Crypto merchants have swung into extra unfavorable sentiment and deeper worry, uncertainty, and doubt (FUD), in line with the onchain analytics platform Santiment, however analysts say it’s doubtless solely momentary.

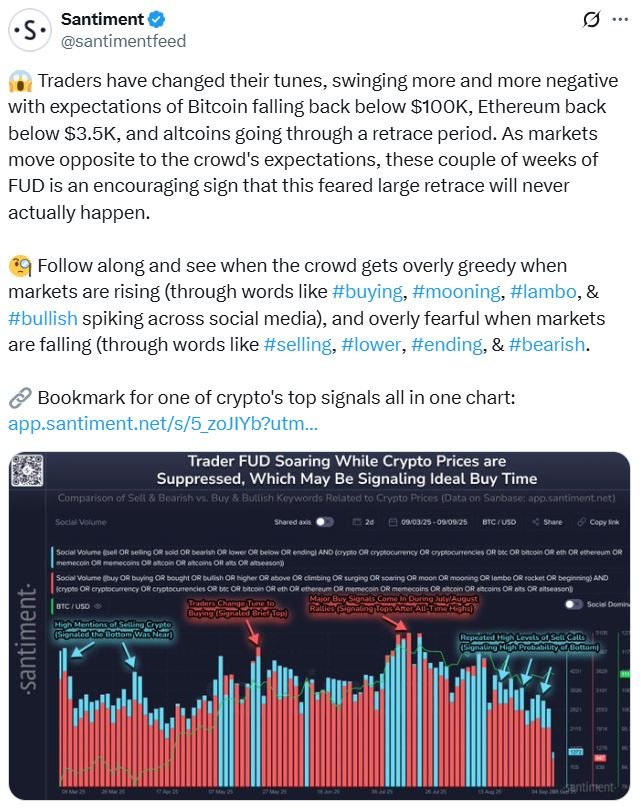

Santiment mentioned in an X submit on Tuesday that with the worth of Bitcoin (BTC) falling, and altcoins going by means of a retrace interval, merchants have been more and more speaking about promoting, the market sinking decrease or a bear market.

It added that markets usually “transfer reverse to the gang’s expectations,” so the final “couple of weeks of FUD is an encouraging signal that this feared massive retrace won’t ever really occur.”

Crypto market sentiment slipped into Worry on Sunday and confirmed indicators that buyers had been briefly stepping again, in line with Santiment.

Analysts advised Cointelegraph that the unfavorable sentiment will doubtless cross quickly, as the worth of Bitcoin recovers and a doable US charge lower is on the horizon.

US charge lower a key catalyst for positivity

Some monetary establishments and market analysts are projecting the US Federal Reserve will slash rates of interest not less than twice in 2025.

Pav Hundal, lead market analyst at Australian crypto dealer Swyftx, advised Cointelegraph all eyes at the moment are on the Fed’s assembly subsequent week, with a lower of any variety probably being “the subsequent key catalyst for positivity.”

He added worries round bond markets and job openings have gotten the market’s consideration, and it’s simply recalibrating with a “wholesome correction” after coming off very excessive sentiment.

“We have now a euphoria index mannequin that very clearly exhibits BTC’s most up-to-date all-time excessive was the product of a frothy market,” Hundal mentioned.

“The rolling 30-day efficiency of Bitcoin is unfavorable and that means we’ve already gone by means of a correction, which can have shaken out numerous weak palms since we hit the $124,000 prime.”

Bitcoin reclaiming $117,000 might shift sentiment constructive

The Crypto Worry & Greed Index, which tracks the broader crypto market sentiment, has been at “Impartial” since Monday after a number of days in “Worry” and registering a mean score of “Greed” final month.

Charlie Sherry, head of finance at crypto trade BTC Markets, advised Cointelegraph that dealer sentiment tends to go to extremes in each instructions, when merchants lean closely bearish, it could usually mark the top of that transfer quite than the beginning.

“If Bitcoin reclaims $117,000, I believe sentiment would swiftly swing again; we’ve got already seen early indicators of that on Bitcoin’s latest bounce to present ranges,” Sherry mentioned.

“Bitcoin has damaged the $100,000 barrier and now there’s a little bit of a query of ‘what subsequent?’ $200,000 is the subsequent excessive timeframe main goal, however that actually appears a good distance away, each time and price-wise, so there may be extra uncertainty quick time period.”

One other issue that might swing sentiment again into constructive is crypto treasuries, which have sparked firms right into a race to build up extra crypto.

In one of many newest situations, design and manufacturing agency Ahead Industries mentioned on Monday it had secured $1.65 billion in money and stablecoins to launch a Solana (SOL)targeted crypto treasury technique.

Associated: Find out how to learn market sentiment with ChatGPT and Grok earlier than checking a chart

“There’s potential for upside within the Solana treasury commerce, however maybe the returns will likely be extra compressed than what we noticed with Ether; however that could be a development to look at that might flip sentiment constructive,” Sherry added.

Merchants extra cautious in September

In the meantime, ZX Squared Capital co-founder and chief funding officer CK Zheng advised Cointelegraph that September, on common, has traditionally been the “worst by way of fairness return. So individuals naturally are typically extra cautious.”

Nevertheless, he additionally thinks the unfavorable dealer sentiment is simply momentary and a shift will depend upon elements such because the Client Worth Index, the Producer Worth Index, and the way a lot of an impression US President Donald Trump’s tariffs have.

Prior to now, Trump’s introduced tariffs on a raft of nations have dented crypto costs and brought about additional losses when applied.

Journal: Astrology might make you a greater crypto dealer: It has been foretold