Sharplink, the second-largest Ether treasury firm, has began a $1.5 billion share buyback plan in an effort to spice up its inventory, which is buying and selling beneath its internet asset worth.

SharpLink mentioned on Tuesday that whereas the corporate “trades beneath its Web Asset Worth (“NAV”), inventory repurchases are instantly accretive to stockholders.”

“We imagine the market at the moment undervalues our enterprise,” mentioned SharpLink co-CEO Joseph Chalom. “Somewhat than situation fairness whereas buying and selling beneath NAV, we’re centered on disciplined capital allocation – together with share repurchases – to extend stockholder worth

It comes simply days after an analyst at NYDIG mentioned crypto treasury firms ought to think about buybacks when their shares fall beneath their NAV, warning that many crypto shopping for firms’ premiums are narrowing.

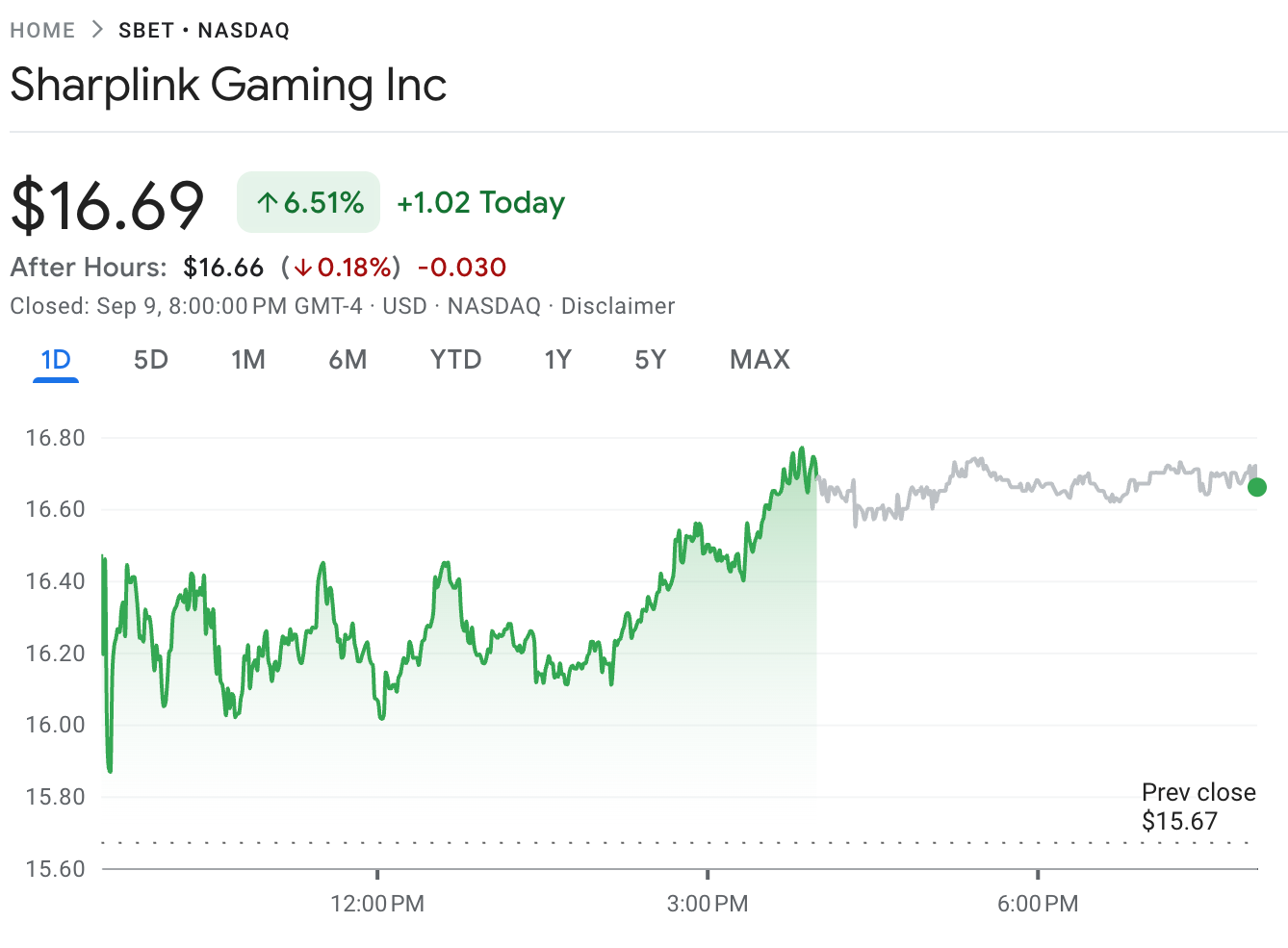

Sharplink inventory surges in Tuesday buying and selling

SharpLink initiated its buyback program with the repurchase of 939,000 widespread shares at a median worth of $15.98. SharpLink shopping for again its shares priced beneath its NAV — the worth of its crypto holdings — goals to extend the NAV per share and enhance its inventory worth.

Shares in Sharplink Gaming (SBET) closed buying and selling on Wednesday at $16.69, up 6.59%, in accordance with Google Finance.

Nevertheless, the inventory worth is down 25.29% over the previous 30 days, with Sharplink including it believes its shares are “considerably undervalued,” with the buybacks representing a “compelling funding that underscores confidence in its long-term technique,”

Sharplink holds 837,230 Ether (ETH), price roughly $3.59 billion on the time of publication, in accordance with StrategicETHReserve knowledge.

Sharplink mentioned that just about 100% of its ETH holdings are staked to earn rewards from the blockchain, “which is producing materials income for the Firm.”

Treasury companies ought to have funds apart for buybacks: NYDIG

The agency approved the buyback program on Aug. 22. Chalom mentioned on the time that this system permits the agency to behave shortly and decisively if these circumstances current themselves.

Associated: Ethereum added $1B of stablecoins virtually each day final week

On Friday, NYDIG international head of analysis Greg Cipolaro mentioned that if shares in so-called digital asset treasury (DAT) firm commerce beneath NAV, “essentially the most simple plan of action could be inventory buybacks.”

“If we have been to present one piece of recommendation to DATs, it’s to avoid wasting among the funds raised apart to help shares through buybacks,” he mentioned.

Simply months earlier, in June, enterprise agency Breed mentioned only some Bitcoin (BTC) treasury firms will stand the take a look at of time and keep away from the vicious “demise spiral” that can affect BTC holding firms that commerce near NAV.

Journal: Can Robinhood or Kraken’s tokenized shares ever be really decentralized?