bull run. An identical sample repeated in the course of the late 2024 easing cycle, when each indicators mirrored short-term promoting earlier than stabilizing into one other rally.

If historical past rhymes, Fed easing in 2025 may once more deliver preliminary volatility, however total present the liquidity backdrop for Bitcoin to method new highs.

Associated: Bitcoin merchants reduce threat over macro worries, however BTC market construction targets $120K

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.