Binance, the world’s largest crypto trade by buying and selling quantity, has entered right into a partnership with the US crypto exchange-traded fund (ETF) supplier, Franklin Templeton.

Binance and Franklin Templeton are collaborating to discover tokenization of securities mixed with a world buying and selling infrastructure, the crypto trade introduced on Wednesday.

“Our purpose is to take tokenization from idea to observe for shoppers to realize efficiencies in settlement, collateral administration, and portfolio development at scale,” stated Roger Bayston, Franklin Templeton’s head of digital belongings.

Following the partnership, Binance expects to unveil safety tokenization merchandise later this 12 months, a spokesperson for the trade informed Cointelegraph.

Co-creating portfolios

“By working with Binance, we will ship breakthrough merchandise that meet the necessities of worldwide capital markets and co-create the portfolios of the long run,” Franklin Templeton’s Bayston stated.

Sandy Kaul, head of innovation at Franklin Templeton, highlighted the significance of the partnership, observing that tokenization know-how has been evolving from “fringes to the monetary mainstream.”

“We see blockchain not as a risk to legacy programs, however as a possibility to reimagine them,” Kaul stated, including:

“By working with Binance, we will harness tokenization to carry institutional-grade options like our Benji Expertise Platform to a wider set of traders and assist bridge the worlds of conventional and decentralized finance.”

As a part of the partnership, Franklin Templeton is anticipated to ship experience within the compliant tokenization of securities, whereas Binance would supply its world buying and selling infrastructure and investor attain.

“The purpose is to ship revolutionary options to satisfy the evolving wants of traders by bringing larger effectivity, transparency and accessibility to capital markets with aggressive yield era and settlement effectivity,” the announcement reads.

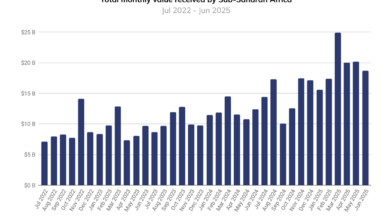

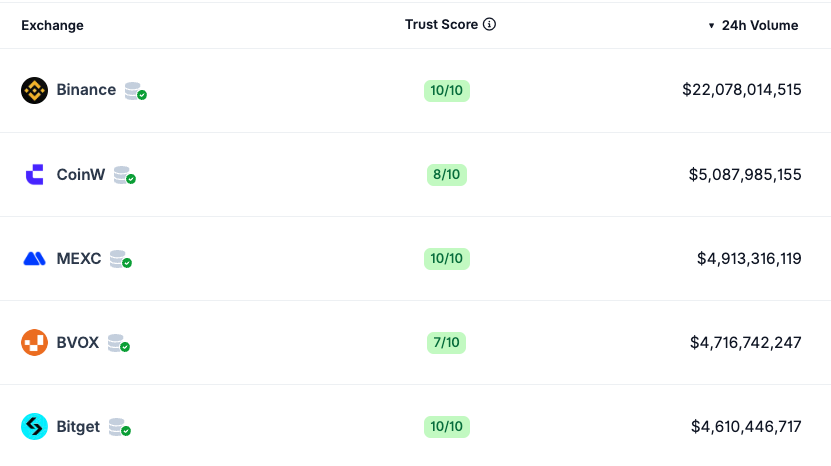

Binance handles $22 billion in day by day crypto buying and selling

On the time of the announcement, Binance is the world’s largest crypto trade, dealing with $22 billion in trades day by day, in response to CoinGecko.

By way of quantity, Binance considerably outpaces different exchanges, like CoinW and MEXC, every buying and selling round $5 billion day by day.

Franklin Templeton is a serious US funding agency, managing $1.64 trillion in month-to-month belongings as of August 2025. The corporate is named one of many first issuers of a spot Bitcoin (BTC) ETF within the US, debuting the Franklin Bitcoin ETF (EZBC) in January 2024, together with different issuers, together with Grayscale Investments and BlackRock.

Franklin Templeton’s collaboration with Binance on tokenization tasks marks one other milestone within the rising tokenization development and main collaborations between massive gamers within the conventional finance and the crypto trade.

Associated: Kraken launches tokenized securities buying and selling in Europe with xStocks

Earlier this week, Reuters reported that the US inventory trade operator Nasdaq reportedly invested $50 million in Winklevoss-founded crypto trade Gemini, which already operates tokenization choices globally.

On Monday, Nasdaq additionally filed a proposal for a rule change with the US Securities and Trade Fee, asking the fee to authorize it to record tokenized shares immediately on its platform.

The information got here amid Binance.US, the American affiliate of worldwide crypto trade Binance, introducing zero buying and selling charges on choose pairs for Ethereum, Solana and 20 extra staking blockchains.

Journal: Can Robinhood or Kraken’s tokenized shares ever be actually decentralized?