Bitcoin hovered round $111,500 on Monday, holding a decent vary as merchants weigh macro catalysts for cues on positioning.

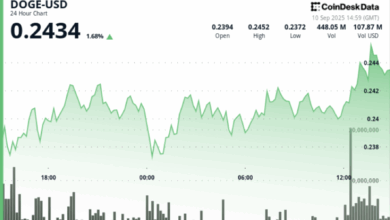

Ether (ETH) traded close to $4,312, XRP held $2.96, BNB (BNB) at $880, and Solana’s SOL (SOL) climbed to $218. Dogecoin prolonged its 11.6% weekly achieve to 24 cents, outpacing most main cryptocurrencies because the first-ever memecoin ETF seems to be set to go dwell for buying and selling within the U.S. on Thursday.

The market tone stayed tentative. “Crypto costs treaded water a lot of the previous week, however with BTC lagging noticeably each vs its peer group in addition to vs equities and spot gold,” mentioned Augustine Fan, head of insights at SignalPlus, in a be aware to CoinDesk, pointing to softer shopping for in digital asset trusts and a pullback in on-ramp exercise at centralized exchanges.

“The short-term image seems to be a bit tougher and we might favor a extra defensive stance in line with the robust seasonal story. Keep watch over DAT premia compressing and the danger of adverse convexity on the draw back,” Fan mentioned, referring to the various digital asset treasuries held by U.S.-listed firms which have sprouted in latest months.

Macro might break the stalemate. “Markets are getting into a decisive week as US knowledge and central financial institution choices converge,” mentioned Lukman Otunuga, senior market analyst at FXTM, in an e mail.

He added a cooler CPI and any downward revision to payrolls would strengthen the case for Fed cuts, weaken the greenback and will elevate different belongings, whereas a sticky print would argue for endurance and lift volatility throughout cryptoThat push and pull is mirrored in positioning.

“Buyers are caught between turning bearish and risking missed upside, or shopping for the dip too early,” mentioned Justin d’Anethan, founding father of Poly Max Funding. He famous chatter about Technique’s potential S&P 500 inclusion pale, denting the company treasury meme, but public firms now maintain about 1 million BTC.

“Within the greater image, BTC consolidating round 111K is a effective place for long-term believers. Pullbacks of 10% to fifteen% inside bull runs haven’t traditionally damaged the development,” d’Anethan mentioned.

For merchants, the guidelines is easy. Watch CPI and PPI for the coverage path, the greenback for cross-asset threat urge for food, and the DAT premium for any renewed knee-jerk promoting into redemptions.