A coalition of Web3 firms has launched a brand new Ethereum token normal designed to streamline compliance and scale back fragmentation within the rising real-world asset (RWA) sector.

In keeping with an announcement despatched to Cointelegraph, the usual, ERC-7943, creates a minimal, modular interface designed to work throughout Ethereum layer-2s and Ethereum Digital Machine (EVM) chains, whereas remaining agnostic to implementation and vendor-specific infrastructure. This implies it may work in any setup and isn’t locked into any particular firm’s instruments.

Dario Lo Buglio, the co-founder of Brickken and the creator of the Ethereum Enchancment Proposal (EIP)-7943, advised Cointelegraph that the brand new normal acts as a “common layer” that sits on high of any token sort. This enables builders and establishments to keep away from having to make use of wrappers and customized bridges whereas integrating tokenized belongings into apps.

ERC-7943 is backed by a coalition of Web3 and fintech companies, together with Bit2Me, Brickken, Compellio, Dekalabs, DigiShares, Hacken, Forte Protocol, FullyTokenized, RealEstate.Alternate, Stobox and Zoth.

Responding to a “good storm” of institutional curiosity

In keeping with Lo Buglio, EIP-7943 is a direct response to developer frustration and a “good storm of institutional curiosity.”

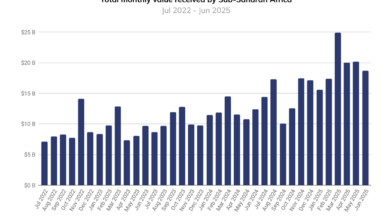

Knowledge from the RWA tracker RWA.xyz reveals that the entire worth of tokenized RWAs onchain has reached $28.44 billion, up practically 6% within the final 30 days. In the meantime, stablecoins’ complete stablecoin worth and complete asset holders are up practically 7% and 9%, respectively.

The expansion of RWAs reveals that establishments are at the moment adopting RWAs at scale, with issuers competing for market share. Lo Buglio mentioned this highlights the necessity for a brand new token normal that addresses the wants of builders and monetary establishments alike.

“Monetary establishments need programmable controls that match their compliance frameworks. Builders, however, are caught rewriting customized logic for each RWA token,” Lo Buglio advised Cointelegraph. “We wanted a standard basis.”

Lo Buglio advised Cointelegraph that the usual entered the overview stage of the EIP course of and has already obtained suggestions from compliance professionals and different token normal authors.

“The EIP nonetheless stands on the overview stage, which is the place the principle suggestions shall be proposed and included.”

Associated: Ethereum validator exit queue to spike as Kiln strikes tokens

Tackling fragmentation and enabling composability

Earlier efforts to standardize RWA tokenization on Ethereum embrace ERC-1400 and ERC-3643. ERC-1400 launched a hybrid mannequin mixing options of fungible and non-fungible tokens (NFTs), with built-in compliance instruments.

ERC-3643 centered on regulated belongings like securities, integrating onchain id and permission layers to implement Know Your Buyer (KYC) and Anti-Cash Laundering (AML) necessities.

Lo Buglio mentioned ERC-1400 goals to deal with separating logic from storage and mentioned that ERC-3643 is robust for securities, nevertheless it’s tightly coupled to its personal id and permissioning stack. In contrast to these options, he mentioned, it differentiates itself by being a minimal, implementation-agnostic interface.

“EIP-7943 defines solely what should exist — not the way it’s constructed — so any challenge or protocol can slot it into their stack with out friction,” Lo Buglio advised Cointelegraph.

“Its main purpose is to unravel the issue of trade fragmentation by offering a single, standardized set of capabilities for compliance.”

Journal: Can Robinhood or Kraken’s tokenized shares ever be actually decentralized?