Hyperliquid’s resolution to launch its stablecoin has sparked one of the vital aggressive governance battles in current reminiscence.

Final week, the decentralized change, which had been counting on Circle’s USDC for its liquidity, introduced plans to introduce USDH as its native stablecoin. The transfer instantly attracted a wave of bidders, every vying for the correct to challenge the token and seize billions in potential worth.

No less than eight organizations have already submitted proposals, together with established gamers like Paxos, Ethena, Agora, and OpenEden.

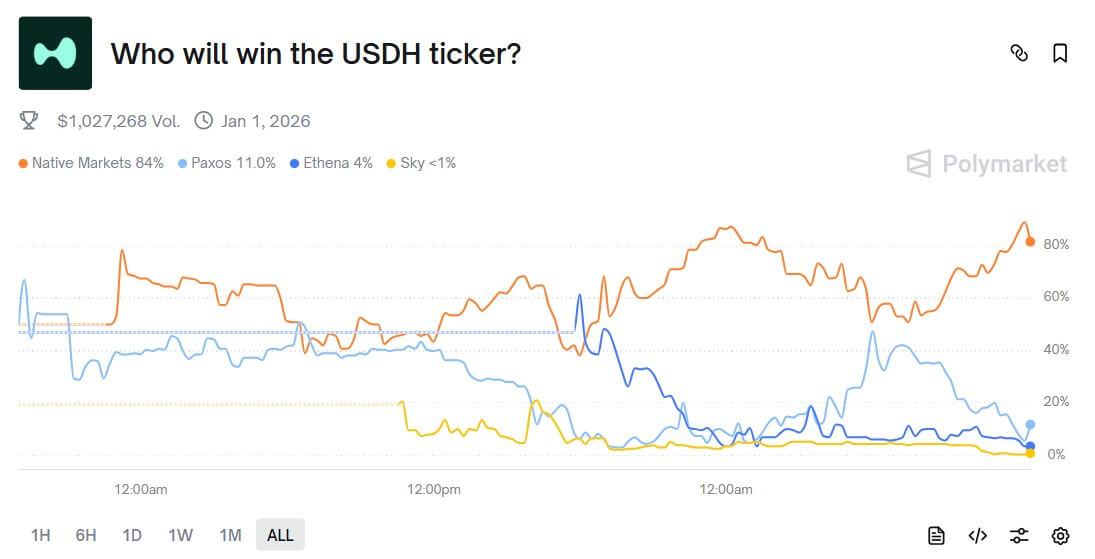

Validators on the Hyperliquid community will in the end determine who secures the mandate, however within the meantime, speculators have taken to Polymarket to put their bets on the result.

Polymarket bettors favor New Market

In line with Polymarket odds, one group, Native Markets, stands out because the clear favourite in a market above the $1 million buying and selling quantity mark as of press time.

Crypto merchants on the decentralized market assigned the newcomer a 90% probability of successful the validator vote, however that share has dropped to 84% on the time of this report.

Native Markets was fashioned particularly to compete for USDH and is led by Max Fiege, an investor throughout the Hyperliquid ecosystem.

The agency’s pitch proposes a hybrid reserve mannequin during which off-chain property can be managed by BlackRock, whereas the on-chain reserves can be held by means of Superstate utilizing Bridge, a Stripe-owned platform.

Native Markets additionally pledged to separate yield from reserve property, with half earmarked for HYPE token buybacks and half for USDH enlargement.

In the meantime, Native Market’s proposal construction has generated each curiosity and skepticism from neighborhood members.

In Agora’s proposal, Nick Van Eck, the founding father of Agora, identified that Native Markets’ proposal reliance on Stripe might show detrimental to Hyperliquid in the long term.

In line with him:

5 Days to Smarter Crypto Strikes

Find out how professionals keep away from bagholding, spot insider front-runs, and seize alpha — earlier than it is too late.

Delivered to you by CryptoSlate

“Stripe lately introduced their plans for Tempo, a brand new layer 1 blockchain. Stripe is dedicated to driving exercise to this ecosystem from a wide range of gamers. How lengthy till Stripe and Bridge begin pushing customers and perps from different monetary functions on to Tempo as a substitute of Hyperliquid?”

Regardless of these considerations, Dragonfly Capital’s Haseeb Qureshi steered that Native Markets could have had advance discover of the request-for-proposals course of, given how shortly its submission appeared.

He wrote:

“Everybody else scrambled over the weekend to place one thing collectively. So this complete USDH RFP was mainly customized made for Native Markets.”

Nonetheless, Alex Svavenik, the CEO of Nansen, countered this declare by stressing that validators have been deeply engaged with all bidders.

In line with him, the method is way extra aggressive than critics recommend, with validators actively searching for the very best long-term possibility for Hyperliquid.

Rival proposals achieve momentum

Whereas Hyperliquid validators may seem inclined towards Native Markets, observers level to Paxos, Ethena, and Agora as candidates with stronger institutional observe data.

Furthermore, these rival corporations have been refining their presents, and new entrants are introducing new bids for the USDH stablecoin.

On Sept. 10, Paxos unveiled a revised plan centered on a partnership with PayPal.

In line with the agency, this collaboration would embed USDH into PayPal and Venmo merchandise, record HYPE on PayPal’s ramps, and inject $20 million in incentives for the Hyperliquid ecosystem.

Paxos additionally set strict income caps to guarantee the neighborhood of its long-term alignment. It wrote:

“Paxos takes nothing till we attain $1 billion in TVL and stays capped at 5% put up $5 billion TVL. Any charges earned by Paxos by means of this milestone shall be held in HYPE tokens.”

Talking on the up to date proposal, Max Fantle, a Paxos govt, stated:

“PayPal and Venmo have 400M+ customers. Paxos is the one impartial, regulated issuer that may unlock a completely new institutional buyer section for Hyperliquid that no different issuer can attain.”