Opinion by: Temujin Louie, CEO of Wanchain

Institutional capital is just not crossing the bridge — it’s ready for the compliance gatekeeper. Whereas crosschain transactions promised a seamless, borderless crypto economic system, regulatory partitions are rising on each chain.

Rising requirements like Markets in Crypto Belongings (MiCA) in Europe and the Monetary Motion Process Pressure (FATF) Journey Rule are now not non-compulsory hurdles. They outline who survives within the race for world liquidity.

With rising curiosity in cryptocurrencies, compliance is changing into a extra vital differentiator than expertise.

AML blind spots persist — bridges are nonetheless a favourite software for laundering

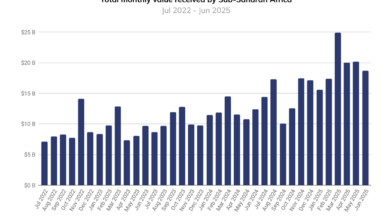

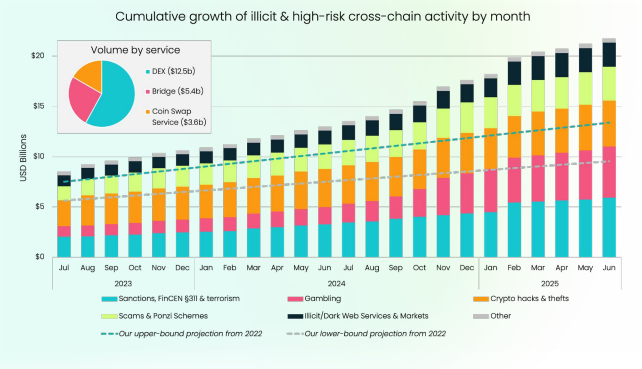

The blind spot in crosschain transactions is Anti-Cash Laundering (AML) monitoring. Crypto mixers, DEXs, coin swap companies and bridges have processed billions in illicit flows, with latest forensic studies tying greater than $21.8 billion in laundered property to those instruments. When funds transfer from Ethereum to Solana via a decentralized bridge, legacy AML analytics lose their path.

The structure of many bridges allows the potential obfuscation of pockets provenance, undermining transaction monitoring throughout networks. Centralized exchanges face mounting strain to implement crosschain surveillance, however bridges stay a favourite software for hackers and cash launderers — with regulation enforcement struggling to maintain up.

Legacy AML instruments usually are not designed for decentralized bridges

Legacy AML tooling is just not preserving tempo with decentralized bridge innovation. Most legacy compliance options had been meant for exchanges and custodians with clear KYC endpoints. Decentralized bridge protocols typically lack counterparty identification, making Journey Rule implementation an open problem.

Whereas AI-powered analytics and good contract plugins now auto-flag pockets clusters and suspicious actions in close to real-time, these instruments nonetheless depend on centralized knowledge assortment requirements, like IVMS 101, which presumes a regulated middleman on each hop. That is instantly at odds with the permissionless nature of bridges and decentralized protocols, typically leaving a compliance void between networks.

Crosschain transactions reveal Journey Rule and jurisdictional contradictions

Crosschain transactions expose profound issues when executing the Journey Rule. International regulators require crypto service suppliers to incorporate originator and beneficiary particulars in transfers over threshold quantities — however bridges and DEX swaps lack the compliance logic, resulting from their decentralized nature, to floor this knowledge.

European MiCA laws deliver uniform requirements, however just for registered VASPs and licensed platforms. Outdoors this, they don’t have a solution to hold monitor of worldwide transactions. Within the US, the latest Workplace of Overseas Belongings Management (OFAC) penalties underscore an urge for food for strict enforcement — digital banks now face fines of over $200 million for AML lapses, in the event that they don’t comply.

The UK regime goals to widen oversight past registration, making the AML lens a lot broader for DeFi.

Every jurisdiction has its personal guidelines and methods for AML monitoring, making it difficult to maintain monitor of worldwide transactions that happen through crosschain flows in bridges. We want options to service permissionless, decentralized methods that adjust to worldwide laws. The crypto analytics companies have a major enterprise alternative in the event that they adapt their instruments to work seamlessly with decentralized methods.

We want higher AML tooling for bridges to get a DeFi-compliant

AML-compliant bridges are wanted for regulated DeFi to be viable for mainstream use. A handful of initiatives are already integrating AML tooling to adjust to most jurisdictions. Nonetheless, sadly, AML tooling that doesn’t demand decentralized protocols to sacrifice their decentralization ethos has but to emerge in any vital approach. DeFi methods will likely be stored far-off from establishments with out this type of infrastructure.

Associated: New BIS plan might make ‘soiled’ crypto more durable to money out

Even so, institutional gamers are piloting regulated crosschain settlements with privateness and compliance baked in. Mass institutional adoption will, nevertheless, stall till bridges are refitted with companies that may embed Journey Rule logic. The chance is for startups to create compliance companies into protocol design — those that do will seize market share as guidelines tighten.

The urgency of self-regulation

There’s a shrinking window for decentralized protocols to self-regulate and develop proactive compliance infrastructure earlier than regulators mandate closed requirements. Some will see this as an existential risk to permissionless innovation — however compliance is rising as the one passport to world scale and sustainable partnerships.

What could also be controversial to permissionless purists is that crosschain compliance isn’t only a regulatory burden — it’s a enterprise crucial. The establishments ready on the sidelines could quickly dictate the phrases of adoption: compliance or exclusion.

Some will object that prioritizing AML guidelines and regulatory mandates undermines crypto’s permissionless spirit. Others will argue that the anti-privacy implications of Journey Rule compliance make each bridge a weak hyperlink for surveillance. Nonetheless, market actuality is shifting — jurisdictions’ writing guidelines are paving the way in which for institutional capital

Ignoring crosschain compliance is not only dangerous — it’s a market drawback. The winners on this area will deal with compliance not as a checkbox however as a design precept. That is how DeFi evolves — and the way institutional capital lastly crosses the bridge.

Opinion by: Temujin Louie, CEO of Wanchain.

This text is for common data functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the writer’s alone and don’t essentially mirror or symbolize the views and opinions of Cointelegraph.