The native token of Chainlink stalled on Wednesday after a powerful begin to the week, giving again a few of the positive factors on information about asset supervisor Grayscale submitting to transform its closed-end fund into an exchange-traded fund (ETF).

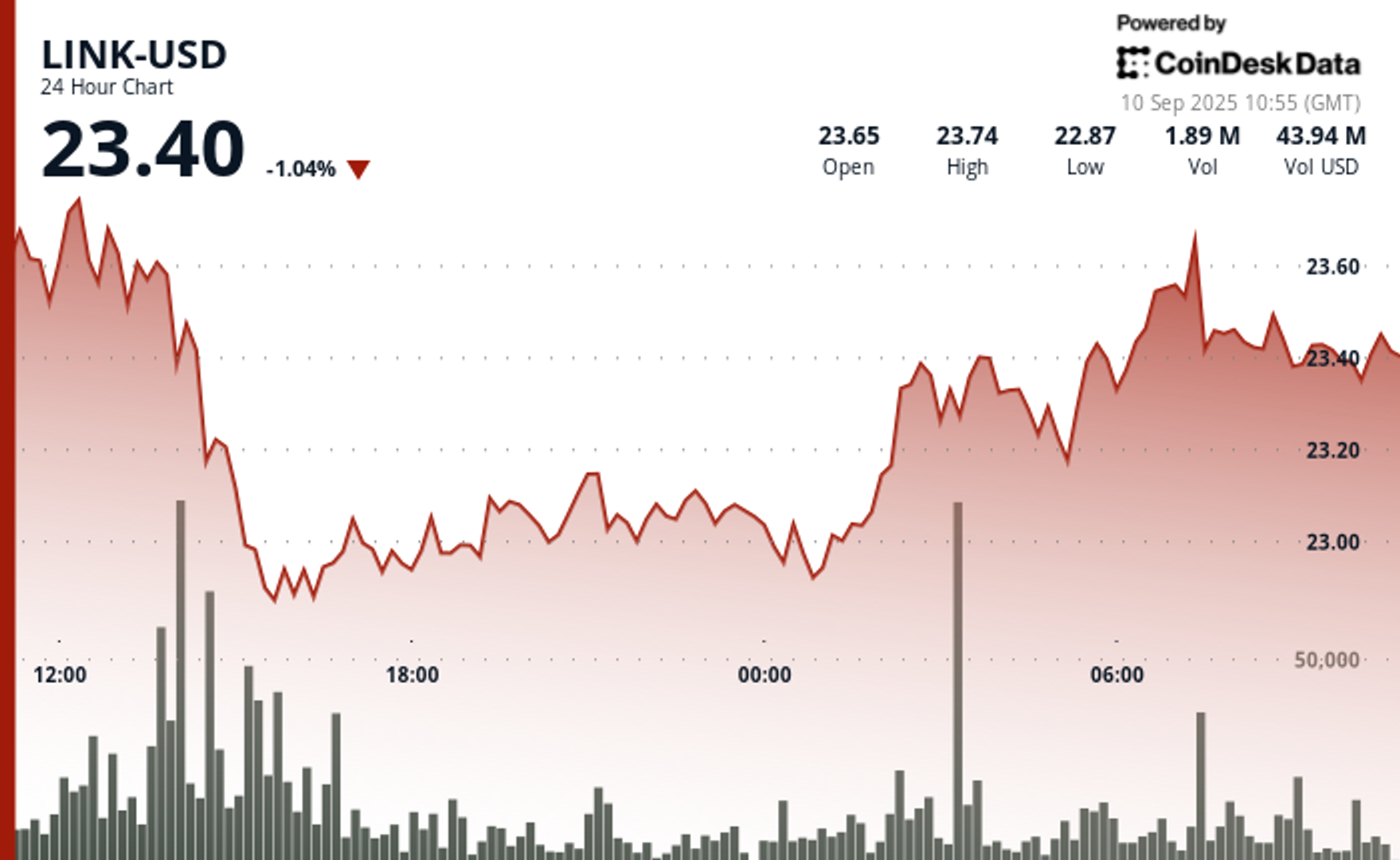

The token is down about 1% prior to now 24 hours in a risky session, experiencing a 7% worth swing, per CoinDesk Analysis’s technical evaluation mannequin.

The value motion adopted Arizona-based actual property and asset supervisor Caliber’s (CWD) Tuesday announcement that it accomplished its first buy of LINK tokens, marking the beginning of its digital asset treasury technique.

Its inventory skyrocketed practically 2,000% on Tuesday earlier than giving again a bulk of the positive factors, down one other 20% on Wednesday pre-market. The agency did not disclose the quantity of tokens purchased.

The transfer makes Caliber the primary Nasdaq-listed agency to undertake a treasury reserve coverage targeted on LINK. The corporate mentioned it goals to build up LINK over time utilizing current credit score strains, money reserves and equity-based securities, with plans to stake tokens to generate yield.

Technical evaluation

- Buying and selling Efficiency: LINK posted a modest 1% decline over the 24-hour interval, experiencing risky intraday swings of seven% between $22.84 and $24.46, CoinDesk Analysis’s technical evaluation mannequin confirmed.

- Quantity Indicators: Buying and selling exercise spiked to three.78 million items at 14:00 on September 9:00 UTC, exceeding the 24-hour common and establishing assist close to the $23 worth stage.

- Resistance Testing: The intraday excessive of $23.49 encountered promoting strain earlier than declining by means of minor assist ranges, indicating profit-taking exercise and potential preparation for added draw back worth discovery.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.